All That Glitters?

I’ve written about the recent gold rally a few times now (Crudely Speaking) and (Gold Bugs and the Debt Boogeyman). The precious metal, and its digital cousin, Bitcoin, benefited from the SVB crisis, which confirmed the worst fears of those who question the stability of the US dollar-based world financial system. Increased online chatter about the BRIC nations issuing new gold backed currencies as a challenge to US-based hegemony is adding fuel to the fire. “Real” assets (gold, land, collectables) are back in vogue. Bitcoin reacts to the same dismal world view, with the added attraction of higher and faster returns.

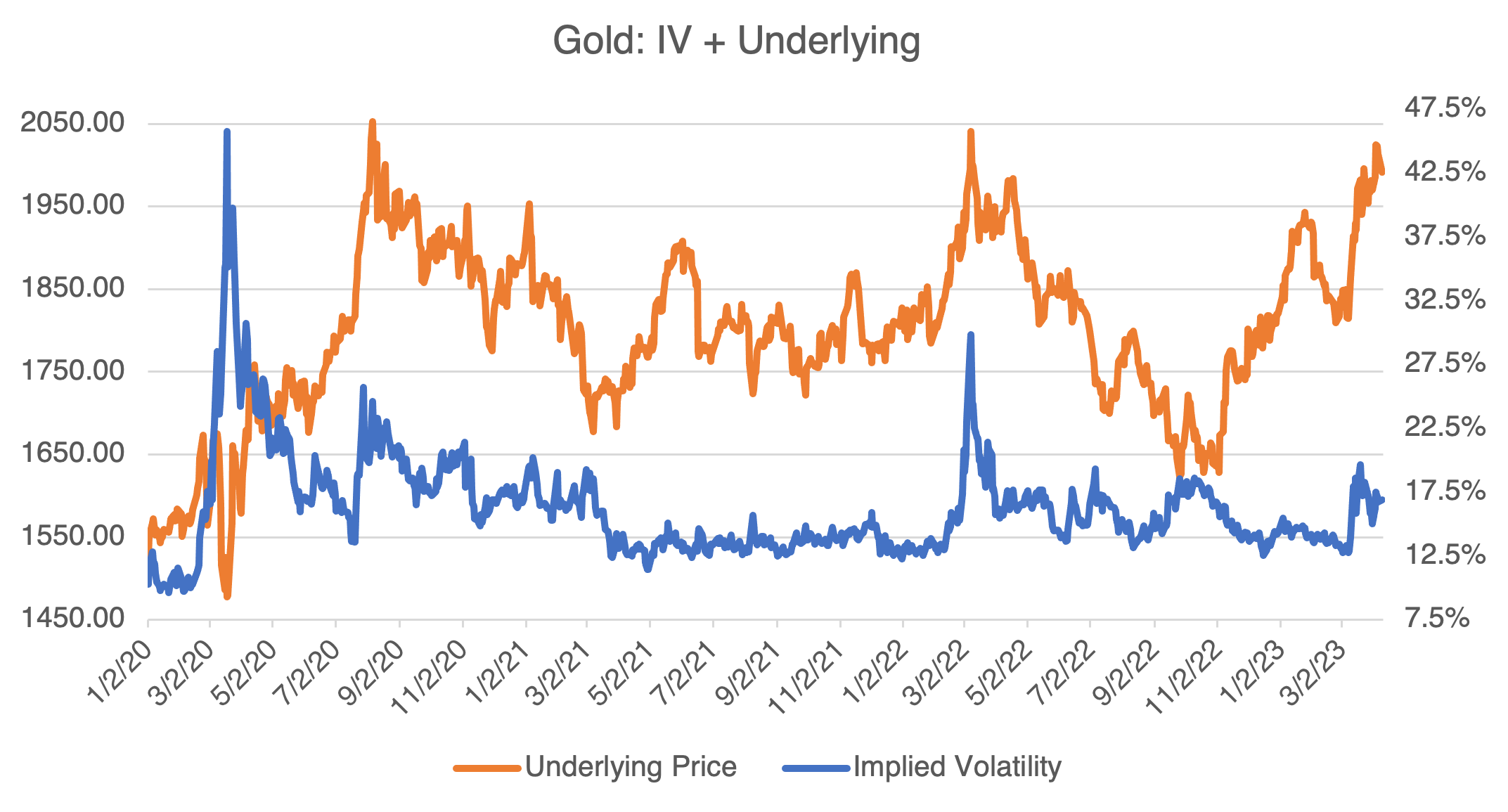

To review, gold has moved decisively over $2000 in the front month futures contract and may be setting itself up to take out the all-time high of $2074.88 from August 2020. At the same time, its implied volatility has risen to the low 17% region, but has not yet shot sharply higher as it did at the start of Covid and the Ukrainian War.

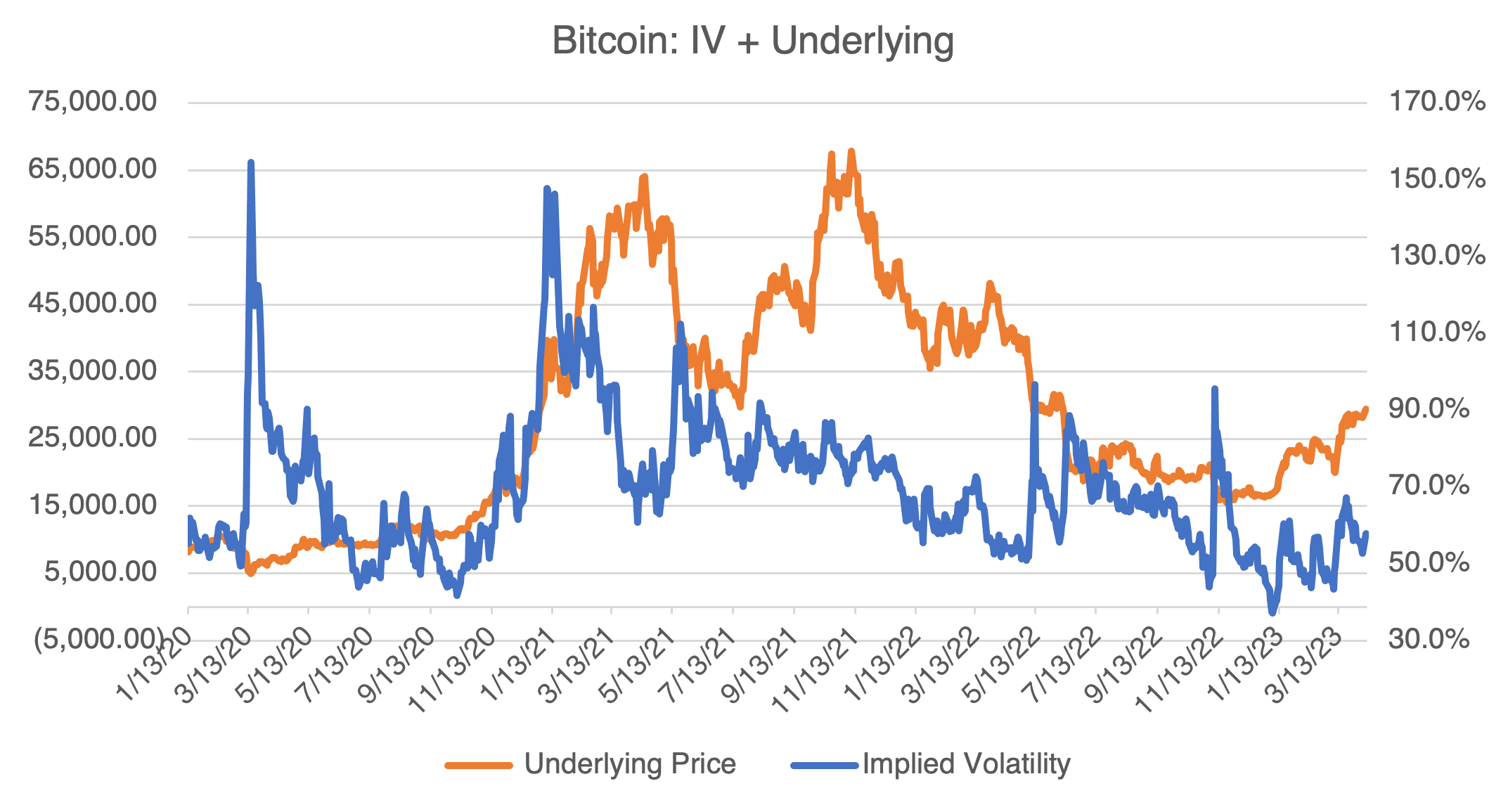

Bitcoin, or “digital gold” as some have taken to calling it, has shown more upside, and has pierced the $30,000 level as of this writing. It’s implied volatility in the high 50% region is towards the bottom of its historical range; it’s been known to shoot into triple digits. Although its implied volatility does tend to move lower as its price increases, Bitcoin hasn’t rallied since the end of 2021, almost a year and a half ago. In addition, its relatively low volume tends to accentuate and accelerate existing trends. For those reasons, I suspect that its volatility will increase sharply if the rally accelerates.

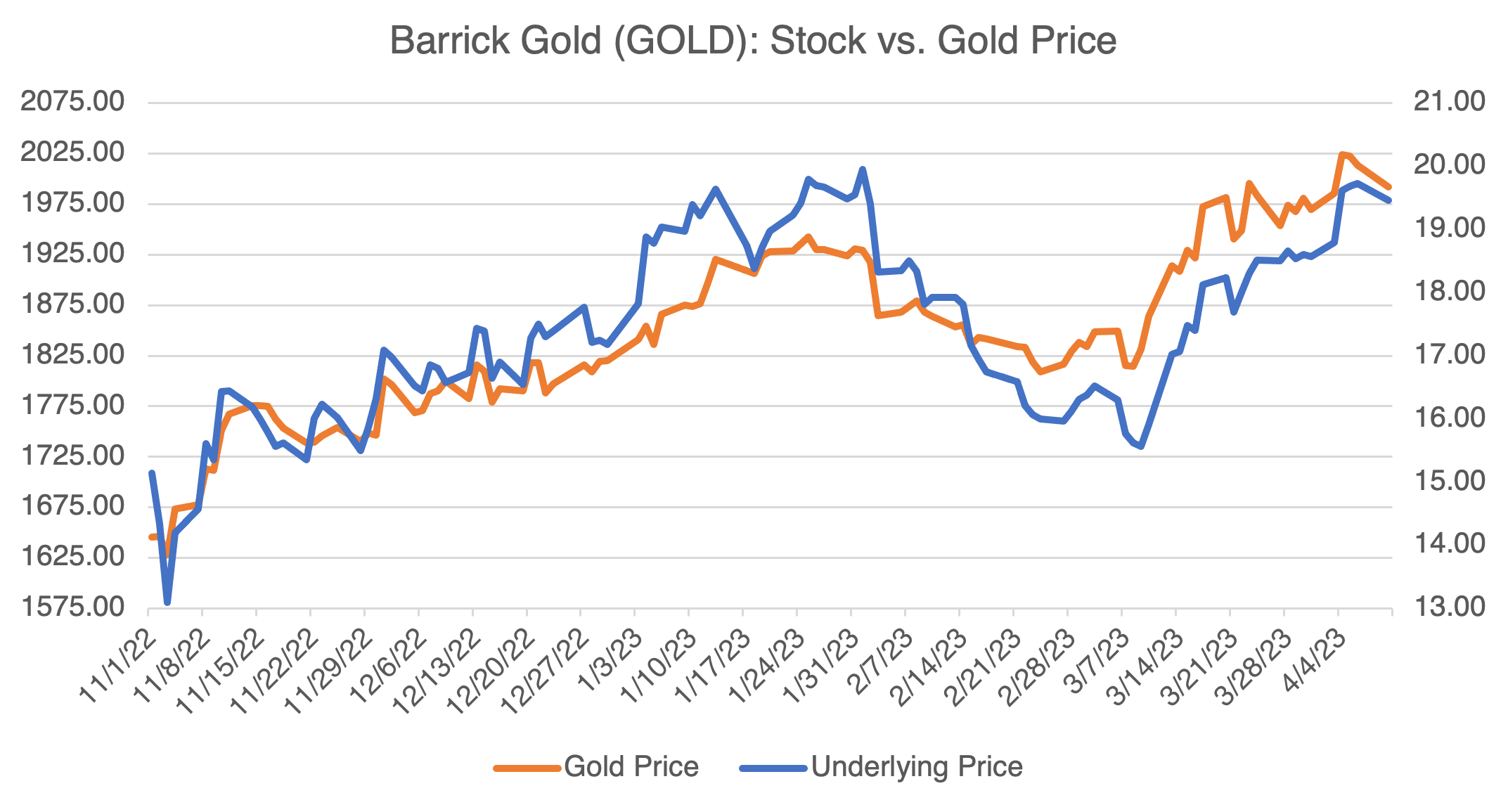

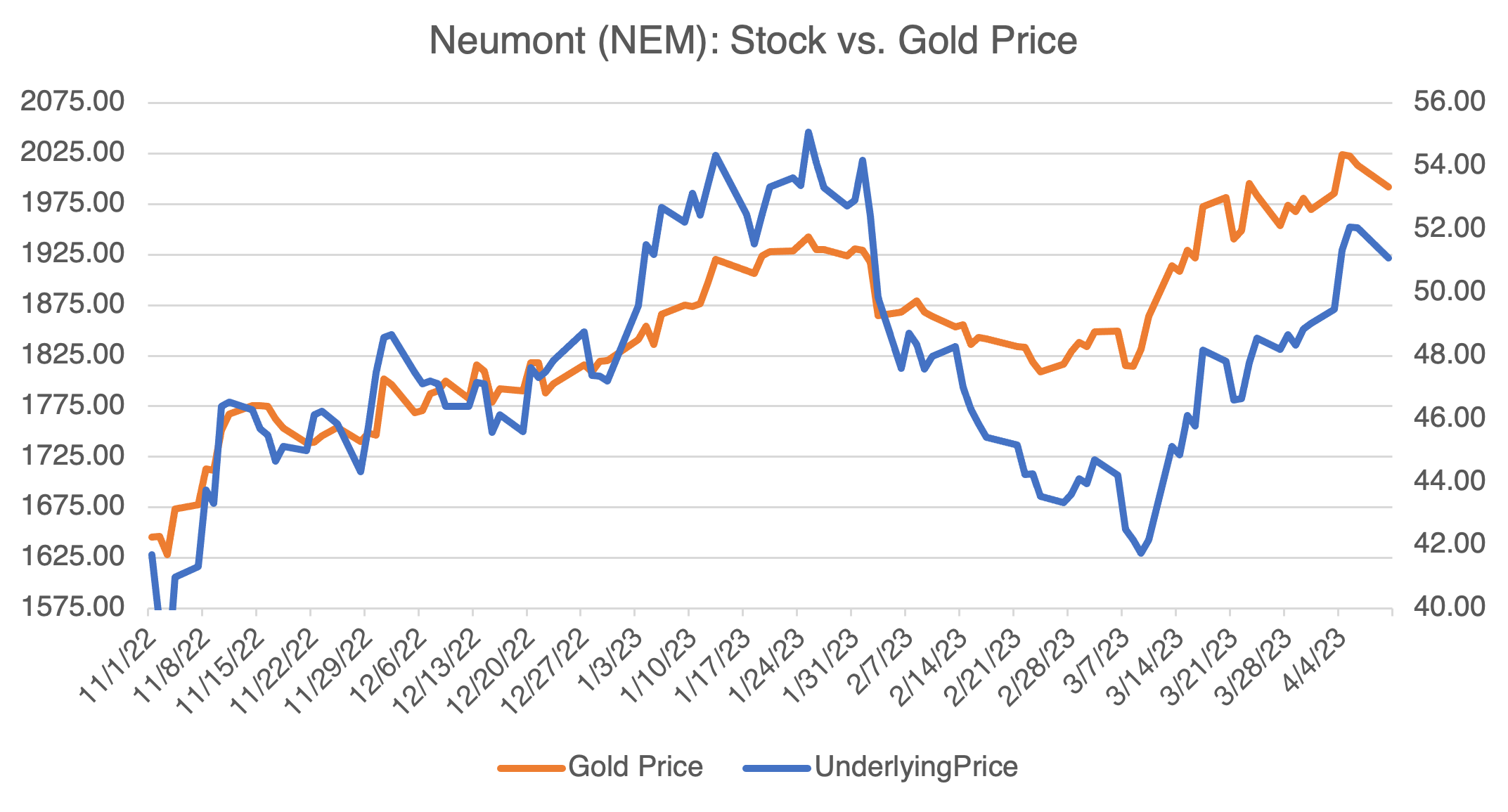

Barrick Gold (GOLD) and Neumont Corp (NEM) are two obvious stocks to play if you want exposure to gold. Obviously, their stock prices are highly correlated to the price of gold (although NEM has been recently affected by its attempted acquisition of Newcrest Mining).

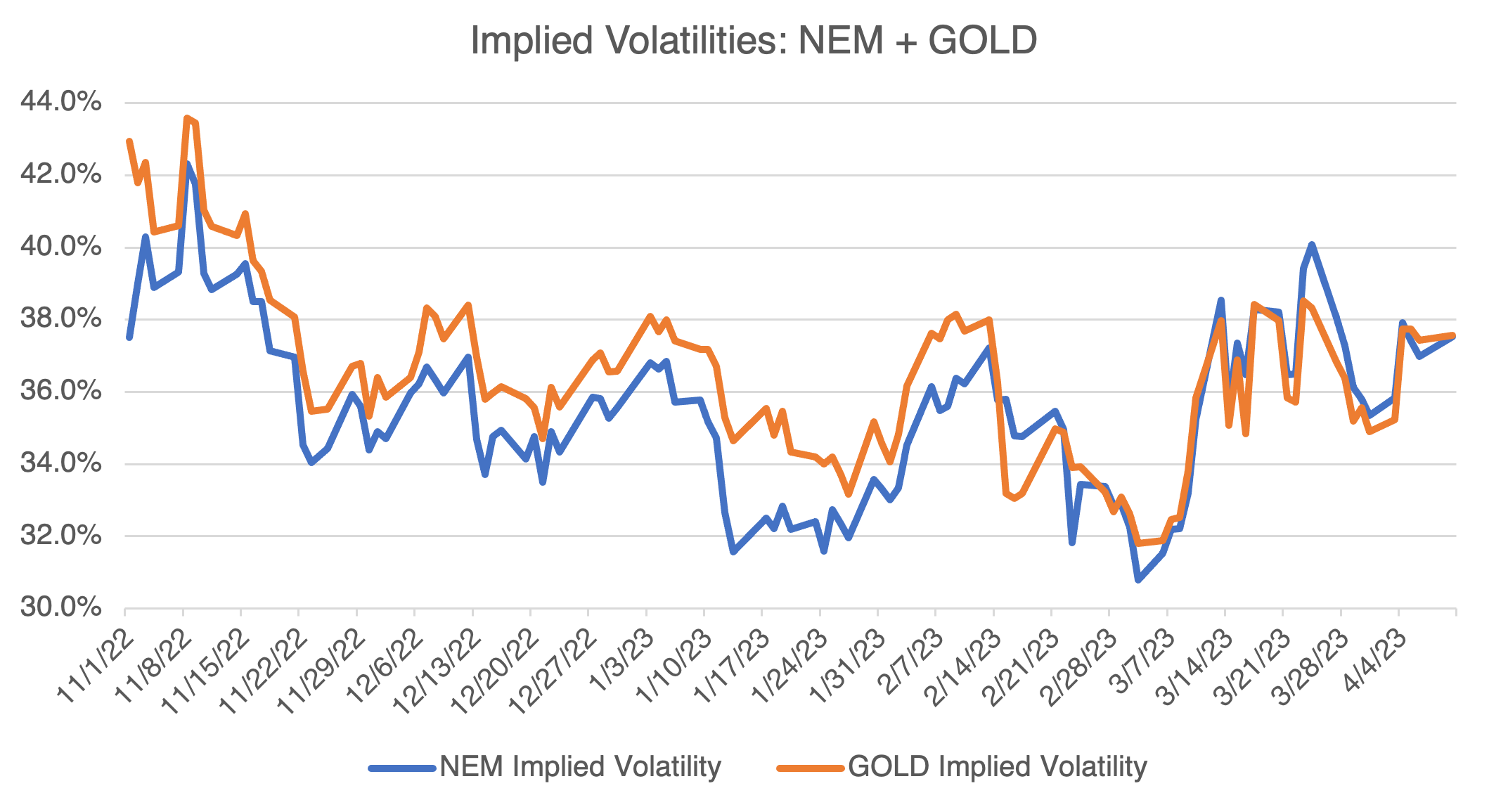

For options traders, GOLD and NEM implied volatilities have been trading between roughly 31% to 38% since the gold rally began in earnest last November. Considering gold’s upside potential and the frenzy it could generate, I consider their implieds to be relatively inexpensive and possibly subject to significant acceleration. To see how to take advantage of this, pull up GOLD or NEM in our options profit calculator tool. Using the IV slider, you can experiment with how various strategies react to an increase in implied volatility.