Storage Wars!

Here’s a crazy statistic: researchers estimate that 1 in 10 Americans lease storage space. Some report that it’s even higher, at 20%. Whichever number you believe, that’s a lot of people, somewhere between 33 and 66 million people. No other country comes even close. No wonder “Storage Wars” is in its fifteenth season!

What’s driving this? Mostly, too much stuff and not enough space. Add that to the fact that the average American moves once every five years, and you get a long term bonanza for storage companies such as Public Storage (PSA), Extra Space Storage (EXR), and CubeSmart (CUBE).

The economics of storage spaces and the industry are interesting. Not only don’t people move out, but they are in a hurry to move in. If you’ve ever rented storage space, then you know what’s going on here. First, moving all your stuff out of storage a pain that most people avoid. The result: once people move their stuff in, they tend to leave it there, and ultimately wind up paying a lot more over time than what the contents are worth. Most renters know its irrational, but they don’t do anything about it. Second, personal changes (divorce, new job, etc.), natural disaster, or moving all lead people to temporary storage. Often, they have no alternative and are in a hurry to store their stuff and move on.

Once you understand the “Roach Motel” aspect of the business (“…they check in, but they don’t check out”), you can see why landlords compete fiercely for new customers with move-in specials, promotions, and other enticements to get new customers through the door. Once they sign, landlords are then free to raise rents over time, knowing full well that their tenants will be very slow to leave.

All this isn’t exactly brand new information — the storage industry has been booming since the ’90s and reached its peak during Covid. During the height of the pandemic, people started reorganizing their homes and apartments and culling their belongings. That meant repurposing their space and storing things they no longer needed (but thought they would need eventually). Since most Americans have a lot more stuff than they need and are natural pack rats, renting storage was the obvious solution.

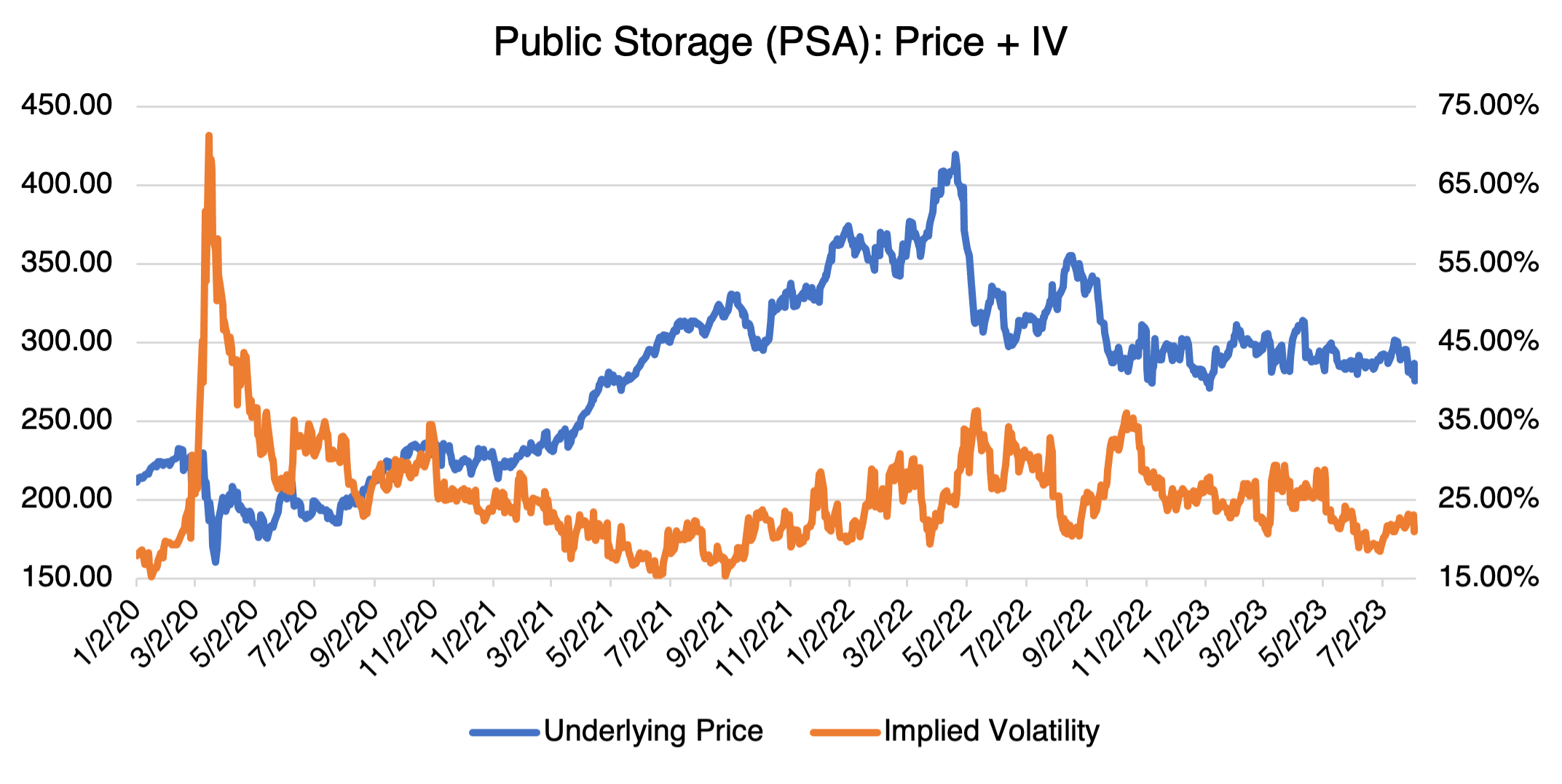

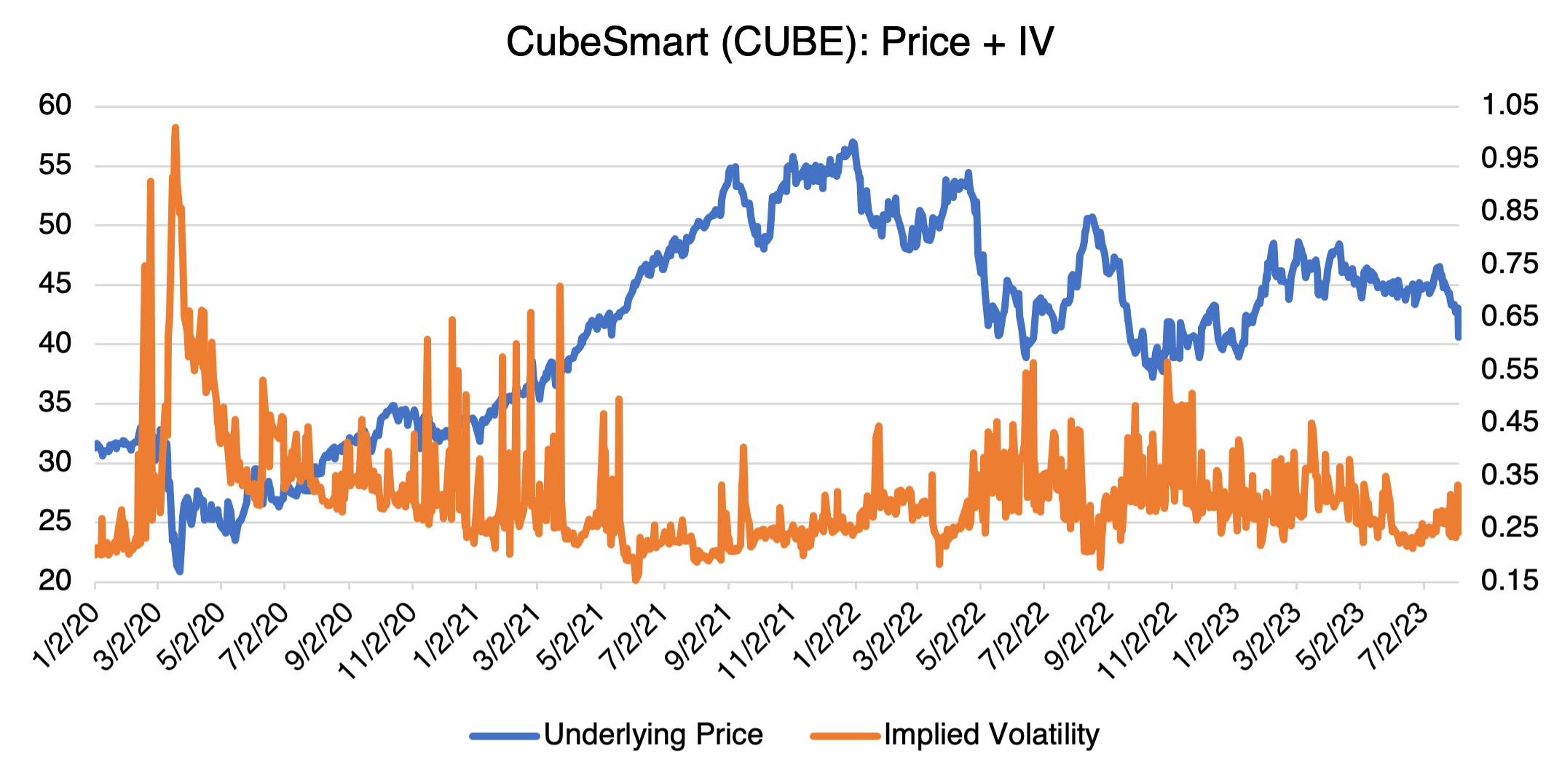

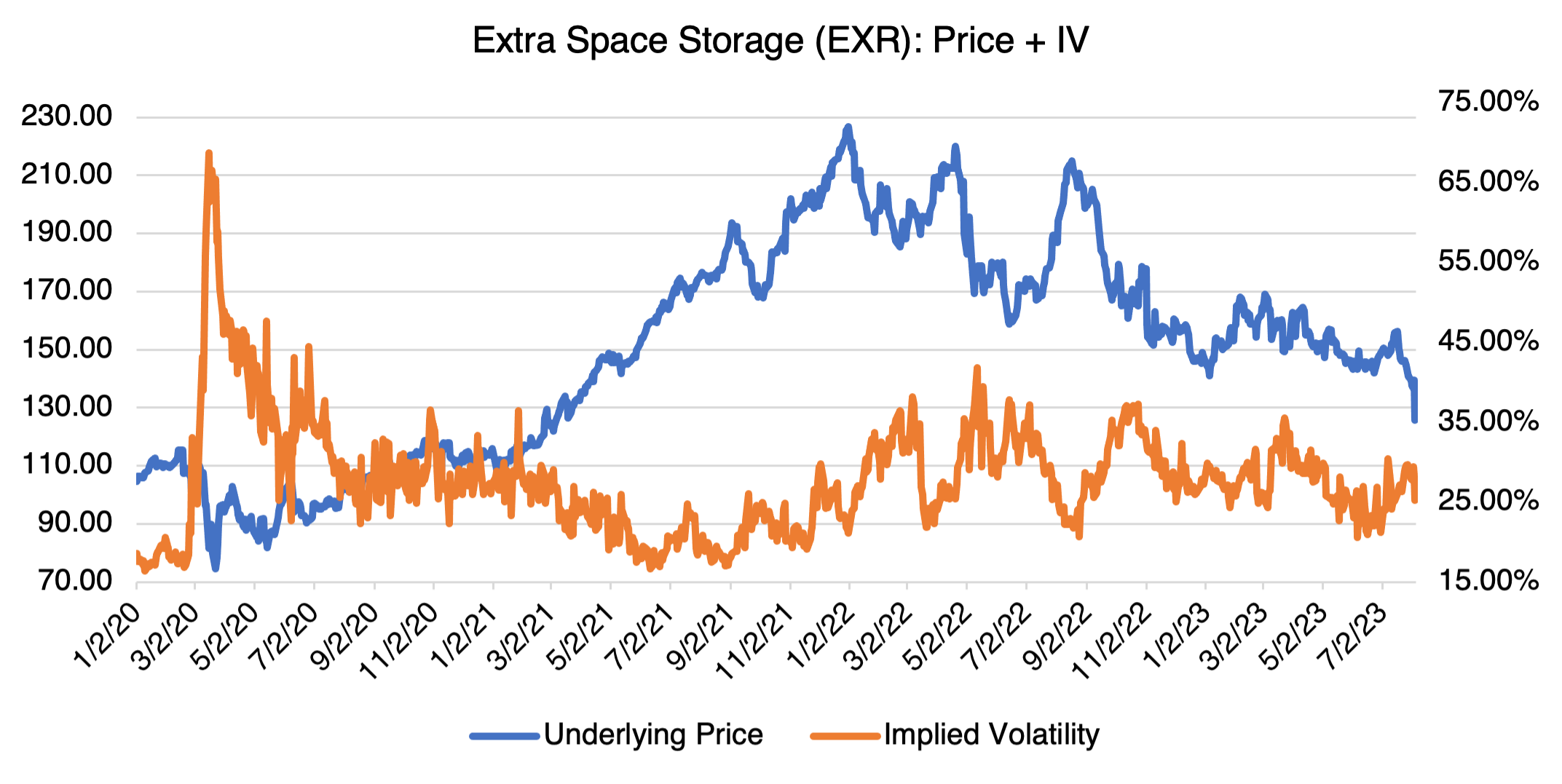

Just like other Covid Darlings, public self-storage stocks peaked during the second half of 2021. As I’ve pointed out before, a lot of traders, and companies, apparently thought that Covid would go on forever and that society would be changed, permanently. That turned out not to be the case, and storage companies have not been immune to the morning after reckoning. Higher borrowing costs to build new storage facilities, as well as lower demand, have led to decreasing rents and occupancy rates. This has been weighing on stock prices.

The industry had a great run during Covid, but now it’s reverting back to normal. Stock prices for the three industry leaders, Public Storage (PSA), Extra Space Storage (EXR), and CubeSmart (CUBE), have been unimpressive year to date after several years of impressive, FAANG-like gains. Regardless, and as outlined above, the storage industry still has very positive, built-in fundamentals that have not changed. The industry may suffer from bouts of over supply or decreasing demand, but as long as Americans continue to consume and don’t want to part with their stuff, the stocks will have a natural tail wind. Consider them part of a long term portfolio.

On an implied volatility basis, options are more or less priced on an average basis. If stock prices for the industry continue to decline, look for IV to increase somewhat.