Only Gold

It was 176 years ago last Wednesday that gold was discovered at Sutter’s Mill in California. Despite the fact that it gets very little notice, the discovery triggered the gold rush, western migration, and had far-reaching effects on the worldwide economy. It’s one of the most significant, and most overlooked, events of the 19th century.

No other commodity has held as much fascination throughout history as gold; indeed, many still consider it the only true measure of value, more stable than fiat currency and the antidote for endless inflation, currency debasement, and monumental national debt. For some, it’s the only thing you count on during the coming economic apocalypse. After all, which other commodity can you buy at Costco?

Why the mini history lesson? Because if you haven’t noticed, gold has been over $2,000/oz. since last November and was stubbornly bullish for most of 2023. Is this significant, or is it just business as usual?

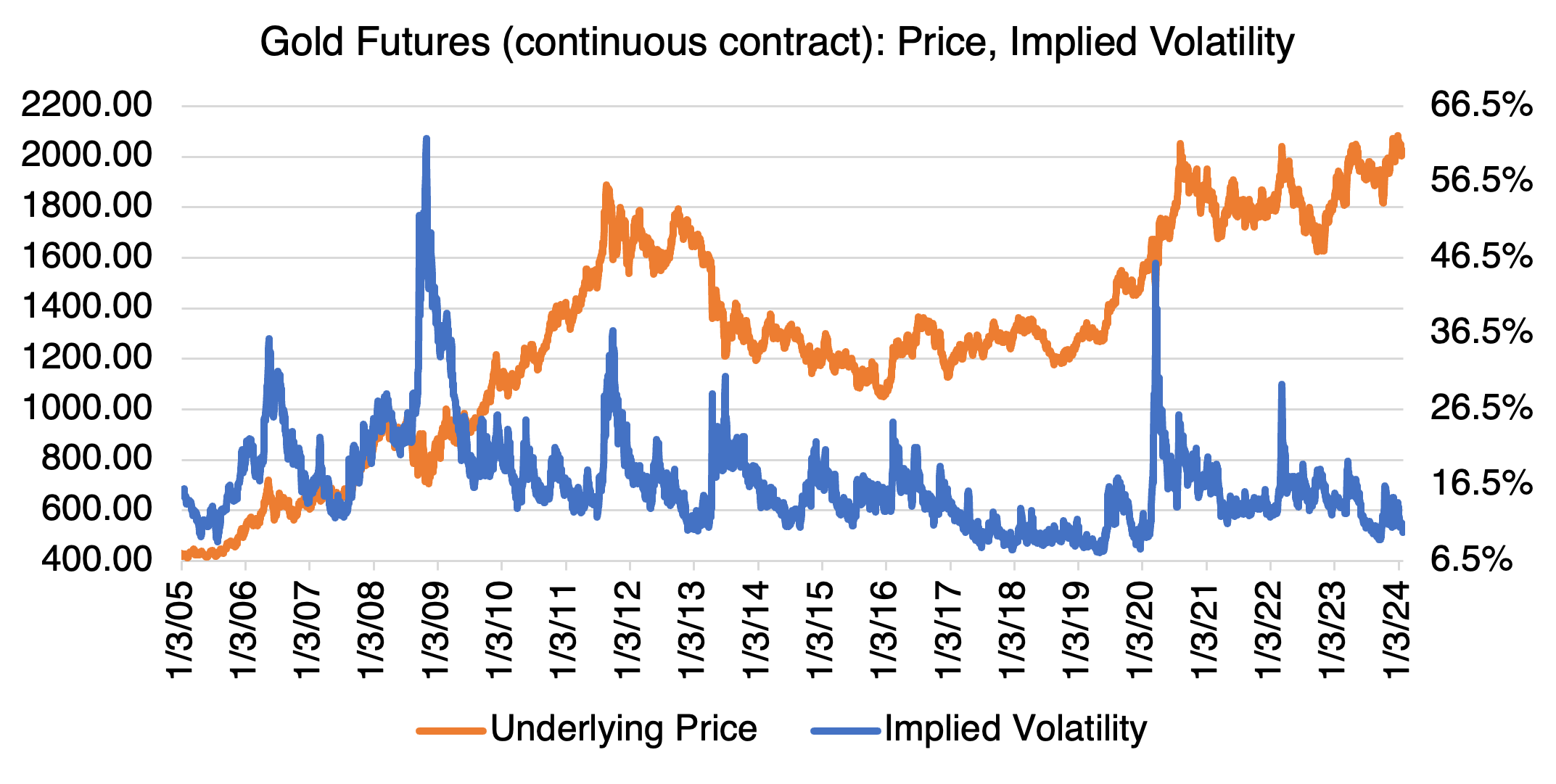

To begin, below are long- and short-term gold futures charts:

Source: OptionMetrics

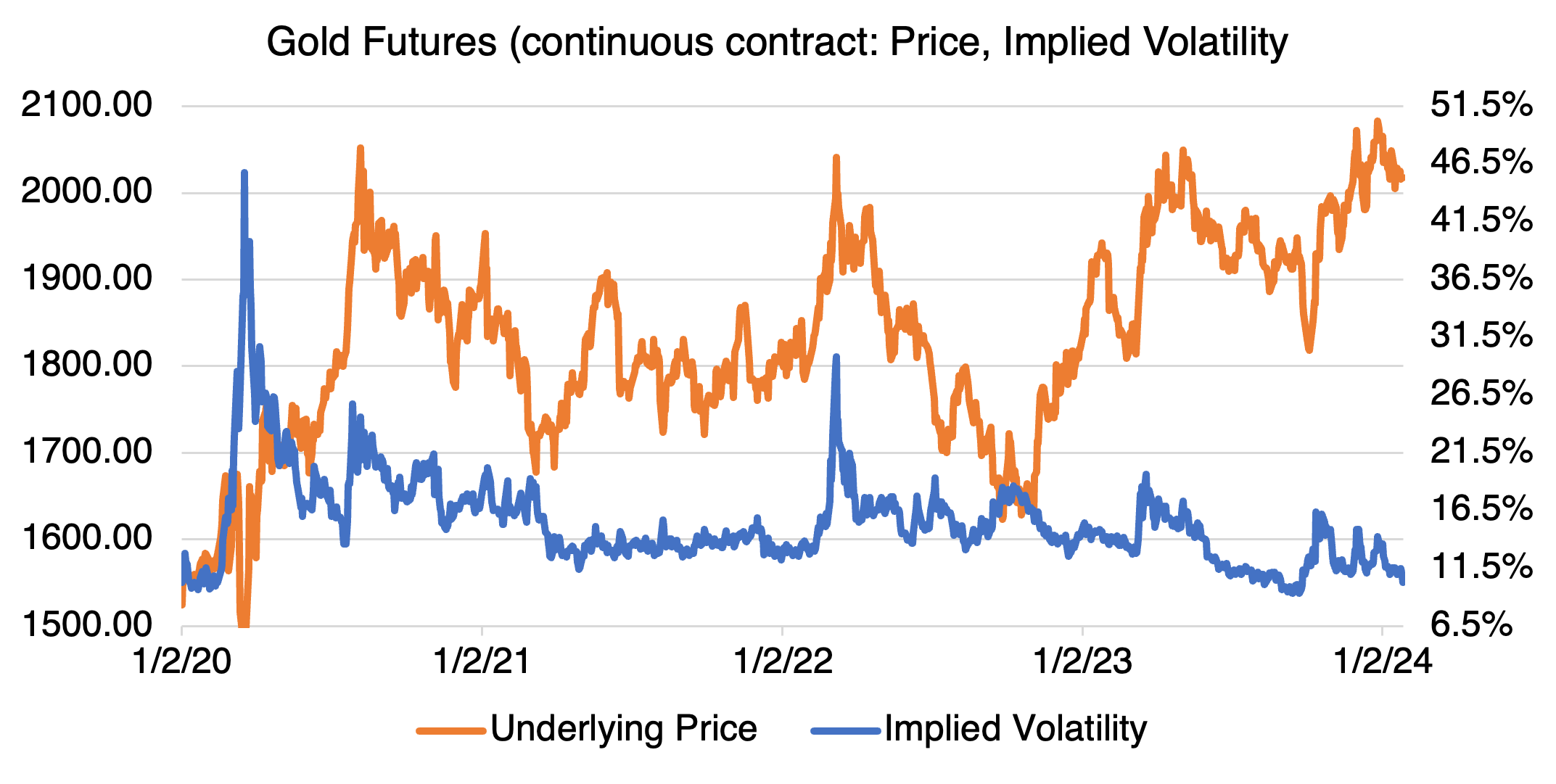

Source: OptionMetrics

As you can see, gold has been knocking on the $2000 plus door on and off since August 2020. Why? Round up the usual suspects that have always influenced gold prices: in this case, geopolitical conditions, interest rates, inflation, and central bank purchases. Like all market-based fundamentals, their effects are not consistent, and they take turns in influencing the gold market. For example, one of the traditional rationales for buying gold is that it acts as a hedge against inflation. However, the metal actually declined in 2022 during a period of rapidly increasing inflation. Similarly, geopolitical tensions are also said to spur gold purchases. And yet, the start of the war in Ukraine in February 2022 had minimal upside effect and the remainder of 2022 was mostly down for gold.

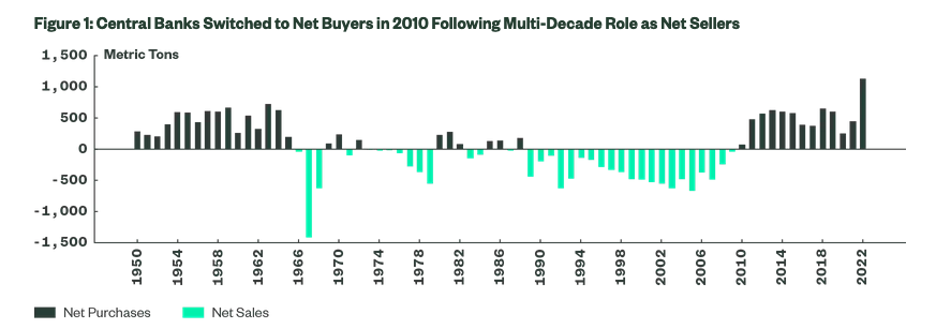

One factor that is clear is that central bank purchases are playing more of a role in supporting gold. The various financial sanctions put in place against Russia due to the war in Ukraine have led some countries, notably China, to conclude that holding US denominated assets might be riskier than previously understood. This, along with dreams of displacing the US dollar as the world’s reserve currency (good luck!), have led China and several others, through their central banks, to buy gold in unprecedented quantities.

Source: State Street Global Advisors, Metals Focus, Refinitiv GFMS, World Gold Council

Currently, the geopolitical tension warning light seems to be on again, as the war in the Mideast rages on with the very real prospect that it might expand to engulf the rest of the region. However, if the war devolves into a back-and-forth stalemate, as has the war in the Ukraine, its effect will decrease.

Gold has some downsides. Bitcoin and its fellow cryptocurrencies, in theory at least, provide an alternative to fiat currencies and a shelter against inflation and irresponsible financial policies. This tends to siphon off those investors that would normally buy gold for those reasons.

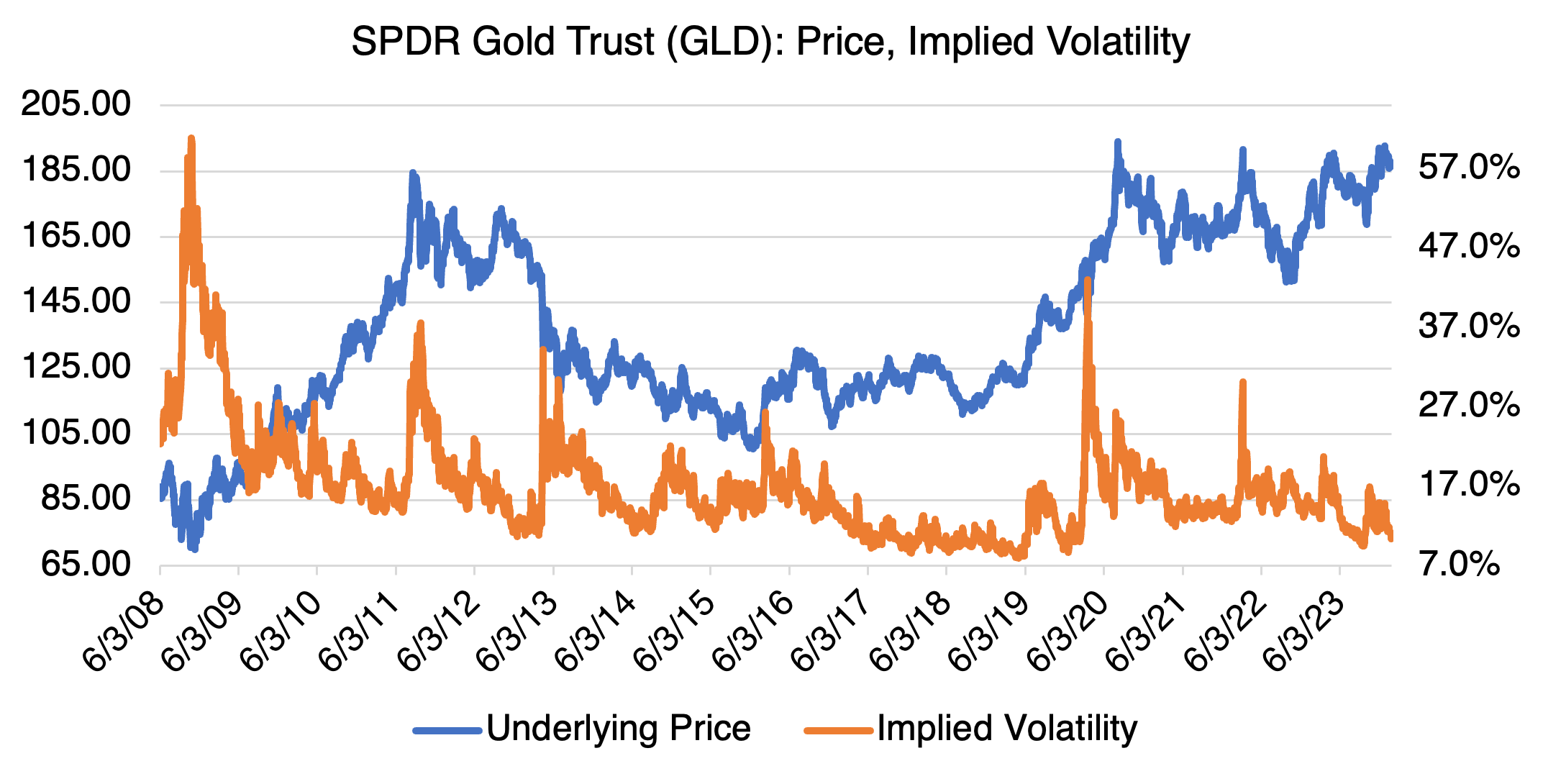

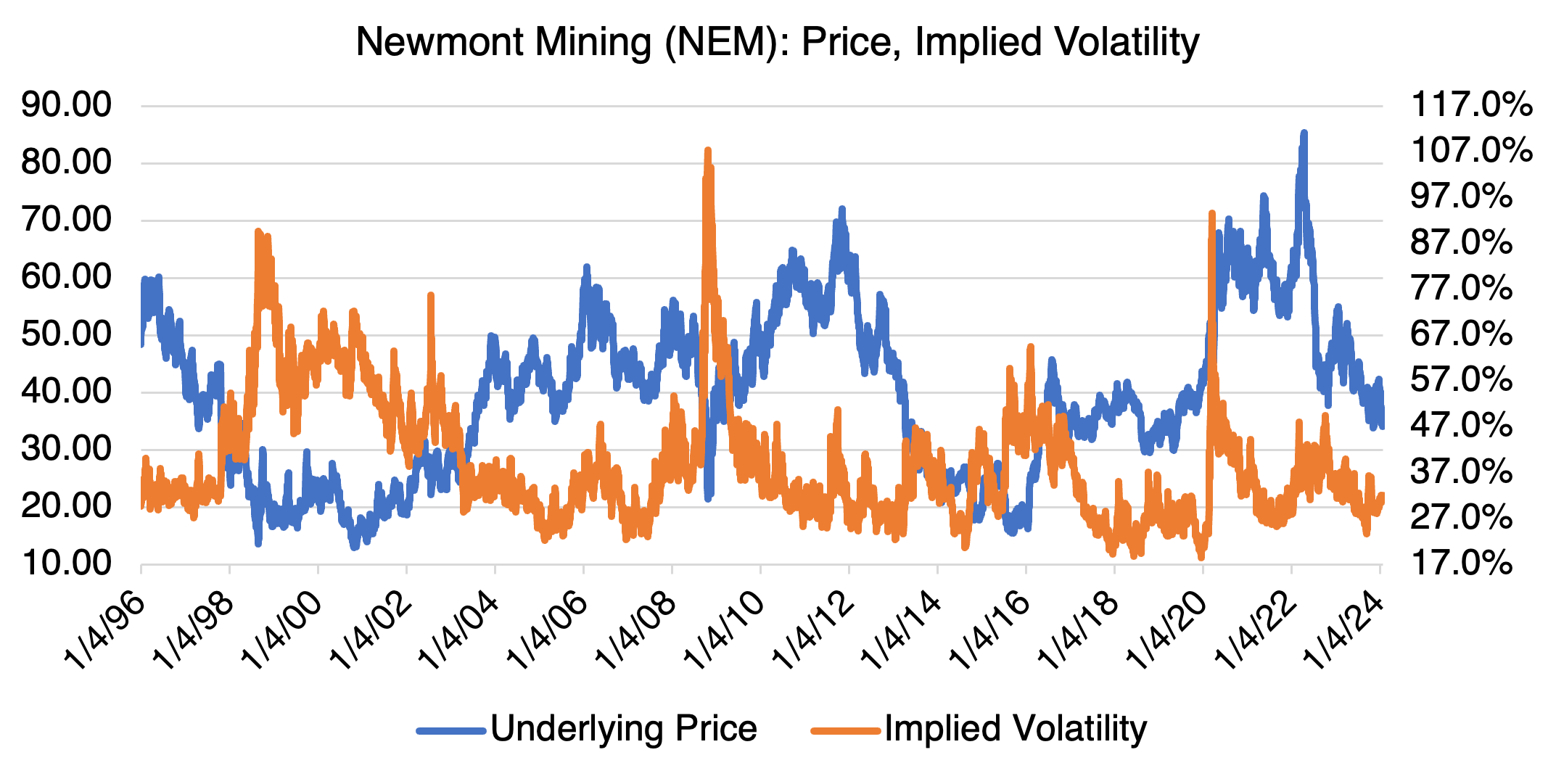

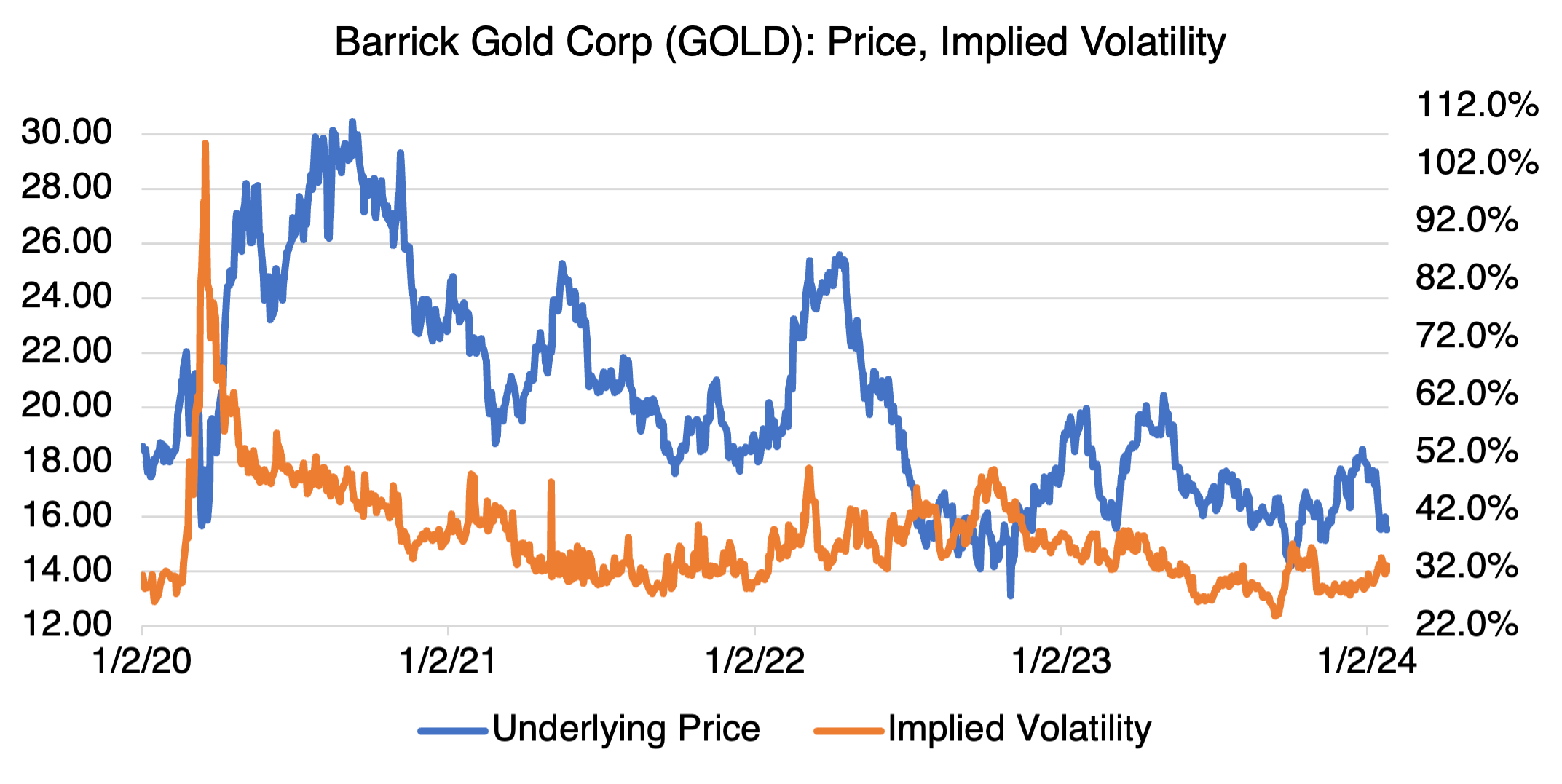

Gold’s popular reputation for volatility and significant daily price swings is overstated. Gold futures implied volatility trades at low levels and has averaged only 16.9% since 2005. Compared to other commodities that regularly reach triple digit implied volatility levels, such as such as crude oil or natural gas, gold is pretty sleepy. Since the beginning of the war in Ukraine, and despite additional geopolitical tensions from the Mideast, gold’s implied volatility has been drifting lower and is currently below 11%. This trend is reflected in the SPDR Gold Trust ETF (GLD) and two representative gold mining stocks, Barrick Gold (GOLD) and Newmont Mining (NEM) (charts below).

If you believe that the geopolitical tensions in the Mideast have the potential to increase significantly due to a widening of the war, and that the market is underpricing its probability, then gold options on either the metal itself or related stocks may be the way to go.

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics