Just a Few Stocks

Last week, I ended my blog (Memes are Back) by noting that that is was ok to trade the latest meme stocks, but “…don’t take your eyes off the prize — finding stocks that take advantage of long term technological change. That’s how you build generational wealth.” Let me explain.

In a 2017 paper by Hendrik Bessembinder (Department of Finance, W.P. Carey School of Business, Arizona State University) entitled Do Stocks Outperform Treasury Bills? (Journal of Financial Economics, November, 2017), the author analyzed common stock returns from 1926 – 2017. The results are surprising:

- 58% of stocks failed to beat Treasury bill returns

- 38% beat Treasure bills, but by marginal amounts

- Most surprising: “$35 trillion in wealth that stocks created over and above Treasury bills returns between 1926 and 2016 could be attributed to just 1,092 companies, or 4.3 percent of the nearly 26,000 stocks that have been traded in the markets. More than half of the $35 trillion came from just 90 companies, or less than one-third of 1 percent.”

- Notice that the majority of stocks in the 1/3 of 1% centered around disruptive, new technologies, either currently or when the companies were first started. Apple, Amazon, Meta, and Intel obviously fall into this category. Less obvious are some companies that were disruptive when they were formed in the early 20th century: ExxonMobil and Chevron, (Standard Oil trust, petroleum as a new energy source), Coca-Cola (mass market advertising and product), General Electric (electricity, engineering), GM (mass market branding, corporate organization), and IBM (computers, corporate sales). Six of the top 20 are directly involved with computers or the internet.

Below is a handy summary of Bessembinder’s findings:

Source: WPCAREY.ASU.EDU / AUTUMN 2018

A whopping 96% of stocks returned just about what you would have gotten had you invested in boring old Treasury bills (and with a lot less risk). No wonder stock picking is so difficult! From the analysis, one can conclude that the probability of correctly identifying the few stocks that will produce outsized performance, and then buying and holding them, is extremely low. As they say, possible…but not probable.

Keep in mind that the results from the study are cumulative and assume a buy and hold strategy. In other words, and for example, you bought GM in 1926 and never sold it, even in the depths of the Great Depression or in any of the other periods of financial distress since then. For stocks that weren’t yet listed in 1926, their returns were measured from the time they first appeared in the study’s database (i.e., when they were first listed).

All this is not to say that you will never profit from the 4.3% superstars, only that they are hard to find and many are obvious only in retrospect. If you doubt the latter, ask around and find out how many people bought Apple, Microsoft, Meta, or Google on the first day of trading, much less kept them through all manner of difficult markets and real and imagined financial calamities. Not many.

Regardless of whether anyone could realistically and practically replicate the study’s methodology in real life, it does point out one of the lesser known benefits of diversification, i.e., that a broad array of stocks will increase the probability that you will happen to have one or more of the 4.3% in your portfolio. It’s akin to the strategy of PE firms that invest broadly in the hope that just a few companies will yield extraordinary returns. It’s also one of the best advertisements I’ve ever seen for long term index investing.

LNG

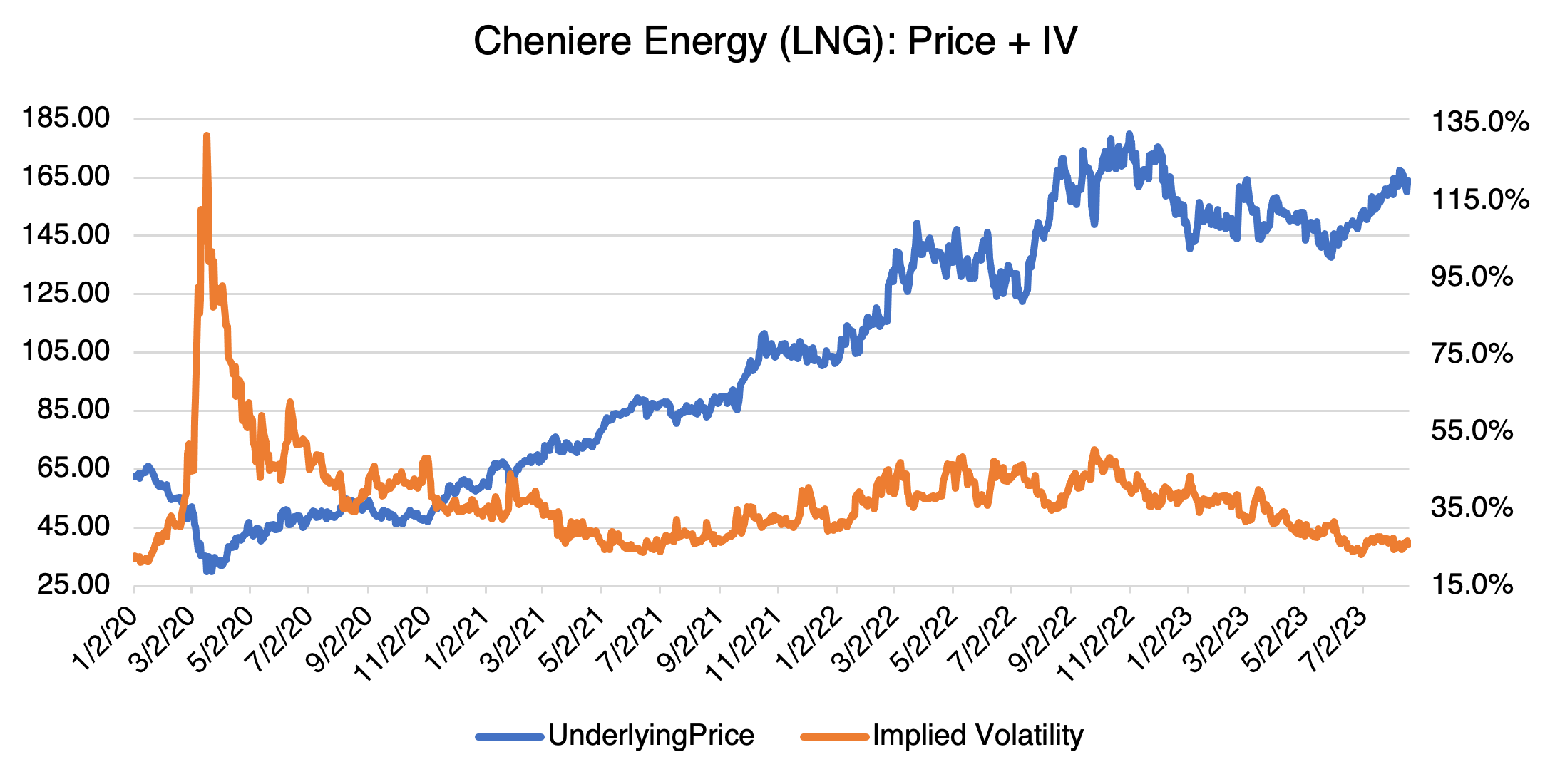

I’ve written about Cheniere Energy (LNG) a few times now, most recently last April (LNG, Again). To recap, the endless war in Ukraine highlighted the problem of relying upon Russia for energy supplies. Last winter, as Russia curtailed Europe’s natural gas supplies, Europeans were forced to diversify their supply. Liquified natural gas, which can be shipped from the US and elsewhere, was an obvious choice. Cheniere, the largest US based LNG producer, stepped in to fill the void, rallying from roughly $116 at the beginning of the war to a peak of almost $180 at the beginning of November.

Source: OptionMetrics

Last winter in Europe was relatively mild, and the worst predictions of energy shortages never came to pass. Consequently, LNG fell back to the $140 level before settling into a sideways trading pattern. In early May, and in anticipation of the 2024 heating season, LNG started rallying again along with natural gas and transport prices.

Notice that LNG’s implied volatility has been declining since prices peaked last Fall when it was trading in the mid-40% region. It currently stands around 26%, almost 20 vol points lower. Options on LNG are therefore relatively inexpensive. If you believe that a harsh European winter may be in the cards, thereby propelling LNG to new highs as we enter the 2024 heating season, then they might be an efficient choice.