Athleisure?

Looking around after boarding a plane recently, I had to ask: does anyone wear real pants anymore? Not that I’m nostalgic for the era when people got all dressed up to fly, but the answer seems to be no. What used to be called sweat pants or loungewear has now been tidied up as “Athleisure,” and is increasingly showing up beyond the gym. As the line between office and home became more fluid as a result of Covid, athleisure moved into the office and became the 24/7 outfit of choice for a lot of people. REI has conquered America!

Needless to say, the worlds of fashion and Wall St. are all over it. Other than the public offerings such as Lululemon (LULU — great ticker!), Nike (NKE), and UnderArmour (AEO), Gap (GPS, via its Athleta acquisition), as well as Adidas, Puma, and others, there is a host of private companies as well, such as Vuori, Alo Yoga, Title 9, Outdoor Voices, etc., etc., etc. There are also knockoffs readily available online via Amazon, etc. By some estimates, about 200 new athleisure brands have started since the pandemic. A new and unsolicited athleisure catalog shows up in my mailbox about once a week (yes, paper catalogs seem to be back).

Looking beyond the hype, is athleisure worth a place in your portfolio? Or is it too late?

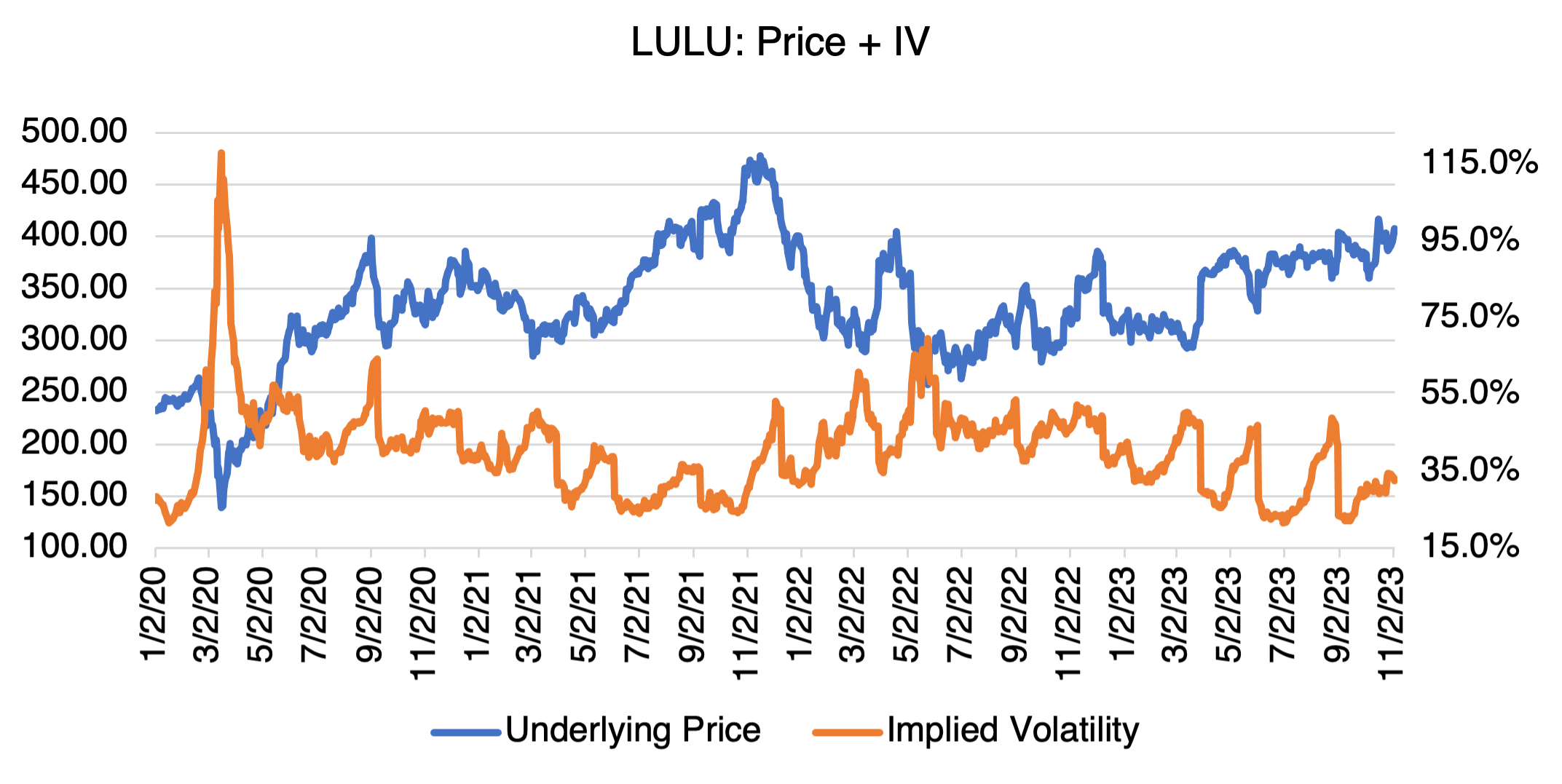

Let’s review Lululemon to highlight the factors involved. The company went IPO all the way back in 2007 when it was the go-to brand for women looking for stylish and well-fitting yoga and workout wear. After expanding their line to include men’s activewear, as well as some more formal offerings suitable for the workplace, their business exploded during the pandemic. Revenue increased 42% in FY2021 and 30% in 2022. It’s stock has followed suit and has shot up about 250% since its low in March 2020, easily outpacing the S&P. Like many other stocks that made Covid-related highs in late 2021 and then crashed down the following year, LULU reached a high of $473 in November 2021 and then came off to a low of $264 the following July. Since then, it’s been making progress on regaining lost ground and is currently trading about $414.

The bullish case for LULU is that a) athleisure is here to stay, and b) more specifically, Lululemon has a proven track record of “product acceptance,” i.e., adapting and innovating their products to changing consumer preferences and tastes, and will therefore continue to gain market share and remain the segment’s industry leader. In short, if they continue doing what they have been doing, it will be smooth sailing ahead.

Skeptics abound and make a convincing case. First, and perhaps most important, fashion is notoriously fickle and requires those involved to be continuously adapting as new trends evolve. “Athleisure is here to stay” flies in the face of history. Nothing lasts forever, and athleisure may one day be looked back upon as a pandemic era fashion that faded after just a few years. Second, maintaining market share and creating a competitive advantage will be difficult. By its very nature, athleisure is characterized by relatively simple designs, similar, stretchy fabrics, and products that change marginally from year to year and are easy to copy. In other words, consumers may come to the conclusion that the offerings from all the different brands are basically the same. Introducing new fabrics or designs only goes so far when all you are selling are relatively simple leggings and tops. Marginal differences usually propel consumers to the lowest priced offering. Added to this is the increased competition from public and private brands. Vouri, the recipient of $400 million from Softbank in 2021 resulting in a $4 billion valuation, is private but a significant competitor to LULU. An IPO may be in its future. By any measure, athleisure is one crowded field.

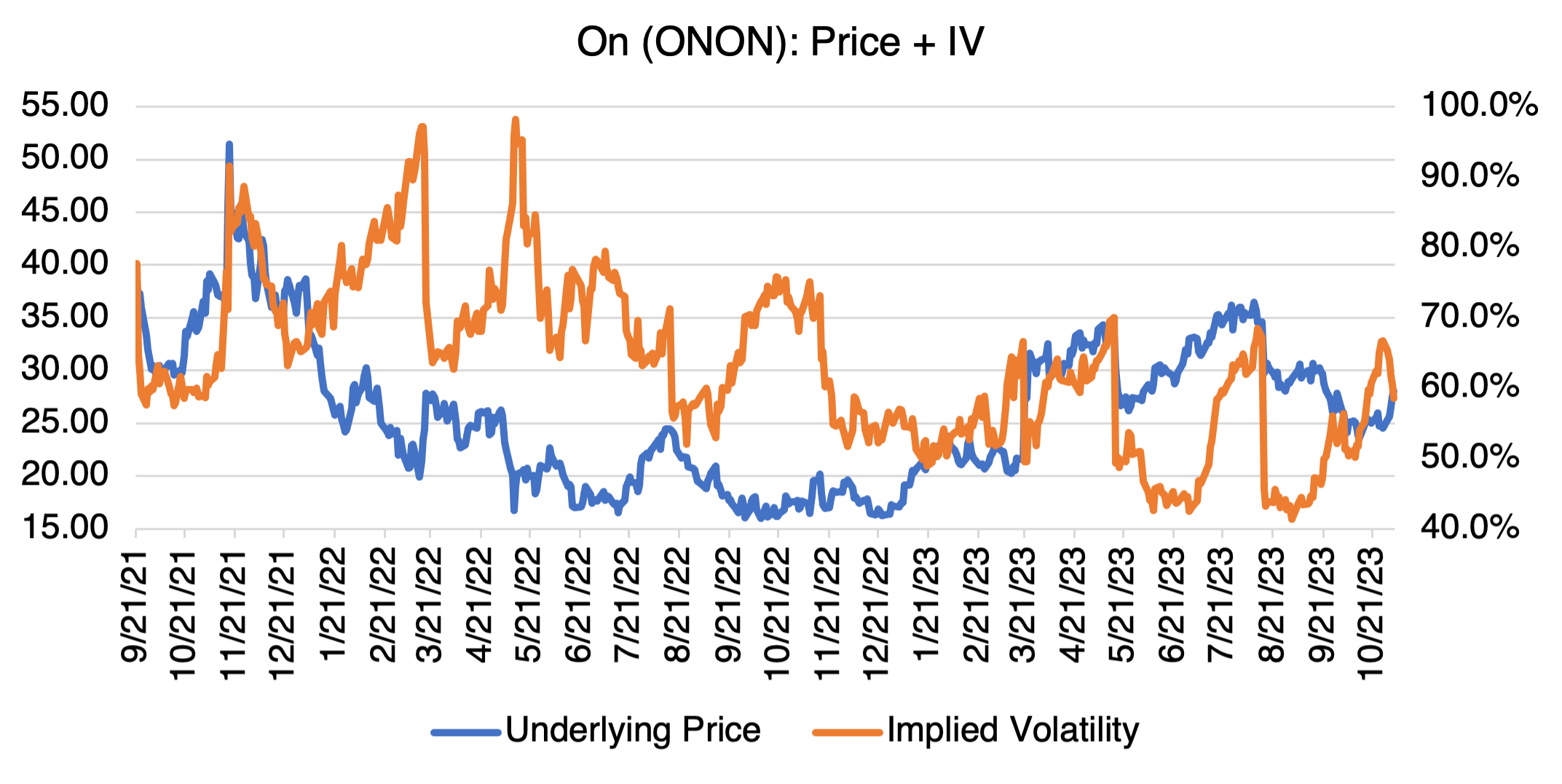

Currently, the only pure athleisure play is Lululemon. If you believe their story and think they can adapt as fashions change (as they inevitably will), then LULU is the only choice in public markets. As you can see below, LULU’s implied volatility is towards the low end of its range — its options are therefore relatively inexpensive.

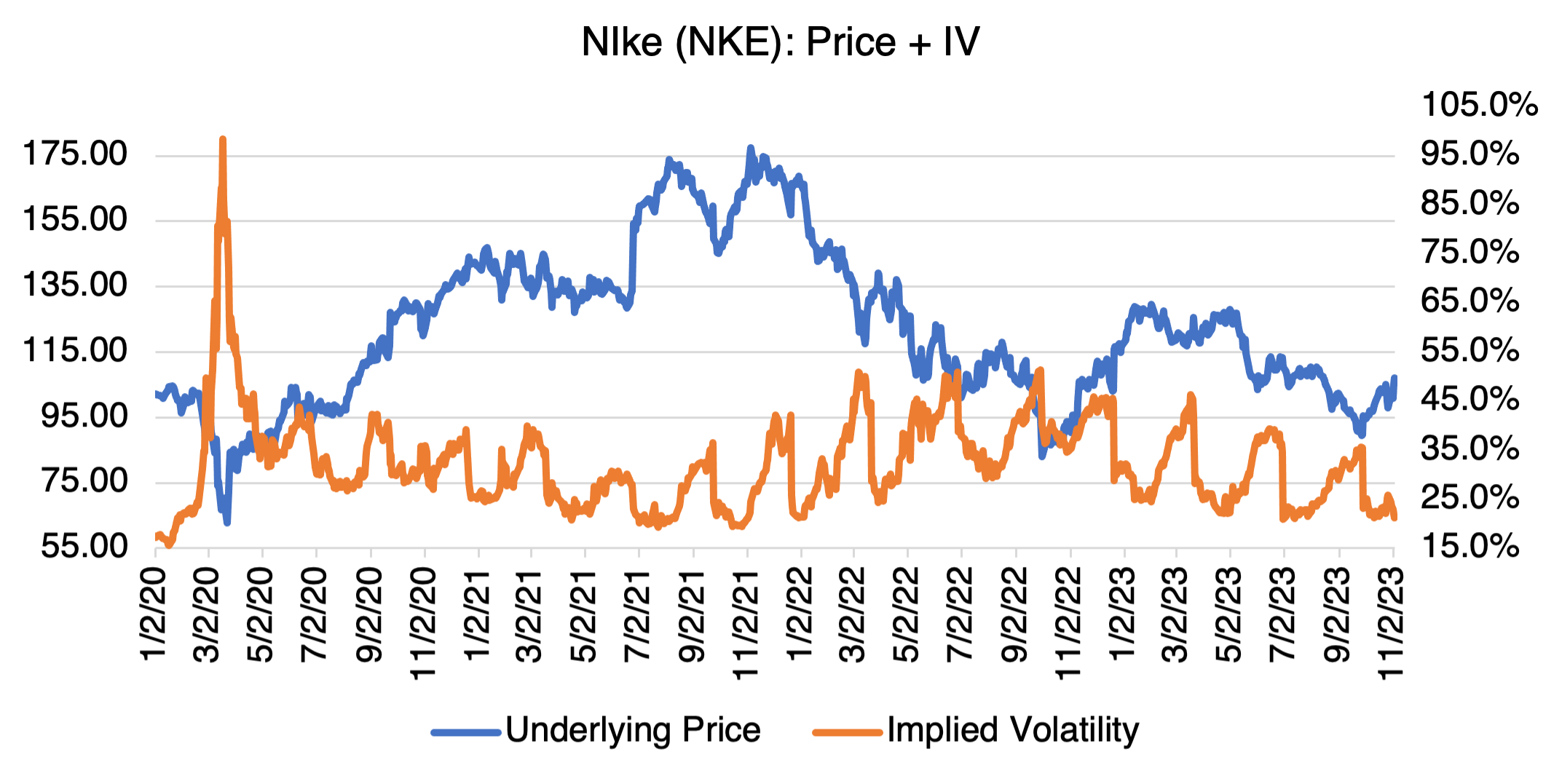

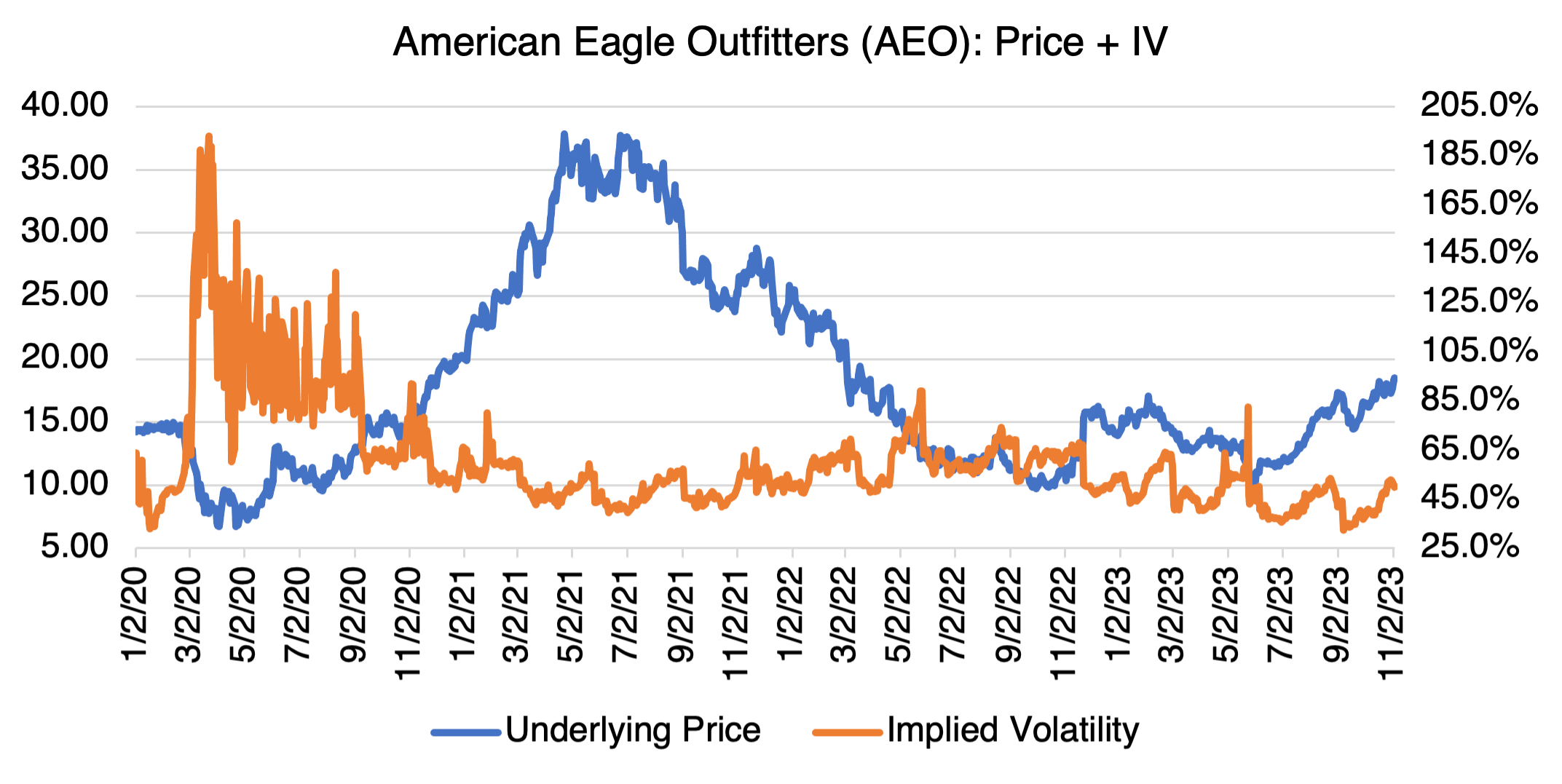

If you believe in the future of athleisure, but recognize that there could be some bumps in the road and want a less pure play, then consider one of the more broad based apparel or shoe companies with significant athleisure presence. American Eagle (AEO), through their Aerie brand, and Nike (NKE) are just two examples. Similar to LULU, both have implied volatilities that are currently trading at the low end of their historical ranges.

Another interesting alternative is On Holdings (ONON), the maker of the trendy running shoes. The company has expanded into apparel, and clothing sales in Q2 and Q3 were up a reported 45% year over year (albeit from a relatively small base). Although the apparel line benefits from the popularity of their footwear, eventually it will be faced with the same issues confronting athleisure in general, and LULU and Vuori specifically, i.e., how to maintain a competitive advantage while selling an increasingly standardized and simple product.