LNG: A Downside Emerges

Most Americans don’t know it, but Europe had a full blown energy crisis during the Fall and Winter of 2022. I wrote about it in August of that year (European Issues) and several times since, focusing on opportunities in the energy sector, specifically liquified natural gas (LNG).

To review: LNG is natural gas that has been cooled to about -260° Fahrenheit. In this state, it is about 600 times smaller in volume and can be transported via ship. LNG is therefore not dependent on pipelines for transport and can be shipped wherever supply and demand dictates. After Russia ceased natural gas exports to Europe in Spring 2022, LNG terminals were quickly constructed in Germany and they were used to meet the energy shortfall.

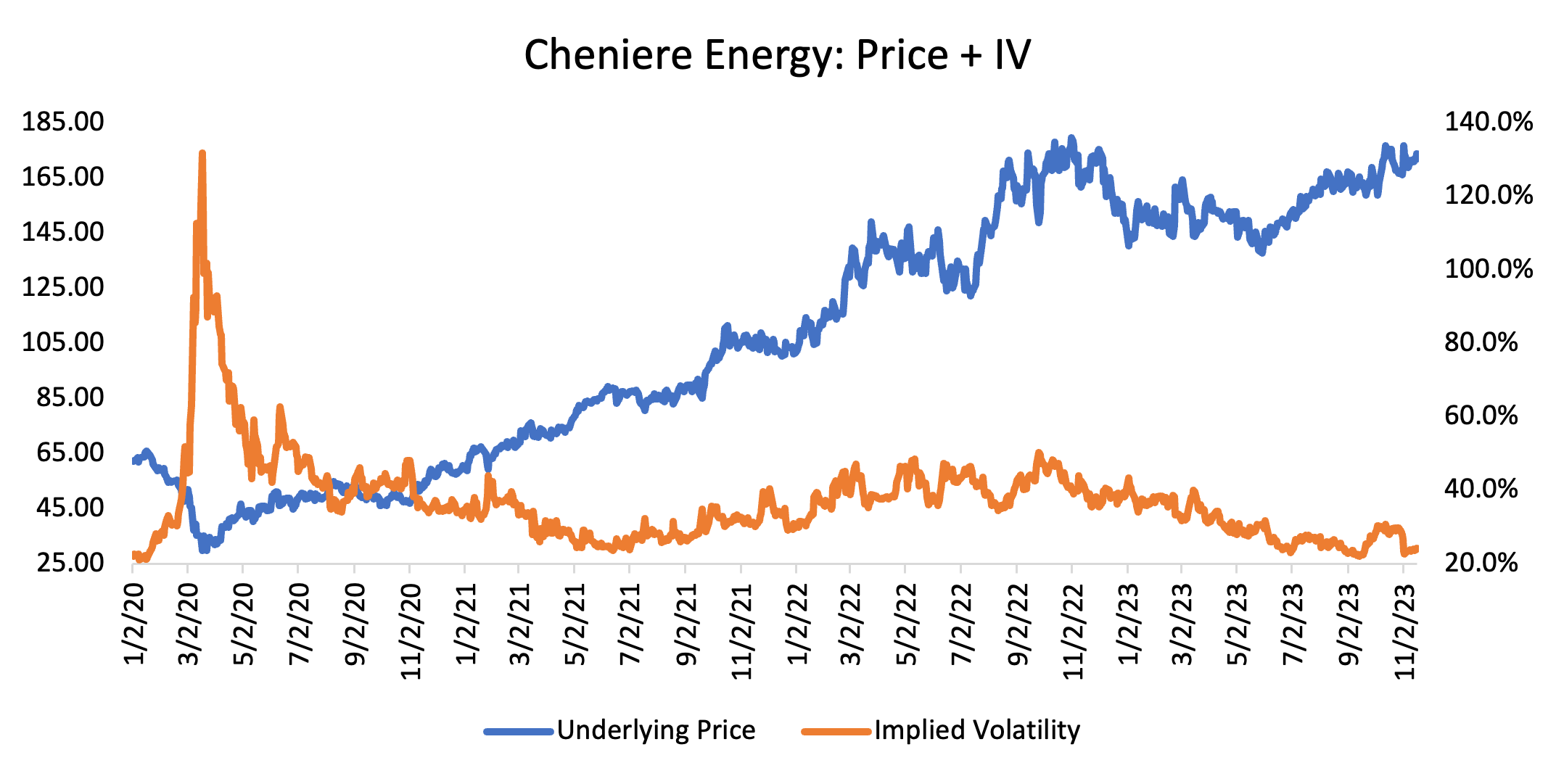

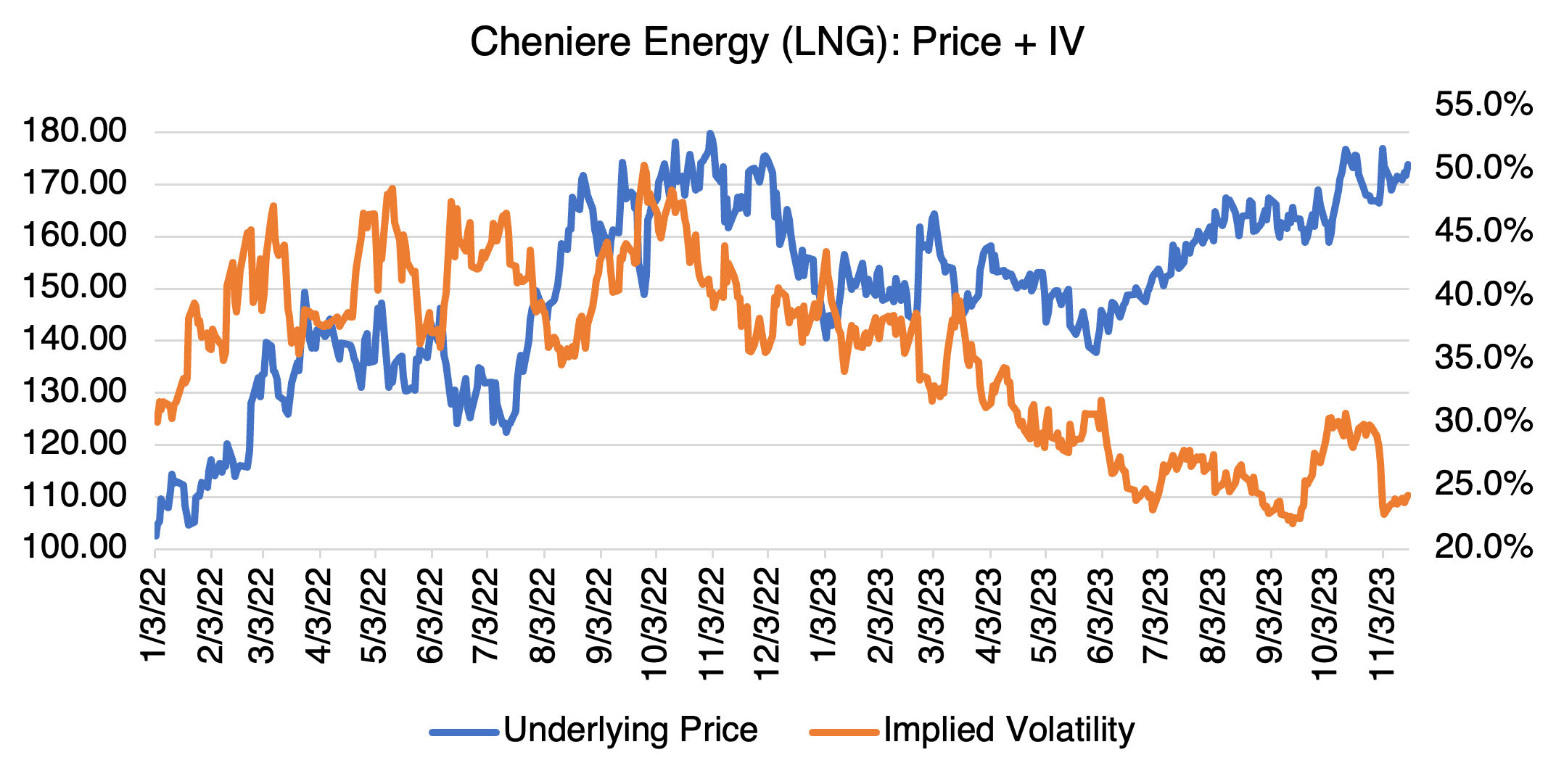

This established LNG as a viable solution to international energy shortages and produced a windfall for the largest liquified natural gas producer in the US, Cheniere Energy (ticker = LNG, confusingly like the gas). LNG rallied from the $105 level to a high of almost $175 by the late Fall of 2022, when fears of European energy shortfalls reached their peak. Contrary to most predictions at the time, an unseasonably warm winter, stockpiled coal, and new supplies of LNG (mostly from the US), headed off the potential crisis. It did point out LNG’s potential, however. With the war in Ukraine dragging on, and European energy supplies questionable, the US LNG business, and Cheniere Energy in particular, was on a roll.

So far, so good. That is, until liquified natural gas fell under the shadow of environmental concerns. LNG is a source of a potent greenhouse gas, methane, and is now in the crosshairs of many environmental groups pressuring for more stringent permitting of planned expansions and the closing of certain existing facilities. Some are even advocating for a complete halt to US exports. Eventually, the current administration will have to weigh in on whether to curtail LNG exports and existing facilities or not.

The decision is not clear cut. The impact of a ban on US exports of LNG will be far reaching and will affect domestic and international energy prices. The upcoming election is obviously a factor and may cause the administrative to postpone any decision until after then. And, of course, all governmental actions can produce unintended side effects (i.e., the stuff that that no one predicted) that are usually “suboptimal.” For example, coal is easily transported internationally and can substitute for LNG. When Europe was facing down an impending shortage of natural gas last Fall, it led to panic coal buying. If that occurs again due to LNG export or production controls, one greenhouse gas villain will have replaced another.

Obviously, export controls, etc. are not good for the LNG industry. However, and at least to date, the prospect of a curtailment of LNG exports does not seem to be affecting Cheniere’s stock price. So far, and with winter already upon us, Cheniere is testing the mid-$170 region last seen during the height of the European energy crisis in Fall 2022. YTD, it’s up almost 25%. That being said, if the LNG curtailment bandwagon picks up steam, I suspect it will eventually become a drag on the stock. New and different trading opportunities will arise. Stay tuned.

LNG implied volatility displays the inverse relation to its underlying price that many other stocks and commodities exhibit. With LNG rallying recently, volatility has fallen to the low end of its range since mid-2021, or about 24%. LNG options are therefore relatively inexpensive should you believe either the bull or bear scenarios outlined above.

And with that, I wish you and yours a Happy Thanksgiving!