LNG Uncertainty

I’ve written several times about Liquified Natural Gas (LNG) and the world’s second largest producer, Cheniere Energy (ticker = LNG, conveniently and confusingly). In a nutshell, LNG is natural gas that has been refrigerated into liquid form, reducing its volume by 1/600th, and then pumped into non-pressurized containers to be shipped anywhere in the world. That makes LNG, and to a certain extent natural gas, an international commodity susceptible to geopolitical events. For example, after the war in Ukraine started, Russia curtailed shipments of natural gas to Europe, causing a mad scramble for alternative energy supplies. Facing an energy emergency, Europeans imported LNG to partially meet their energy needs. This significantly reduced the effectiveness of Russia’s natural gas weapon and got Europe through the winter. For investors, it highlighted the new found importance of LNG and the prospects of its major producers. Cheniere Energy (LNG) was one of the main beneficiaries, with its stock rallying almost 46% as a result.

It’s coming up on two years since the war in Ukraine began. Have the prospects for Cheniere and LNG, the commodity, changed? Yes, as least in the short to medium term. Despite its advantages, LNG is still a fossil fuel and therefore in the crosshairs of anyone opposed to their expansion. Acknowledging their concerns, two weeks ago the Biden Administration temporarily froze permits for new LNG export projects. The freeze will remain in place until the Department of Energy can update the analyses used for consideration and authorization of new projects. This will almost certainly take several years, or at least until after the election. Of course, this is largely a political process and injects a whole new level of uncertainty into US LNG production, exports, and domestic natural gas prices.

How does this affect Cheniere Energy? First, restricting exports increases domestic supply and is almost certainly bearish for natural gas. If you need verification of this, you only need look at one of the parties that has been lobbying the hardest for limiting exports of LNG — chemical manufacturers that use large quantities of natural gas. Second, since Cheniere is a major exporter, limiting US exports will shift demand to other exporters, such as those based in Qatar.

Since the permitting freeze is political, a new Administration or changes in the political winds may change its prospects. Naturally, Europeans who have depended on LNG to blunt their dependence on Russian natural gas aren’t happy with the decision. Energy can be used as a geopolitical tool and weapon, and LNG is no exception.

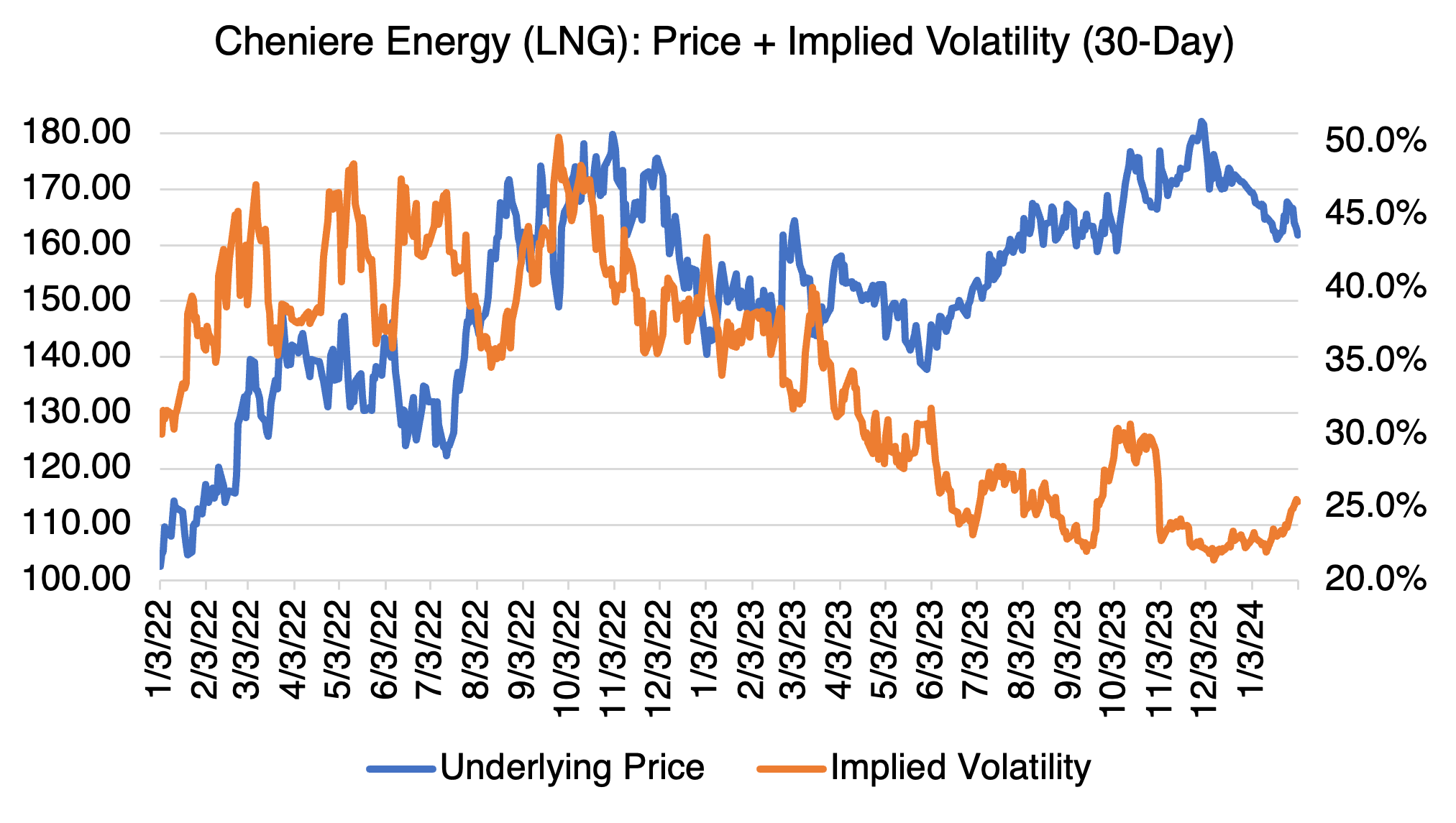

Faced with declining natural gas prices in the US, Cheniere has been coming off since early December. Coupled with the permitting freeze, uncertainty is rising and driving LNG implied volatility higher. Adding to this is the inverse relation of LNG prices and implied volatility. Although still at relatively low levels, if the stock breaks down lower, volatility may increase to levels not seen since 2022. A strategy that benefits from lower prices, coupled with long volatility, may be therefore merited.

Source: OptionMetrics – Historical Options Data Provider