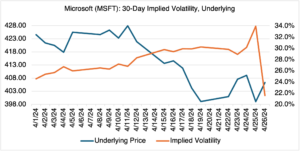

Vol Crush, Exhibit A: Microsoft (and Nvidia?)

Last week, I wrote about “vol crush,” or the tendency of implied volatility to increase before earnings announcements and then to decline rapidly immediately afterwards (The Magnificent Seven: The Remake). I used Microsoft (MSFT) as an example because its earnings were going to be released within a few days. Let’s see what’s happened and whether the same thing is going on in another stock, Nvidia (NVDA). Although no longer the center of the market’s attention as it was just a few short weeks ago, Nvidia’s implied volatility has been reacting to its upcoming May 22 earnings announcement and may be gearing up for a severe case of vol crush.

In my previous blog, I employed a very simple at-the-money MSFT call strategy to illustrate vol crush:

Trade Date: 04/23/2024

Strike: $400

Expiration: 05/17/2024

Underlying: $401

Premium = $13.93

Implied Volatility: 30.3%

In the weeks before MSFT’s April 25th Q1 earnings announcement, its average 30-day implied volatility shot up to 34%, an increase of 15.5 vol points since 03/01/2024.

Source: OptionMetrics

Microsoft’s announcement after the close last Thursday beat expectations, but the stock rallied only a subdued 1.8% and closed at $406.32. At the same time, its implied volatility plunged to 21.6%, a decline of 12.4 vol points from the day before, or a whopping 36.5%.

Consequently, the $400 call in the example closed last Friday at $12.75, a loss of $1.18 from the original purchase price of $13.93 (see table below). The magnitude of the decline in implied volatility was such that it overwhelmed the price effect. In other words, you could have correctly called the direction of the earnings announcement and the direction of MSFT and still lost money on the call. As a matter of fact, instead of buying the call, you could have sold it and made money, even though the market went up 1.8% in one day. As I have reiterated numerous times, ignore implied volatility at your peril.

Source: OptionStrat

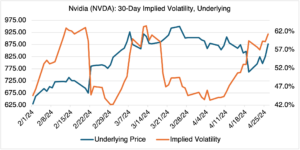

Nvidia, despite having faded from the front page (for the time being), should be an excellent candidate for vol crush before and after its Q1 earnings announcement coming up on May 22. As you can see below from its action before and after NVDA’s last earnings announcement (Q4, February 20), and from key remarks from the CEO at the March 18th GPU Conference, Nvidia’s implied volatility follows a predictable and regular vol crush pattern in response to impending news.

Source: OptionMetrics

NVDA’s current implied volatility of 61.3% is 15.8 vol points higher than what it was on April 1 (45.5%), or 34.7% higher. If the pattern holds, it should continue to trend higher before the Q1 earnings announcement on May 22, but then abruptly plunge afterwards.

Again, this is not just some technical detail that only option nerds pay attention to. The magnitude of the changes in implied volatility due to vol crush can be large enough to overwhelm the price movement that may occur. You don’t see that too often in options. It’s worth planning for!