0DTE Options: Straight Talk

If you’ve been trading options for the last few years, then undoubtedly you’ve read all about the explosive growth of 0DTE options and have probably even traded them for yourself. For the uninitiated, “0DTE” stands for “zero days to expiration.” To be clear, these can be either a) options that are in their final day of trading, or b) options that are listed and expire on the same day. Both, are usually lumped into the 0DTE category.

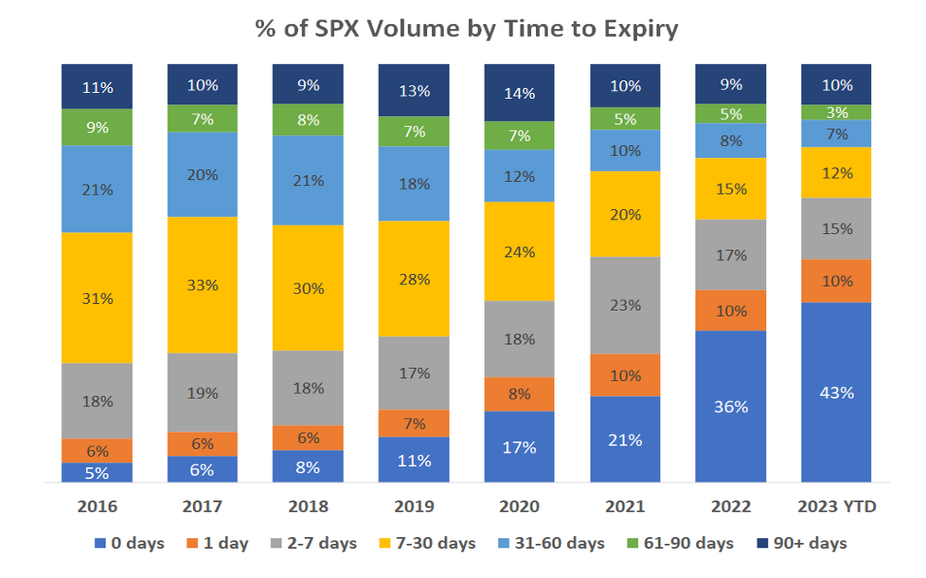

Expiration cycles have been getting more frequent since options were first introduced on the CBOE in 1973. The introduction of weekly Tuesday and Thursday expiations in 2022 meant that there were SPX options for every weekday. By last August, 0DTEs accounted for about 50% of all SPX options trading. They have a lot going for them: low cost, liquidity, leverage, flexibility, and short term gratification.

Like many financial products, increasing volume leads to increasing attention, and scrutiny. Unsurprisingly, the internet is bristling with how-to guides and dire commentary on the potential impact of 0DTEs on the VIX and the market in general. Tales of impending doom get clicks and attention, so there is no shortage of those claiming that 0DTEs could be the source of the next financial meltdown. Do they have a point? Yes, and no.

The nature of 0DTE options is central to the answer. Since their time to expiration is so short, indeed measured in hours, not days, the question of whether they will expire in or out of the money is essentially binary, a yes or no proposition. The sensitivity of 0DTE options to time and price can change significantly from relatively small changes. In Greek terms, their theta and gamma (the change in delta as the underlying price changes) are massive. Since options market makers use delta and gamma to determine their hedge ratios (i.e., how much underlying to trade to get price neutral), their instability can produce sudden activity. Consequently, the fear is that market makers could all suddenly react at the same time and in the same direction, accelerating whichever trend is already present. Under certain extreme conditions, a “doom loop” scenario could unfold: (a) abnormal price movements could occur due to an unexpected, extremely low probability event that occurs during the trading day, (b) market makers and other sellers of 0DTE options could then rush to hedge their high gamma positions, selling into a declining market in an attempt to hedge their short gamma positions, thereby amplifying the downward price spiral in a classic “gamma squeeze.” A rush to the exits and a market crash could then result.

At least, that’s the fear. How realistic is it? Two factors determine whether 0DTEs could have an outsized effect on the S&P: 1) Net positions across strikes from market makers — if they are significantly net long or short, then their gamma exposures will be higher and the prospect of a gamma squeeze increases. However, if the flow between buyers and sellers is balanced, then systemic risk will be reduced, and 2) Volume — the higher the volume, the greater potential impact.

The CBOE published some compelling research on this last September in a note entitled Volatility Insights: Evaluating the Market Impact of SPX 0DTE Options by Mandy Xu. The results:

- The nature of customer activity in 0DTEs is relatively balanced, ranging from hedging, yield acquisition, systemic trading, to outright speculation. It does not conform to the popular “day trader in the basement” notion. As a result, market makers tend to have a more balanced book than believed and volume is consistent regardless of market cycles.

- As a result, market makers’ net positions are relatively small compared to total SPX futures volume. By CBOE’s estimate, market maker hedging flows are 0.04% to 0.17% of total S&P futures liquidity.

- Market maker daily gamma exposures, i.e., how much their delta exposure (amount to be hedged) will change given a 1% move in the SPX. They found this to be, in extreme circumstances, between 1.3 and 1.9 percent of S&P futures daily notional volume.

- If 0DTE options were causing more volatility, then one would reasonably expect the VIX or the VVIX (the volatility of the VIX) to be increasing. That is not the case, and as a matter of fact, many wonder why the VIX doesn’t seem to be reacting more to the upside.

Of course, it is in the CBOE’s best interest to highlight the benign nature of 0DTEs, but their results are compelling and make sense. The so-called “doom loop” is certainly a non-zero probability (as we say in risk management when we don’t want to say that something will never happen), but should be viewed skeptically.

A short comment on 0DTE options and their effect on the VIX. Many print and online authors have focused on the growth of 0DTE options and how they may be limiting the VIX’s upside and volatility. As we have discussed, the connection of 0DTEs to the SPX is due to their extremely high gamma and the consequent effects of sudden hedging in the SPX. However, although their connection to the SPX is clear, their effect on the VIX is less so.

Two conditions must be met before the VIX can be affected on anything other than a short-term basis:

- Daily SPX price moves must be large enough and sustained over multiple trading sessions, not just the result of a short term 0DTE gamma squeeze that affects the SPX

- Additionally, the VIX measures 30-day volatility, not 1-day volatility, as is relevant for 0DTE options. Consequently, an event that could significantly affect the VIX must be one that is perceived to influence the market’s perception of 30-day implied volatility. In other words, the triggering event must be deemed long-term in nature. Sustained upward moves in the VIX require longer duration crises.

Therefore, 0DTE options can affect the SPX due to their high gamma nature, but require that certain extreme conditions be met before they can affect the VIX on a long-term basis. The connection is there, but it’s tenuous.