Bitcoin: The Dream Lives On?

As is its habit, Bitcoin is back in the news lately. Bitcoin futures have been rallying, almost without a break, since the beginning of the year. As of this writing, it’s up a whopping 122% on the year and 36% during the last month alone. For context, that’s almost 8X greater than that of the SPX YTD performance. Sure, Bitcoin’s gain has not been in the Nvidia (NVDA) class (240% YTD, 1085% 5 YR), but triple digit returns, especially those that consistently grow over time, are impressive nevertheless. Needless to say, social media is abuzz, again, with predictions of six figure prices.

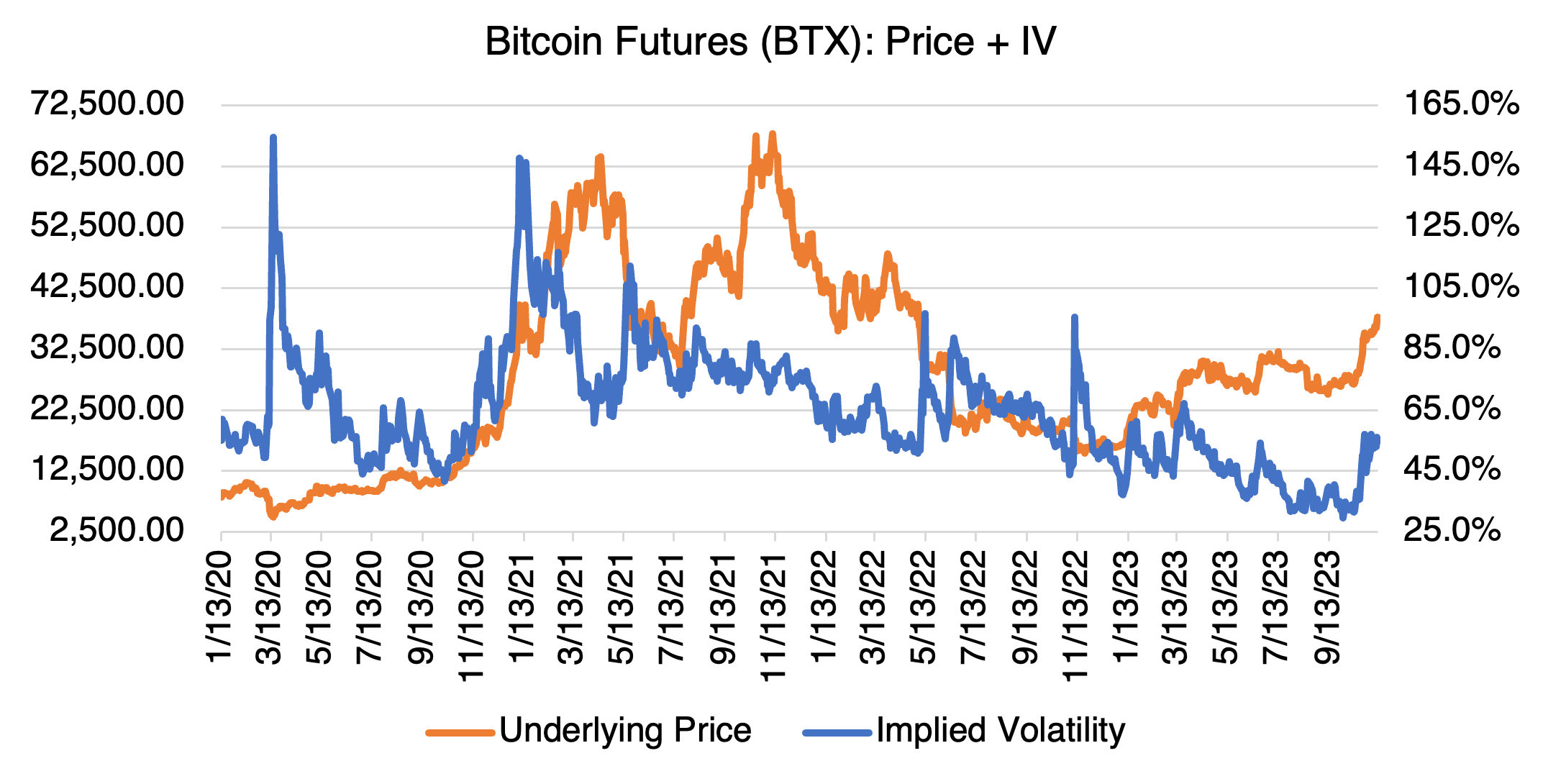

Given that, I guess it’s not shocking that BTC’s implied volatility has kicked up almost 20 vol points to the 55% level, helped along by the war in the Mideast. Notice that recently its implied volatility is increasing as bitcoin increases, not inversely so as is the case with many other stocks and commodities. Despite the higher implied volatility, it is still nowhere near the triple digit levels experienced in 2020 and still at relatively low levels (for BTC).

Why are Bitcoin and crypto back in favor? A few reasons:

- The prospect of bitcoin spot ETFs. Large and well-known asset managers, such as BlackRock and Fidelity, are waiting for SEC approval to issue a spot bitcoin ETF. Issuance will offer investors a means to invest in crypto directly and increase the legitimacy of the product. SEC approval (or denial) is expected in early 2024, and possibly for multiple ETFs.

- As part of the Bitcoin protocol’s design, halving is a mechanism to control its supply and describes the rate at which new tokens can be created. The next halving is expected to occur in April 2024 and will reduce the token award by 50%. Most simply, this will reduced bitcoin supply.

- Bitcoin proponents have always touted it as a hedge against political uncertainty, and it has acted accordingly since the Mideast war started in early October.

- FTX is out of the news, finally.

- It’s going up! Remember the excitement that bitcoin generated during its first serious rally at the end of 2017? People who didn’t even know what Bitcoin was were jumping in, Florida Land Boom Style. Thinking it might happen again is very seductive and could lead to a FOMO driven explosion.

With those factors in mind, the case for a bull market in bitcoin and crypto in general is simple: increased demand via the ETFs, coupled with decreased supply due to the halving process, as well as continued instability, will lead to significantly higher prices. As in all things crypto, hyperbole is king and there is no shortage of commentators predicting stratospheric increases in price. Earlier in the week, none other than ARK Investments CEO Cathie Wood predicted a base case of $600,000-$650,00, or even higher.

Of course, there is another, less optimistic crypto prognosis:

- The two main factors behind the bull case, ETF issuance and halving, are well known and discounted in the current price. News of the impending ETFs has been in the market for some time, as well as the halving process and expected date. Moreover, the effect of the halving process is unpredictable. None of this is a secret and has been widely known in the market for some time. In other words, new ETFs and halving may already be priced in. The old adage, “buy the rumor, sell the news” may apply.

- The new spot ETF will not attract new investors or volume, just reallocate existing business. ETFs already exist in Canada and Europe and have attracted only limited interest. In addition, new investors may be wary of adding crypto due to its well-deserved reputational issues.

- FTX, and other crypto related bankruptcies and scandals, still hang over the market. The trial of Sam Brinkman-Fried and the bankruptcy of FTX betrayed the crypto market’s immaturity and ignorance (willing or not) regarding security laws and proper operational practice.

- It has been reported that Hamas’ strike on Israel was financed, at least partially, through cryptocurrency. This confirms its reputation as a transaction vehicle for those wishing to pursue, shall we say, “extra-legal” activities. The SEC will take this into account when ruling on the ETFs. This leads to a more general problem — the crypto use case still remains a mystery to the vast majority of people. At the end of the day, is it just a speculative vehicle and has no real purpose other than as a means for those engaged in illicit activities to conduct business?

- Commentators predicting 20X returns and the like are usually the telltale sign of an overhyped, overdone market.

Personally, I don’t think it’s a slam dunk that the SEC will approve the new spot ETFs. The FTX debacle, complete with the sordid spectacle of SBF testifying, coupled with alleged crypto financed terrorism, isn’t the greatest PR in the world when seeking regulatory approval. Crypto’s reputation as a hedge or alternative to traditional financial systems remains in doubt, to say the least. Since SEC approval seems to be discounted in the current price, regulatory failure would be quite a shock to the market and could send it sharply lower.

But…in the meantime, the bulls are still raging. As I mentioned above, options are still cheap enough to play if you are strongly convinced of either the bull or bear case. However, not for widows or orphans!