All Hail the Dollar!

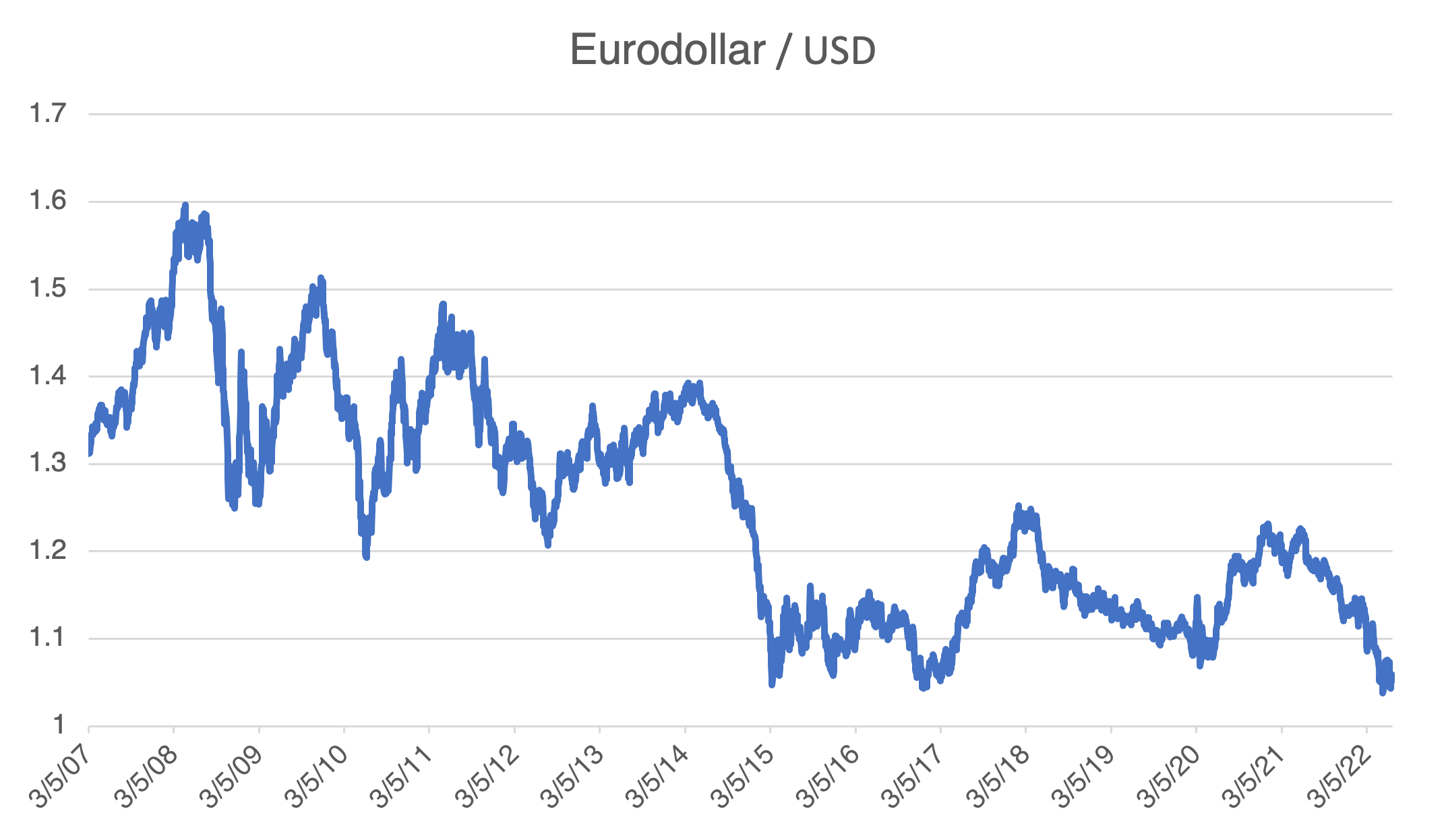

With all the news about inflation and gas prices and various other depressing news, the incredibly high value of the dollar has largely flown under the radar. Unless you trade foreign exchange, hedge a company’s FX exposure, or are going on vacation abroad, most Americans are ignorant of prevailing foreign exchange rates. That is, unless something significant occurs, and the latest movements in the dollar certainly qualify. Although you wouldn’t know if from the popular press, currently the dollar is at levels we haven’t seen early 2017, and it has the potential to go a lot higher. This presents some opportunities that are tailor-made for options.

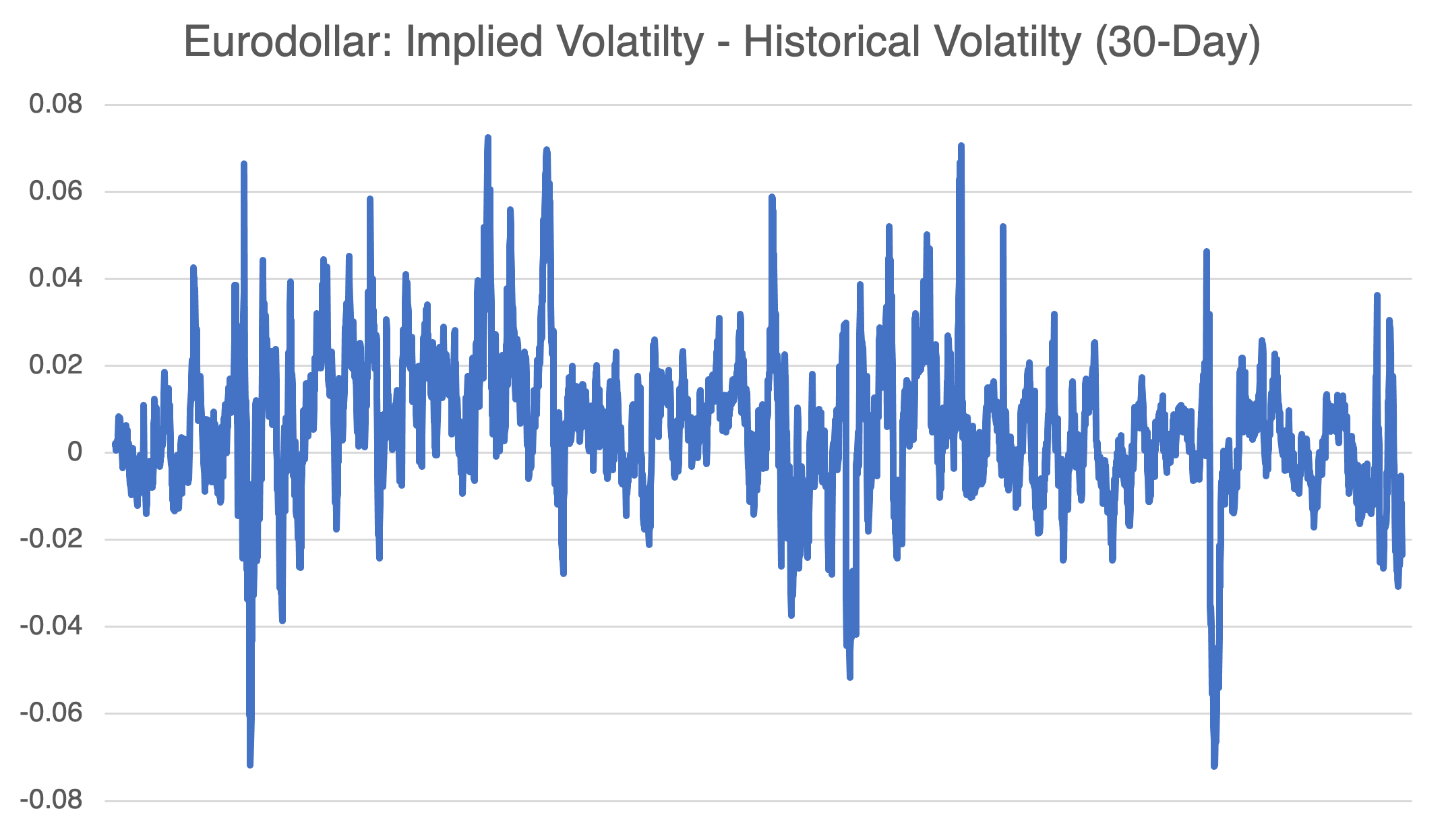

As an options trader, one thing to notice is that FX options trade at relatively low implied volatilities compared to other option products. For example, 30-day implied volatility in the Eurodollar is currently about 9%. Compare that to natural gas in the 70’s and selected tech stocks that regularly go into triple digits, and you can see what I mean.

Why is this? Realized, or historical volatility, measures past, historical price movement (variance) and is the most important component that goes into implied volatility. Hence, if realized volatility is high or low, implied volatility will follow suit. However, implied volatility is the market’s assessment of future, potential price variance. Although implied and realized are both volatility measures, one measures the past and the other assesses the future, so they will never be equal.

As an example, Eurodollar 30-day historical volatility is running about 11.4% and its implied is trading at a similar order of magnitude at 9.0%. Compare that to natural gas with a historical volatility of 62.5% and an implied of 71.1%.

The difference between the two volatility measures represent the markets’ current uncertainty about the future and how well historical volatility is predicting future price variance.

Although they are measuring different things, the difference between implied and historical volatility is tracked by options traders as an indicator of whether current option prices are cheap or expensive. Whether there is a useful exercise or not is up for debate, but the fact is that options traders follow the spread and it should at least be recognized before considering any strategy.

Regardless of the spread between implied and historical volatilities, a sudden jerk down in the Eurodollar below parity with the dollar is certainly possible. Such a move has precedent: the EUR was below parity for most of the 2000 – 2002 period and was as low as 0.8231 in October 2000. Breaking the psychological 1:1 ratio can happen again, and could cause a sharp increase in price and implied volatility for EUR puts struck below parity.