Retail Zombies

One of the longest-lasting effects of Covid is the way people buy things. Unwilling to leave the house, people naturally pivoted to fulfilling their needs online, accelerating a trend that had already started in the mid-90s. Personally, I remember my first few online purchases from the likes of Amazon and eToys, but it was more for novelty than necessity (and it’s fun to get boxes in the mail). That is no longer the case. In the US, the percentage of total retail sales continues to grow relentlessly.

Source: Tidio

Online shopping is now firmly entrenched and the preferred, if not only, mode for the generations that grew up with the internet. My kids visit brick and mortar stores rarely, and with about the same frequency as going to the bank or dentist. On a visit to my local Nordstrom’s recently, employees outnumbered customers. The fact that retail has changed radically has been written on the wall in about a 1000 font for some time now, but it seems that certain segments of the sector still can’t read it. The retail landscape is littered with those that failed to adapt. Sears, Bed, Bath, and Beyond, Rite-Aid, Brooks Brothers, JC Penney, Lord & Taylor…the list goes on and on.

None of this is good news for traditional department stores that have been left still standing. Reviewing them, I get the feeling that I’m looking at a fundamentally outdated business model with no real “edge,” i.e., competitive advantage. Is there still a place for large department stores, like Macy’s, or are they in long-term decline, despite the various new strategies, initiatives, and machinations they will try along the way?

Frankly, and disappointedly, I don’t know (more on predicting the future next week!). I do know that certain retailers, such as Costco and Walmart, seem to be thriving because they have honed their business models and operations to the changing times. My local Costco (in Salt Lake City and the largest in the world, no kidding) is always busy and its can-be-seen-from-space parking lot filled. Same for Walmart. So, I guess retail can work, if executed properly, realistically, and with a business plan for the 21st century.

Let’s look at a few charts.

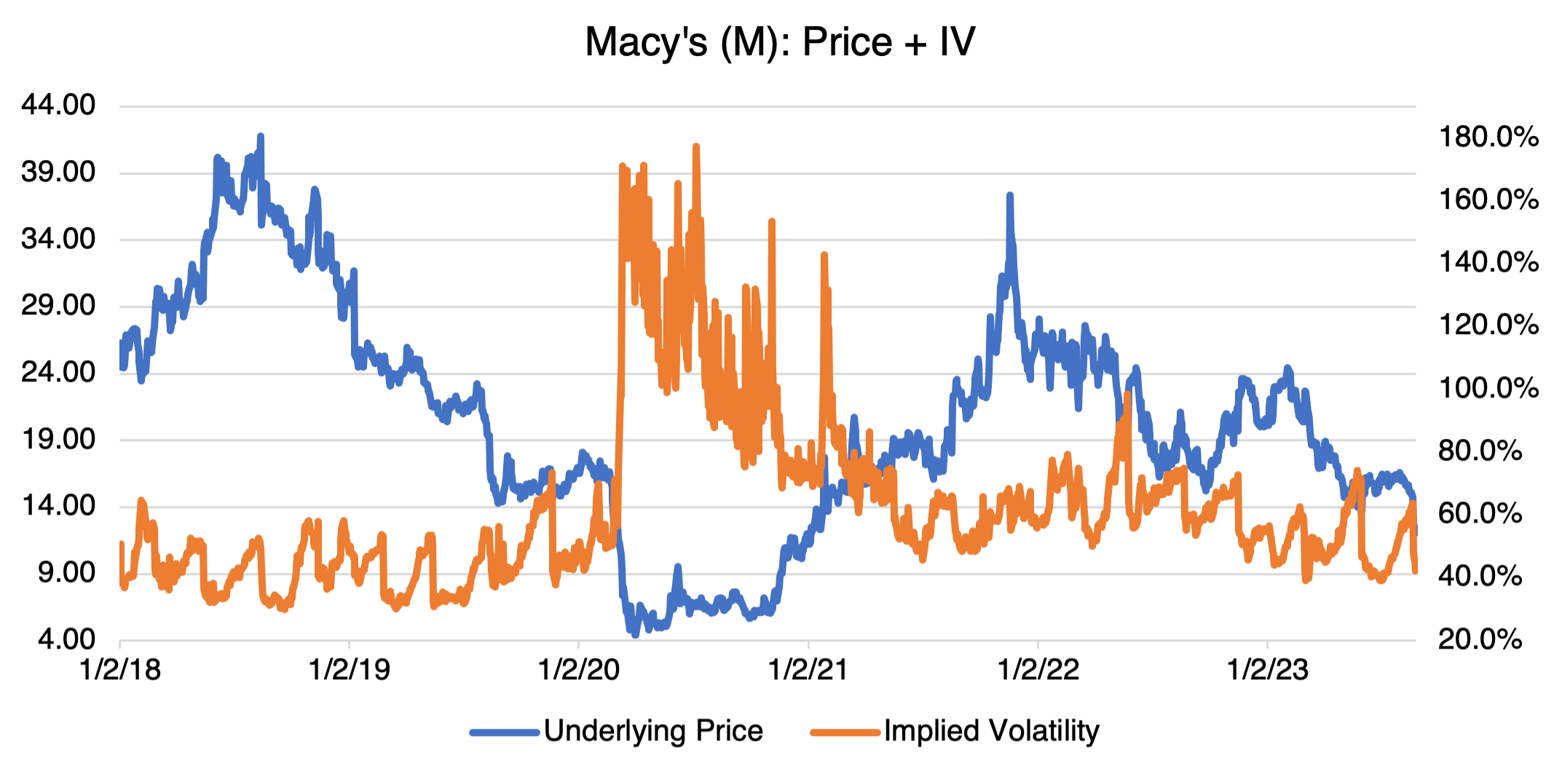

First up, Macy’s (M):

As you can see, it seems well on its way to giving up its Covid-inspired gains.

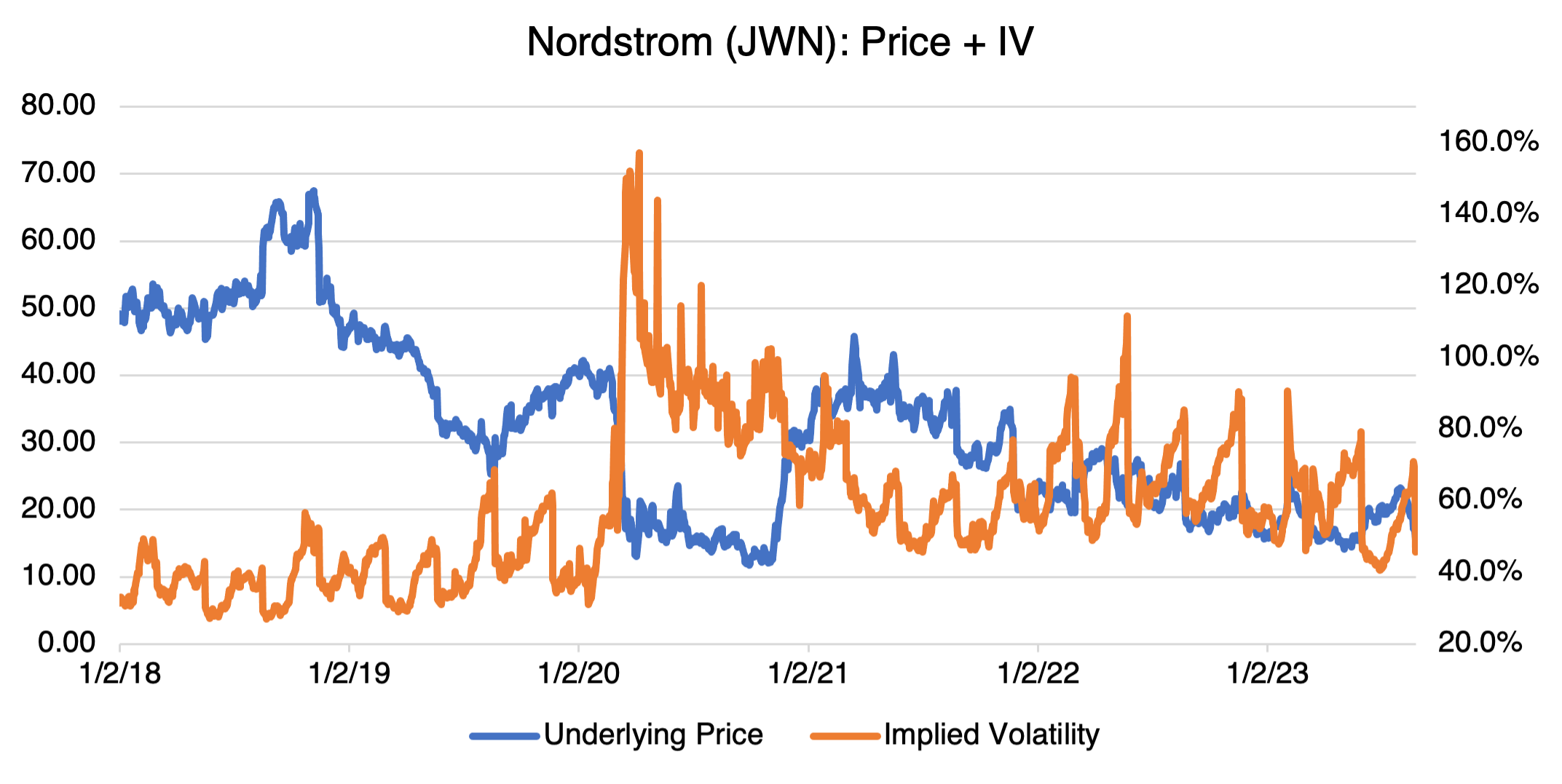

Nordstrom (JWN) tells a similar story:

Same story: no bounce since Covid.

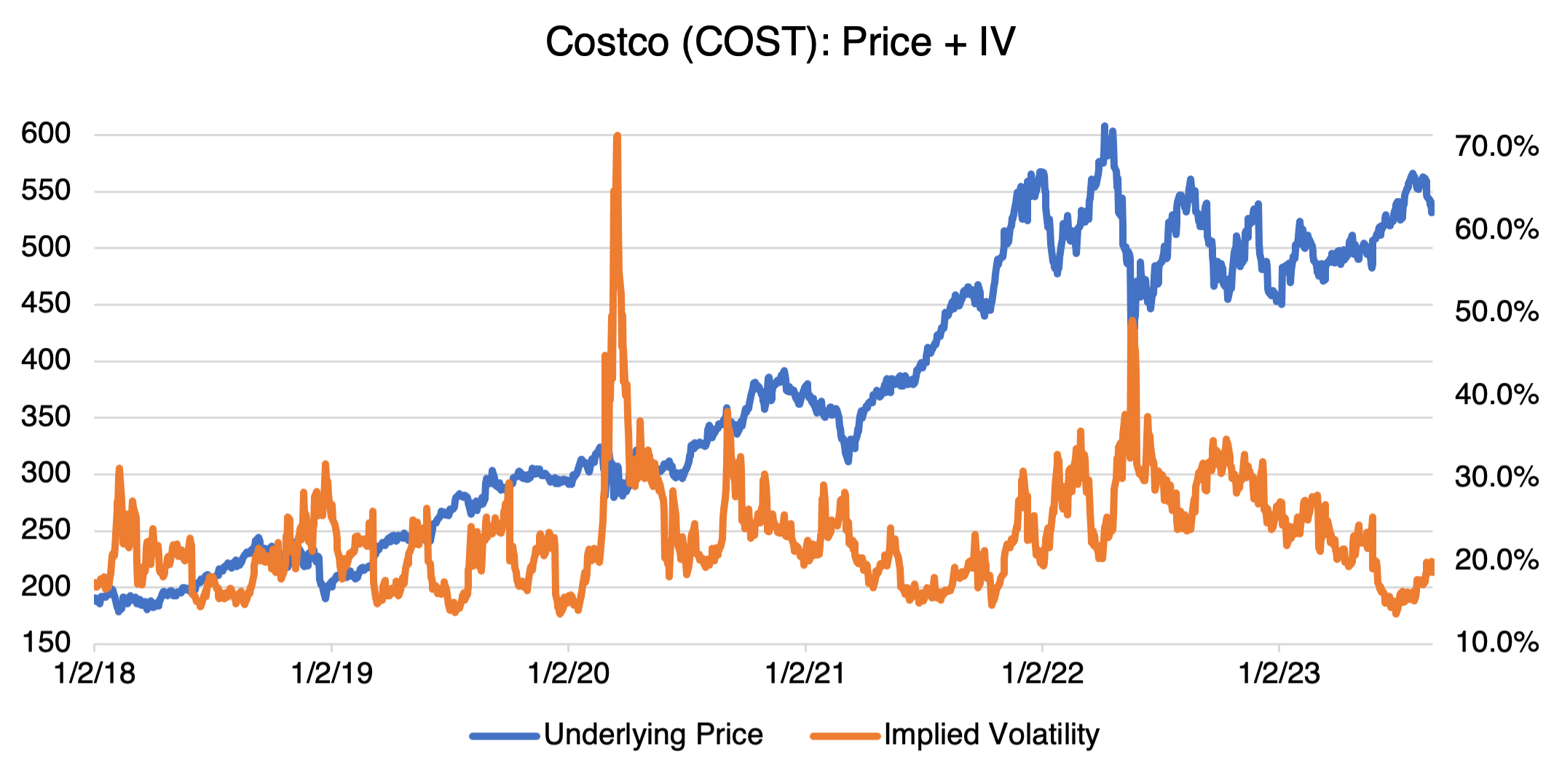

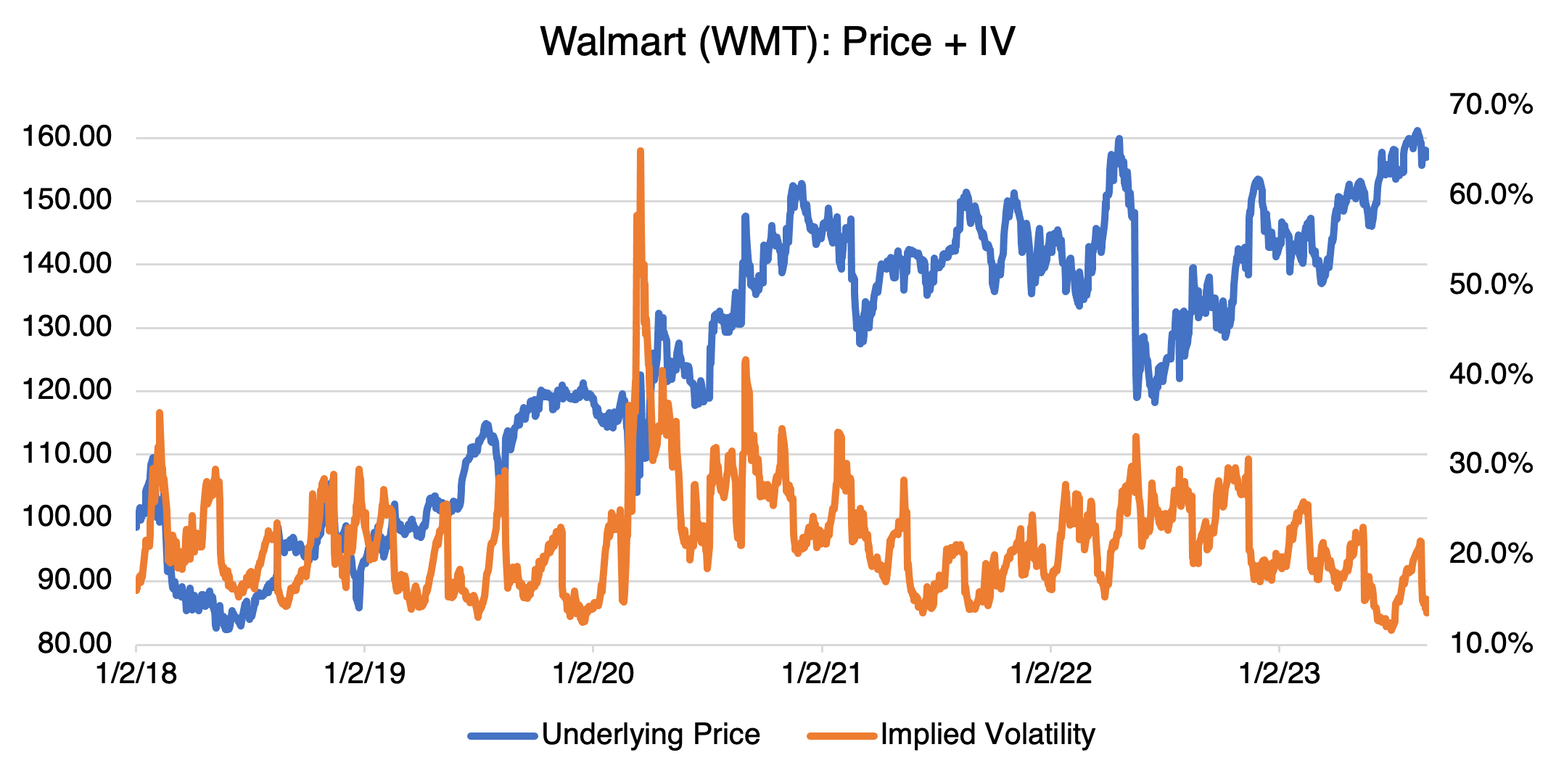

Now, compare Macy’s and Nordstrom to Costco (COST) and Walmart (WMT):

Costco and Walmart look like the type of upward trending, relatively low implied volatility stocks I might want to have in my portfolio. Why are they succeeding while Macy’s and Nordstrom are treading water?

As I quoted in the last blog, (Just a Few Stocks), “$35 trillion in wealth that stocks created over and above Treasury bills returns between 1926 and 2016 could be attributed to just 1,092 companies, or 4.3 percent of the nearly 26,000 stocks that have been traded in the markets. More than half of the $35 trillion came from just 90 companies, or less than one-third of 1 percent. Notice that the majority of stocks in the 1/3 of 1% centered around disruptive, new technologies, either currently or when the companies were first started.”

Costco is a great example of this. It’s disruptive (membership warehouses), data driven, and appeals to a wide demographic. People like shopping there.

Good companies that have a proven, disruptive business plan, a history of adaptation, and can execute are the keys to a resilient, long-term portfolio. And as Costco demonstrates, they can even do it in a challenged sector like retail.