Nvidia — My Two Cents

Nvidia was a Wall Street mega darling even before its incredible results were announced last Wednesday night. Since then, it has been anointed The Greatest Stock of All Time. Press coverage has been universally positive since the beginning of the year, with some heralding the start of a new age of artificial intelligence powered by chips from Nvidia. The dawn of the internet in the early 90’s will pale in comparison! Needless to say, retail investors are all over it, treating NVDA as a great tech momentum play grounded in solid fundamentals.

And who can blame them? Not many companies can say nowadays that demand exceeds their supply. With Q4 profits 8 times higher year-over-year and sales almost 3 times higher, NVDA has shot up 63.4% YTD, after surging 239% in 2023. For context, the S&P is up only a paltry 7.1% YTD and was up only 24% in 2023 (levels that investors would have killed for in 2022).

Despite the bullish fundamentals, the obvious question is whether NVDA is overvalued or not. After all, as the old time trading aphorism goes, “trees don’t grow to the sky.” As an options trader, I’m not going to add much to this debate. I can say, however, that NVDA fails my relatives, friends, and college kids test, i.e., if distant relatives, friends, and college kids are talking about it, and bragging loudly about how much money they made, then the party is very 4 am. I know that’s very anecdotal, and hardly scientific, but when people start talking about a stock with quasi-religious conviction, you should get nervous. Maybe we are on the cusp of a new AI revolution and NVDA will be in the right place at the right time forever. Or maybe that’s true, but the promise of AI vastly exceeds reality. Or maybe competitors will rush in, ruining NVDA’s semi-monopoly. I don’t know, but I do know that it’s always good to be skeptical when investing. In the meantime, NVDA is a freight train, and it’s never a good idea to step in front of one.

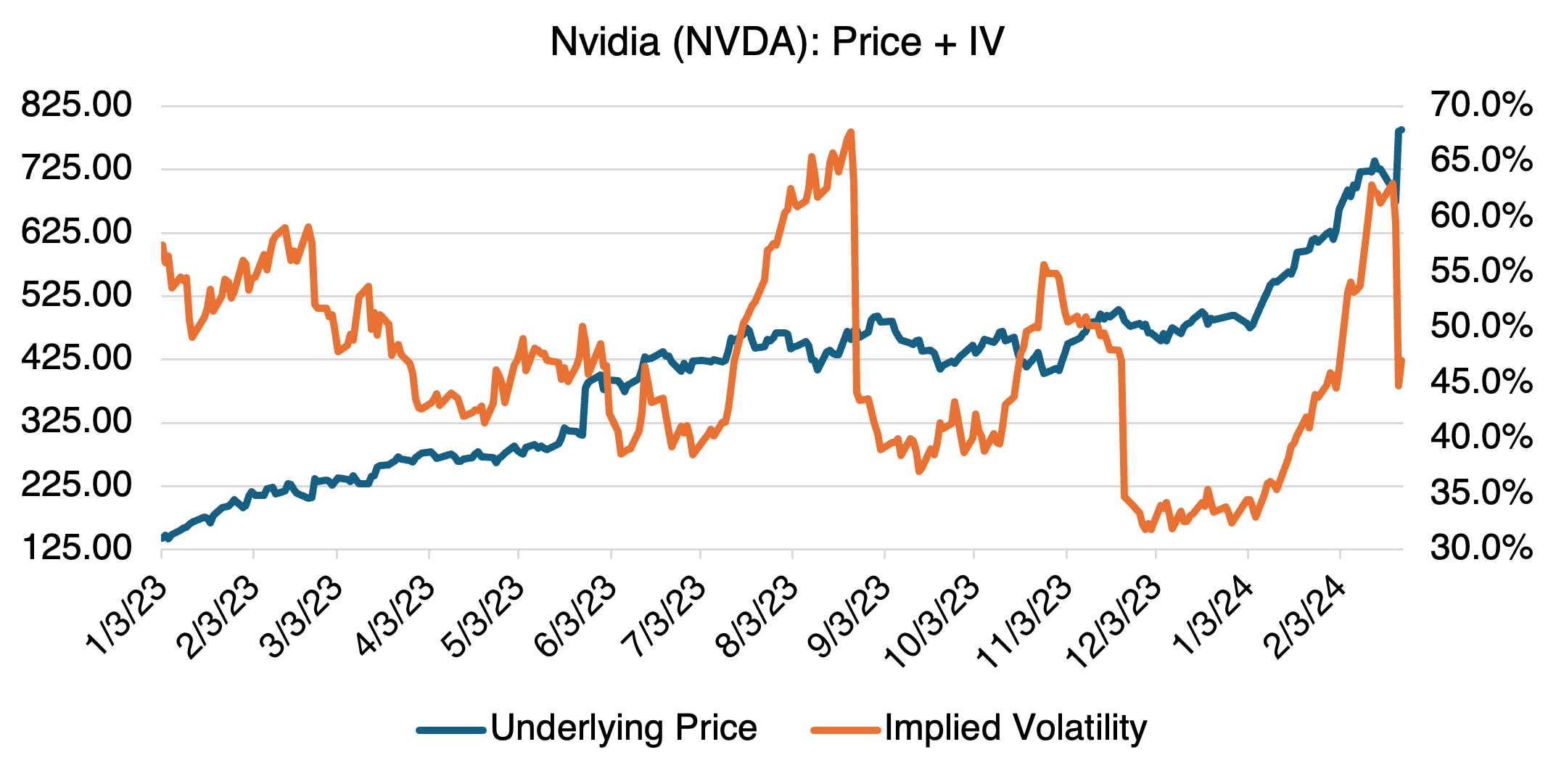

I do know about what drives implied volatility. And that’s one thing that should make NVDA prospective investors happy. In a blog earlier in the month (The Magnificent Seven), I noted that of the Mag Seven stocks, only the implied volatility of NVDA was increasing, reflecting the uncertainty surrounding its impending earnings release and whether the stock had gotten ahead of itself. A lot was riding on it, and NVDA came through with incredible numbers. Consequently, uncertainty decreased and implied volatility came off hard, decreasing from roughly 63% to 45%. Past NVDA earnings releases have followed a similar pattern. The result? Despite the volume and the hype, NVDA options are relatively cheap right now, on an absolute implied volatility basis.

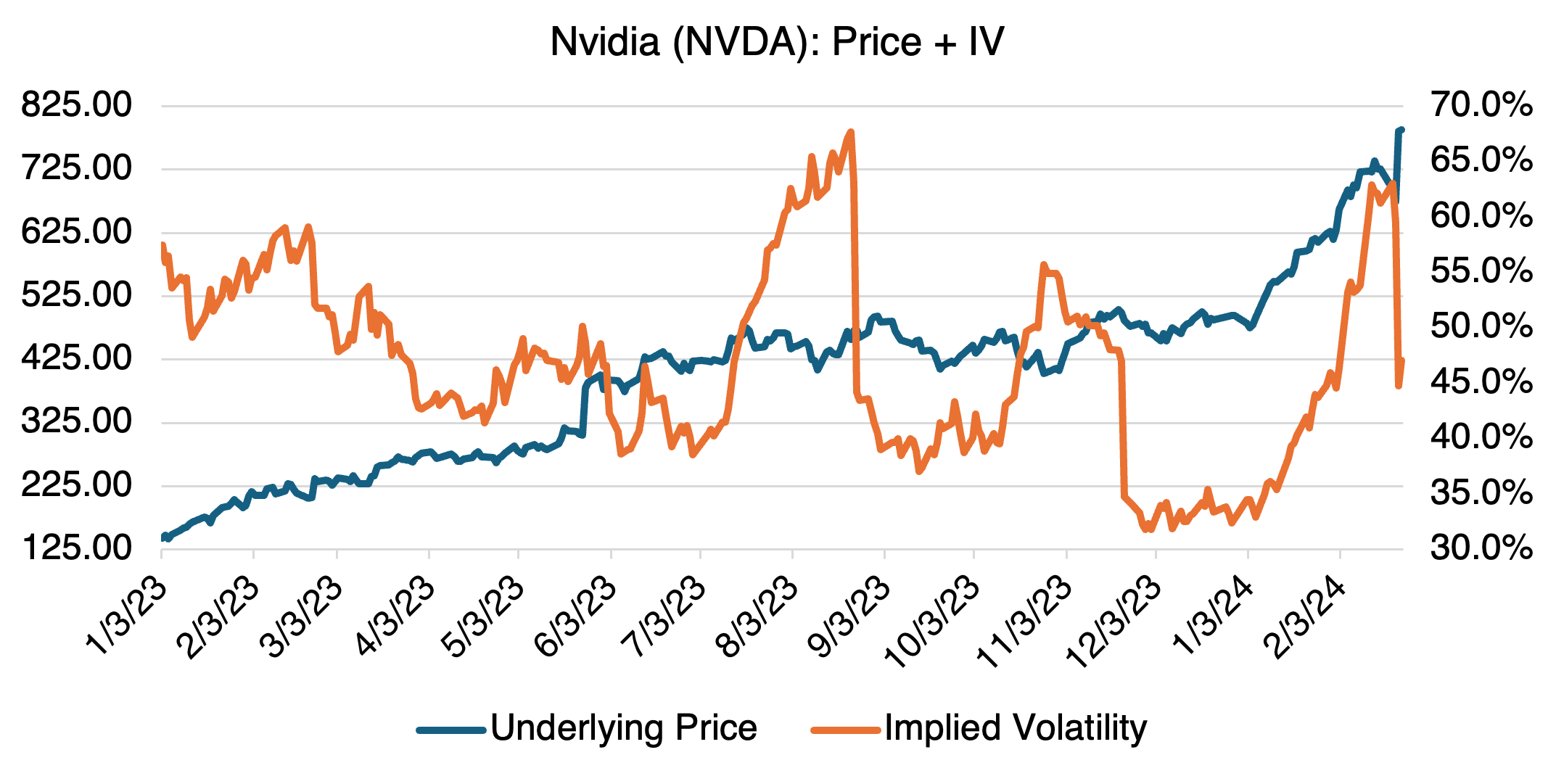

Another way to look at the relative value of NVDA options is to measure the skew, or the difference between at-the-money (ATM) and out-of-the-money (OTM) options. The theory goes that bullish investors tend to buy OTM options because they are less expensive in absolute terms and could produce outsized gains. In other words, they are a cheap lottery ticket. As they buy the OTM strikes, and ignore their true probability of exercise, they tend to bid them up over ATM options. As that process accelerates, the implied volatility of OTM strikes increases relative to those ATM and the skew increases.

Another way to look at the relative value of NVDA options is to measure the skew, or the difference between at-the-money (ATM) and out-of-the-money (OTM) options. The theory goes that bullish investors tend to buy OTM options because they are less expensive in absolute terms and could produce outsized gains. In other words, they are a cheap lottery ticket. As they buy the OTM strikes, and ignore their true probability of exercise, they tend to bid them up over ATM options. As that process accelerates, the implied volatility of OTM strikes increases relative to those ATM and the skew increases.

Some use the skew as an oversold/overbought indicator, or to determine the relative value of each strike. In the case of NVDA, the skew this year (see below) seems to be in normal territory and is not indicating anything special.

The conclusion that NVDA options are not overvalued, in implied volatility terms, is counterintuitive. After all, one would expect that given its fundamentals, bullish price action, and high retail volume, that NVDA options should be expensive. But again, the direction and level of implied volatility is a function of uncertainty. If the trend is well-established, as it is with NVDA, then implied volatility should decrease or remain steady as long as the underlying trend is in place. The opposite should also be true. If, against all expectations, NVDA starts to come off, reversing trend, then uncertainty and danger will increase, and implied volatility will follow.