Bitcoin and Geopolitical Risk: The Jury is Still Out

It’s always interesting when markets refuse to follow conventional wisdom. For example, in March 2020 amidst the scary beginnings of Covid, you couldn’t find too many people who were bullish equity and real estate. Gloom and doom prevailed, and many were worried that their 401K would be worthless and that they would never be able to buy toilet paper again. Needless to say, they and their depressing, hysterical brethren were completely wrong about the markets.

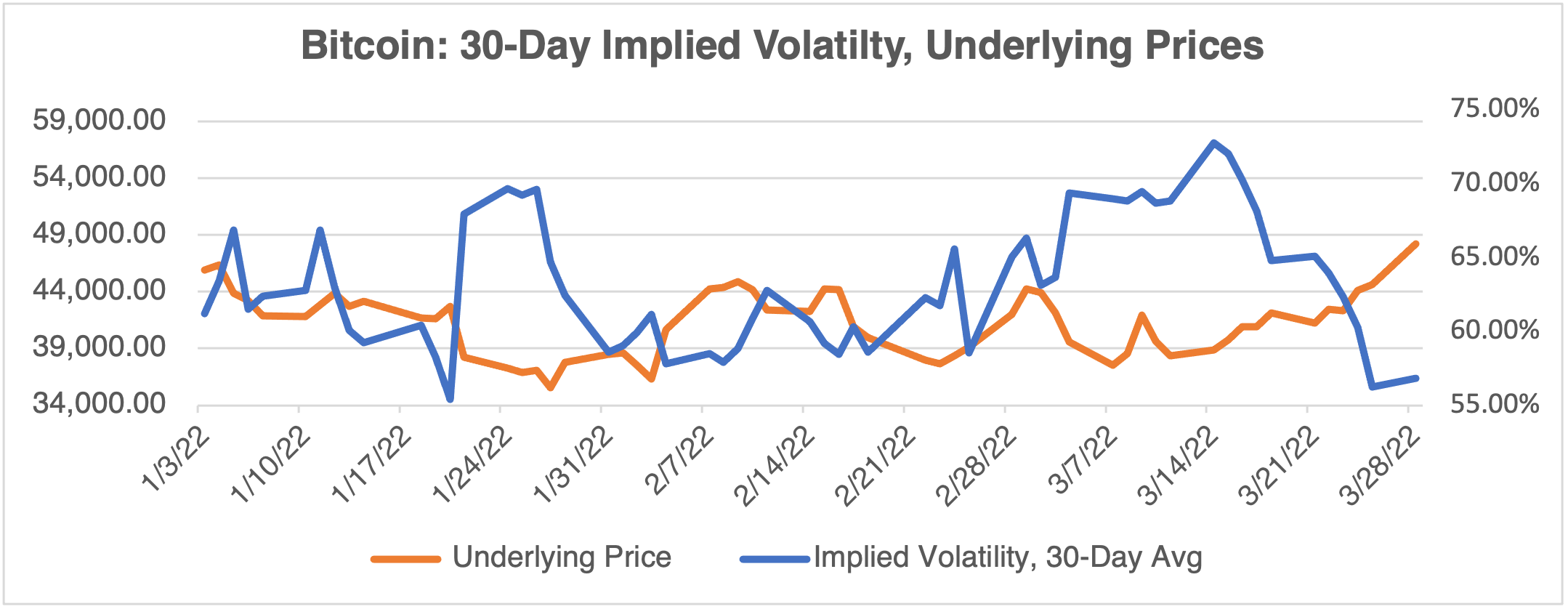

What’s been going on in bitcoin lately as a result of the Ukrainian war is a similar, albeit less dramatic, example. As I wrote last week, “After listening to anyone who regularly attended The True Church of Crypto over the last several years, you would have thought that the last six months would have been the golden age of crypto. Inflation, sanctions, war: all the elements cited for its ascendancy came to pass.” All this has been true since the war began in late February. And yet, the action in bitcoin since the beginning of the year has not been that impressive compared to what one would have expected given the perfect setup:

(Source: OptionMetrics)

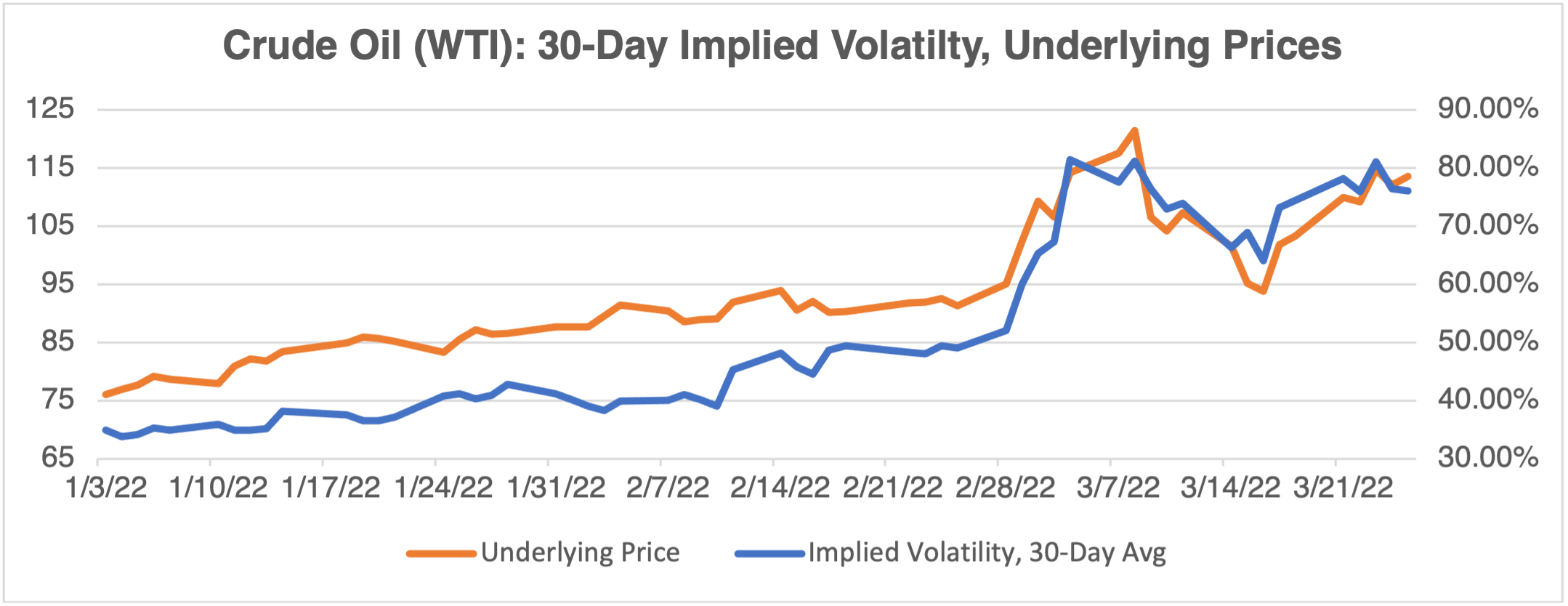

Contrast this with the action in crude oil (WTI) since the beginning of the year:

(Source: OptionMetrics)

All the elements touted by its supporters – war, sanctions, inflation – are present and should produce an impressive rally. That is, if bitcoin behaves as it’s supposed to behave and the factors that most agree drive the market are indeed correct. But maybe current circumstances are indicating that they’re not. A few comments:

- Given the current ideal conditions, if bitcoin doesn’t rally hard (and if it doesn’t rally now, when will it?), it follows that it could be just another speculative product amongst hundreds, not a hedge against inflation, corruption, currency devaluation, or Twitter-based conspiracy theories. Bitcoin could be at an important turning point: if it can’t attract hedgers, then its long-term future as anything other than a niche speculative vehicle could be in doubt.

- If it is indeed a speculative vehicle, then its lackluster performance is due to the fact that speculators are simply trading products with better liquidity and ease of execution. In other words, traders aren’t flocking to buy bitcoin because it’s just easier to trade other products that are showing a clearer connection to the war.

- Despite the attention that bitcoin and all its crypto cousins and in-laws get in the press, volume is still relatively limited and a fraction of what is present in more established markets. I hate to tell all the true believers, but it’s still a niche product with more potential than actual volume. Consider the volume figures below for March 28th:

| Product | Volume |

|---|---|

| E-mini S & P 500* | 1,184,232 |

| 10-Year T-Note* | 1,776,042 |

| Crude Oil (WTI)* | 770,776 |

| Japanese Yen* | 238,508 |

| Gold* | 296,950 |

| Bitcoin** | 36,017 |

*Source: CME

**Source: data.bitcoinity.org

Needless to say, major, high-volume speculator will not be attracted by bitcoin’s low volume figures.

- Of course, bitcoin might just be late to the party and will attract more buyers and volume if and when it rallies. Then, the True Believers will get to say “See, I told you so!” Personally, I’m waiting.

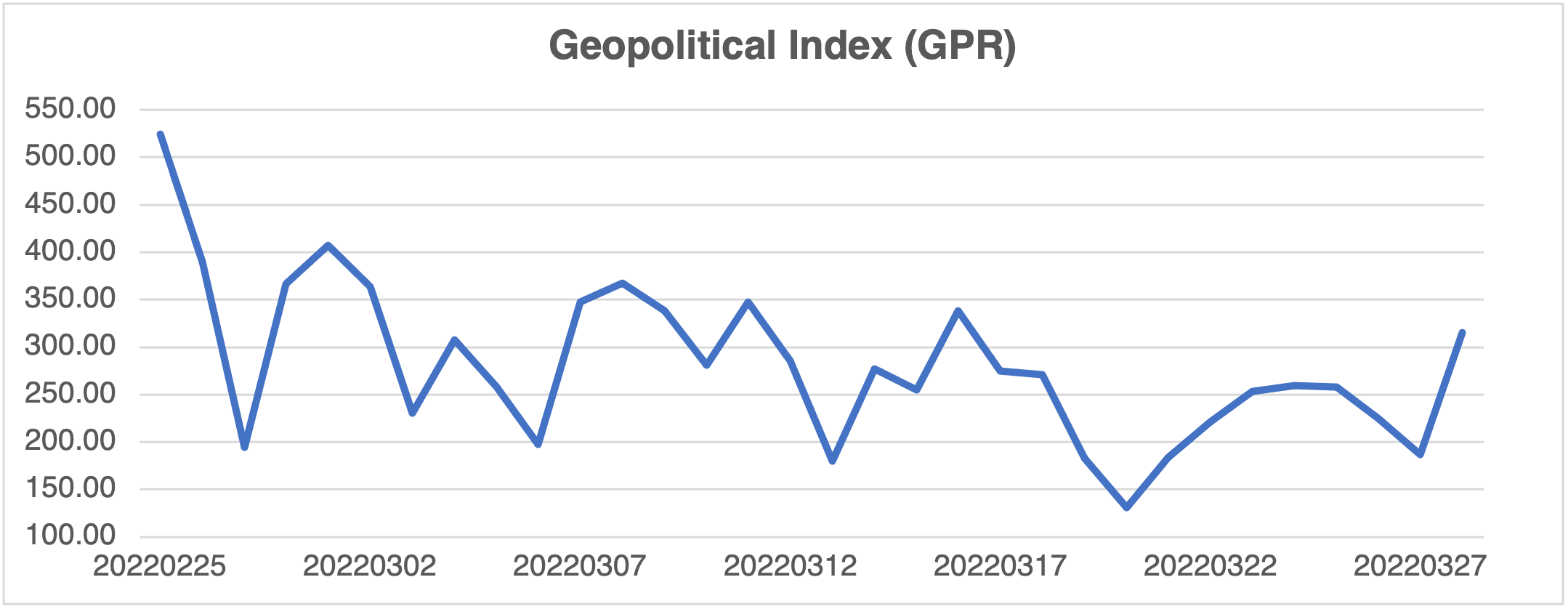

Geopolitical Risk, Quantified

Not surprisingly, geopolitical risk becomes a popular risk factor when international tensions start affecting the markets. Luckily, there are two economists at the Federal Reserve Board, Dario Caldara and Matteo Iacoviello, who in 2021 came up with a Geopolitical Risk (GPR) Index based on the frequency of newspaper articles discussing adverse geopolitical events. Their methodology may be found here. Below are the figures since the war began in February:

(Source: https://www.matteoiacoviello.com/gpr.htm)

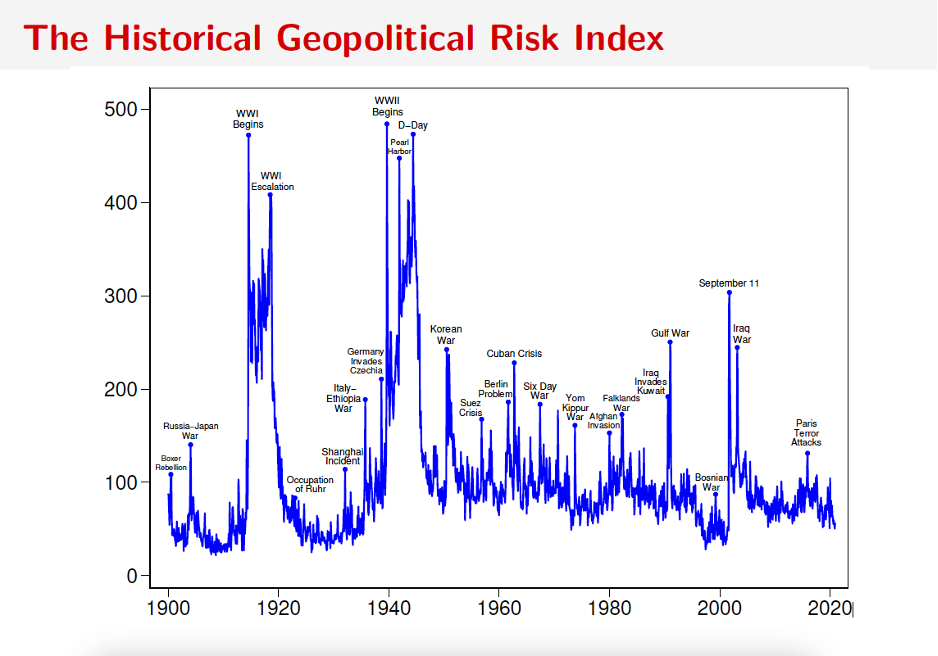

For reference, below is the index since 1900:

(Source: Measuring Geopolitical Risk, Caldara and Iacoviello, FRB, October 2021)

Interesting stuff. More about this in future blogs!

Finally, shouldn’t this have been obvious all along?

This headline from the Wall Street Journal (March 25th): “Behind the Scenes, the IPO Playbook Is Changing. Bankers are preparing for an eventual initial public offering market thaw by focusing on companies with profits and stability [emphasis mine].”