Remember WeWork?

My son, who has a real day job but trades stocks on the side, pointed out to me the other day that WeWork was trading at $0.23 cents. Frankly, I didn’t even know that WeWork (WE) was still alive and kicking, much less trading at penny stock levels. Well, it is still around, but hanging on by a thread. It’s an ignominious endgame to a company that represented all the best and worst of the pre-Covid market: cultish, New Agey founders, laser focus on growth instead of earnings, and disruption above all else. Remember, WE was a tech company, not a stodgy real estate play.

It’s been some time, so a very short refresher on the trials and tribulations of WeWork is in order. Started in 2010 by Adam Neumann, Rebekah Neumann (Adam’s wife), and Miguel McKelvey, the idea was simple: rent office space under long term leases, fix them up to look fresh and startupy, and then sublet them out as “coworking spaces” to “members” on a monthly or yearly basis. For small startups with uncertain prospects, or for freelancers looking for a small office outside of their home, or even for corporates looking for some extra space, it was a great idea. Growth was fast, and by 2014 they were reportedly the fastest growing lessee of new office space in New York. Investors piled in, culminating in a $10.65 billion investment by SoftBank in 2018 and 2019. At that point, the company was valued at a staggering $49 billion and an IPO was the next natural step to world domination.

But then, potential investors woke up and the kimono was ripped off. Looking past the hype, tech pretentions, and hyper growth, astute observers noted that the company had never come close to breakeven, was burning through cash like water, and was run by people (the Neumanns) with some questionable business behavior (one of their goals was to “elevate the world’s consciousness”). Ultimately, the 2019 IPO was canceled and Neumann was replaced by Sandeep Mathrani, a real real estate executive. As if the company’s problems weren’t bad enough, Covid then broke out and all-time high office vacancy rates followed. After making progress on negotiating lower rents, restructuring the company’s debt, and finally taking WE public, Mr. Mathrani abruptly resigned in frustration last May. Supposedly, he had endless problems with SoftBank, WE’s majority shareholder. No successor has been named.

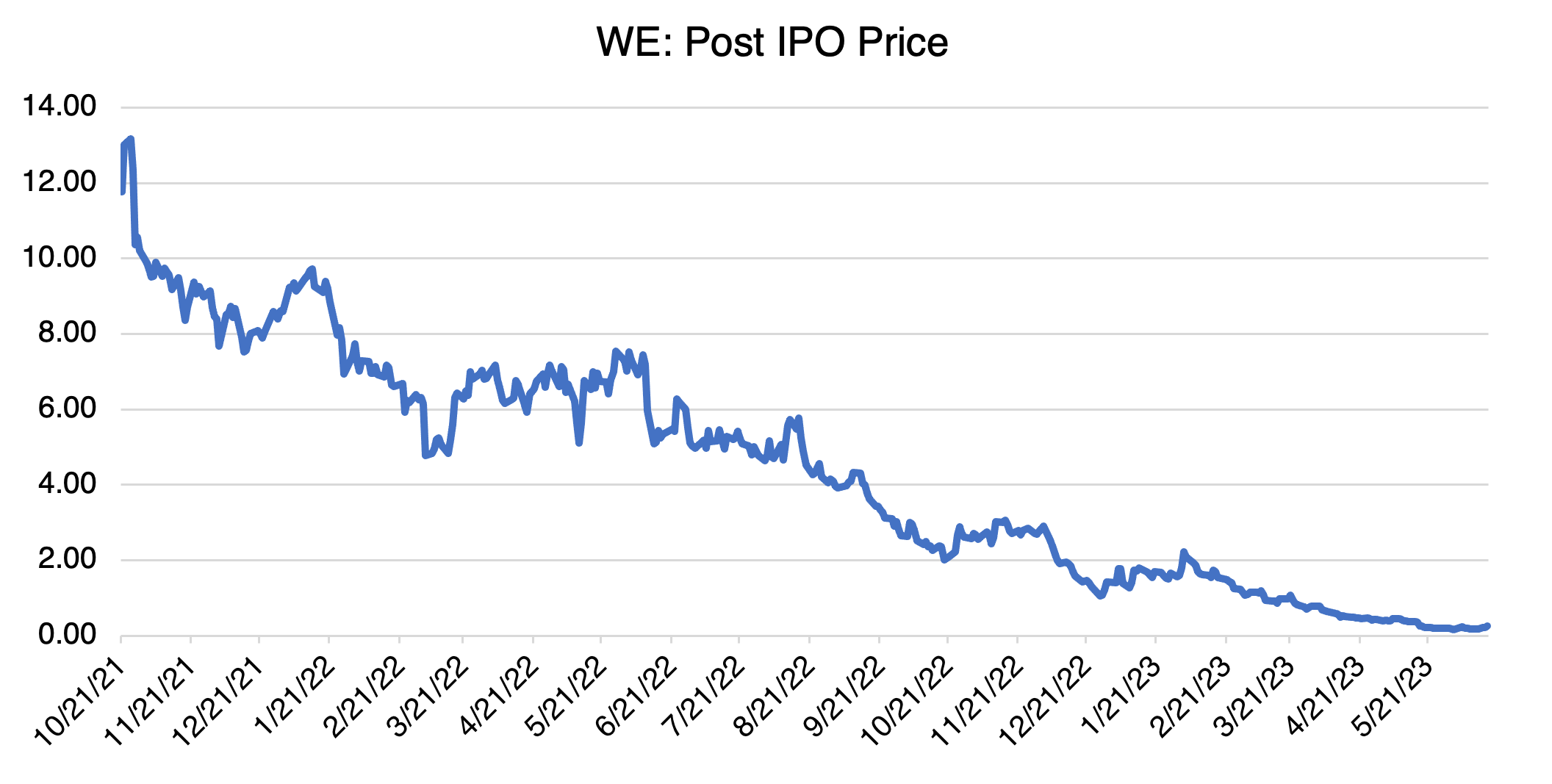

The departure of Mr. Mathrani threw water on those that thought the company was recovering. WE is currently trading at $0.23, and has been as low at $0.17 as institutional investors headed for the exits. To put that price into perspective, it peaked at $13.18 right after its 10/21/2022 SPAC-based IPO and ended 2022 at $1.43. Since then, it’s been gliding down to its current abysmal level.

That takes us up to WeWork’s current state.

Regardless of its sordid history, there is a fundamental problem baked into WE’s business model, the most serious of which would be familiar to any investor burned by Silicon Valley Bank, namely, the mismatch between short and long term assets. If you rent space on a fixed long term basis, and you plan on subletting short term, then you must have enough short term renters in order to turn a profit. In order to attract and retain them, you must offer high quality space with extensive perks and in expensive locations. All of these are expensive and can drive up fixed costs to unrecoverable levels if occupancy rates fall. If that occurs, then the business is caught in a vice between high fixed expenses (long term leases) and decreasing revenue. The only way to make the business model work is to keep a tight lid on costs, growth, and debt, something that WeWork failed to do (to say the least).

There are some bright spots for WE (well, more like the light from an almost dead flashlight) if you look hard enough. The post-Covid hybrid, coworking model seems like it’s here to stay and that’s what WeWork is all about. Their brand is still strong, and they might just thread the needle IF they can manage to keep costs under control, IF they can price realistically, IF they can manage their debt, and IF they can attract talented senior management. That’s a lot of very big IFs.

Yes, the stock is trading less than a quarter, and like all penny stocks, it’s tempting to drag out the “what can I lose” logic to justify buying WE. It’s very similar to investors that are serial purchasers of deep out-of-the-money options, or even those that buy lottery tickets every week. If you can afford to lose 100% of your investment on the chance that it could miraculously recover or somehow turn into the latest meme stock, it’s hard to argue with the logic. Maybe the popularity of the coworking, flexible workspace model and brand recognition will save them, maybe not. The cold reality is that WE’s current outlook is grim and bankruptcy and subsequent restructuring may be the most probable outcome.