Something to Worry About, Part 2

Last week, I wrote about the intensifying debt ceiling crisis (Something Real to Worry About, No Kidding!) and that the equity markets don’t seem to be taking it too seriously. Since then, and with time running out, the press has finally latched on to the story. Regardless, the VIX, the market’s supposed “fear gauge,” hasn’t seem to notice and is still languishing in the high teens. If the debt ceiling is such a potentially earth-shaking crisis, then why isn’t the VIX shooting up? A few possible reasons.

First, the parties are talking and seem to be negotiating. Whether they are making real progress, or whether they are still far apart, is anyone’s guess, but they do seem to be closer than just a few weeks ago. Obviously, the pressure to make a deal is increasing. The deadline is coming up, the President is scheduled to be out of the country for the next few days, and the markets, especially in short term rates, are noticing. What’s keeping them relatively calm? As I pointed out last week, the limit has been extended 102 times since WW2 and neither side, especially in the run up to an election year, wants to be blamed for the first default in the nation’s history. Similar to the bomb in every action movie ever made, most assume that the situation will be defused with two seconds to go. Some solution will be found and we can then move on to the next time the limit needs to be increased, or so the thinking goes.

Second, many investors, consciously or subconsciously, believe in the “Fed put,” the notion that the Fed will ride to the rescue to prevent any serious market calamity. Most recently, the Fed was instrumental in calming the markets during the regional banking crisis. For better or worse, investors increasingly trust the Fed to maintain financial stability. Eventually, we will find out whether that trust is misplaced or not.

Third, the prospect of a market meltdown, or serious tremors, may force an agreement. The negotiators could be scared straight by scenes reminiscent of 2008, complete with plunging stock prices and rates going through the roof. In other words, if the politicians can’t solve the problem, then the market might force them to. A brutal solution, but an agreement will result.

As I’ve written, it’s important to keep this potential crisis in perspective and not get too influenced by online doomsayers. Most likely, the four factors discussed above will yield an agreement, probably some version of a middle course, an unholy workaround, such as delaying or suspending certain non-debt related payments, a short term extension, or a legal remedy.

But — and this is a big but — there is still a non-zero probability (as they say in risk management) that the situation will not be resolved, that the gulf between the two parties just couldn’t be bridged by early June. As an investor, your strategies need not be dependent on actual default; as the deadline gets closer with no agreement, the effects of a potential default will be increasingly evident.

Last week, I outlined one possible debt crisis related trade: buy the VIX. The logic had to with the asymmetrical nature of the risk, i.e., it could shoot up if no settlement is apparent or if default occurs but will probably not decline that much if an agreement is reached. In other words, the trade has a great upside/downside balance.

Obviously, and other than the VIX itself, interest rates will be the most effected by the crisis. Secondary shocks could be felt as well in the dollar, gold, and commodities (especially those used as industrial inputs, e.g., crude oil and copper) as recession fears become more pronounced.

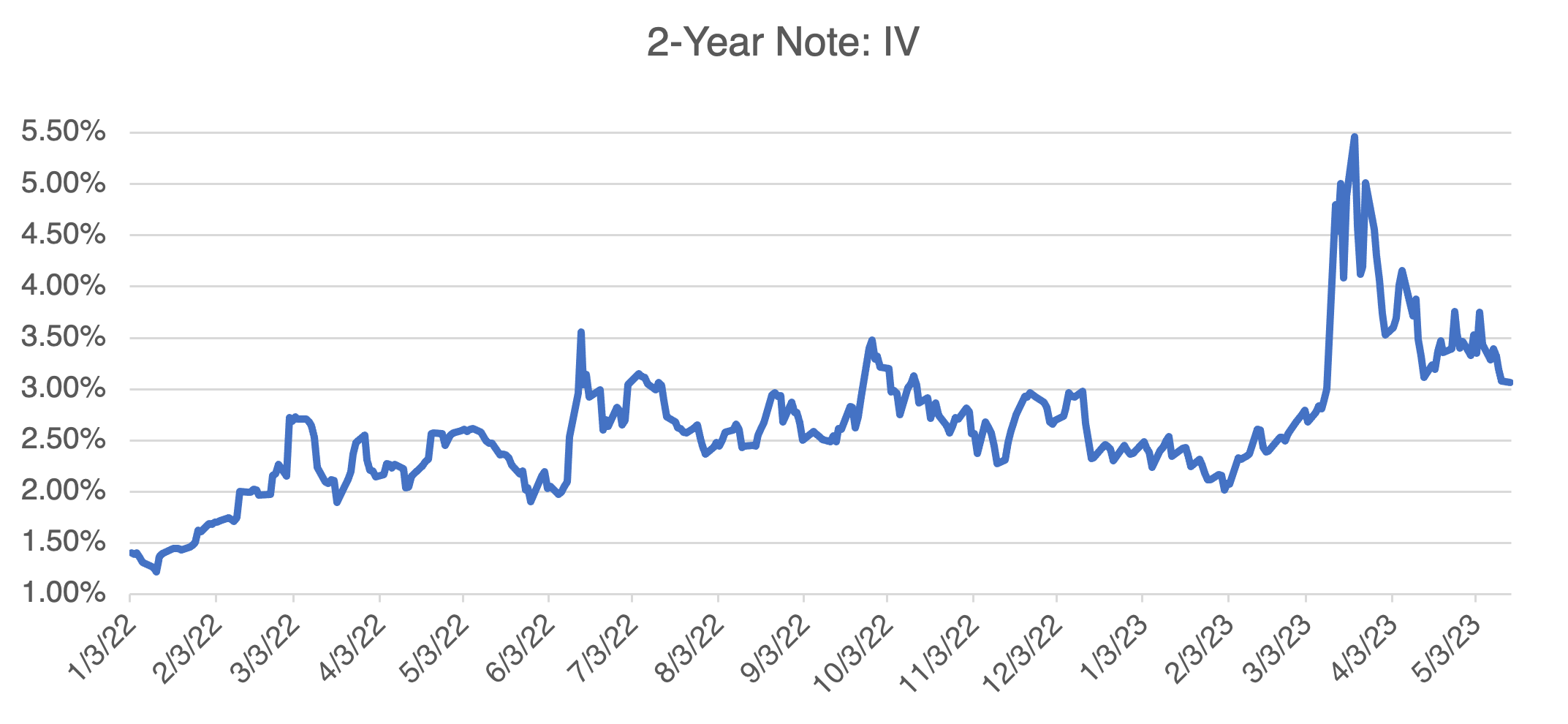

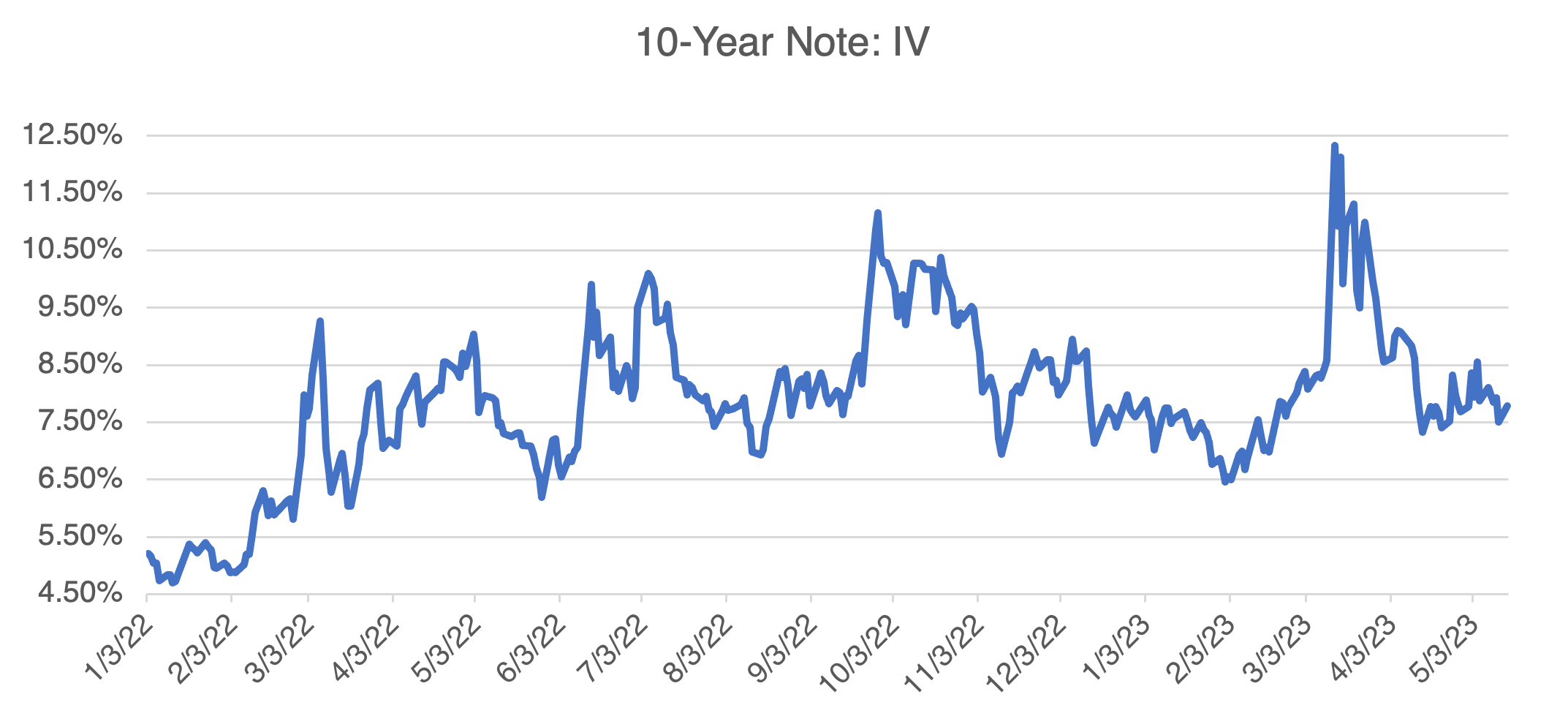

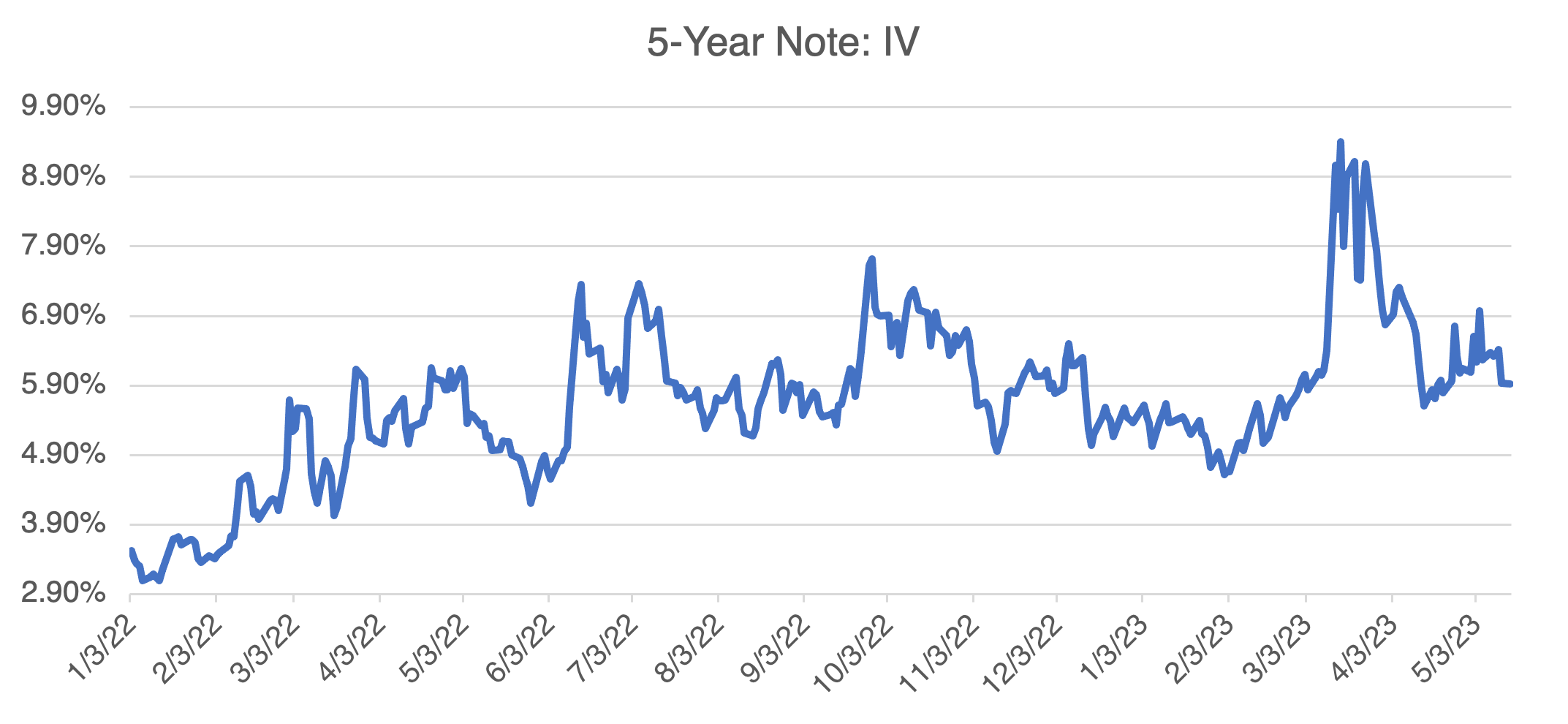

Regarding interest rates, elevated implied volatility levels of the various maturities (below) are indicating that the options markets are taking the debt ceiling seriously, but not yet as a catastrophe in waiting. Indeed, the regional bank crisis last March had a much more pronounced effect (at least so far). A default, or a reasonable prospect of one, would be much more serious and should produce sharply higher implied volatilities that will flow into other markets, such as the VIX. On the other hand, if the debt ceiling is negotiated away, as is likely, then interest rate implieds, especially in the shorter maturity notes, should decline as uncertainty decreases. However, inflation and continued recessionary fears will limit its decline. Similar to the VIX, its upside potential due to an unsuccessful resolution to the debt ceiling issue dwarfs that of the downside.