The Coup That Wasn’t

When asked how he went bankrupt, Hemmingway famously replied, “Two ways. Gradually, then suddenly.” I remembered this over the weekend while keeping track of the mutiny/rebellion/uprising/coup/protest (or whatever it was) that was going on in Russia at the time. Autocrats like Putin tend to have long shelf lives, but can combust rapidly the minute their carefully constructed facade is called into question. In this case, it took another autocrat-in-training, mercenary leader Yevgeny Prigozhin, to light the match.

So far, it looks like Putin has pulled off a narrow escape. But clearly, none of this would have happened had the war in Ukraine been going according to plan. It’s not, and despite the rosy picture that his various subordinates, sycophants, and incompetent underlings are painting, even Putin must know that by now. And that leads to an existential problem for him, since the beating heart of any autocratic regime is the effective use of violence to amass and retain power. Naturally, people will begin asking: if Putin is the all-knowing, shrewd Capo dei Capi that he portrays himself as, then why can’t he win a war against a fourth rate power, or prevent a renegade subordinate from easily marching on Moscow, or even eliminate him after he’s defeated? What good is he if he’s not as tough or smart as we thought he was? Not only that, the other guy just said that the whole war was a sham. Has Putin just been telling us a bunch of lies for the last 20 years? It would be an understatement to say that Putin’s credibility as the toughest kid on the block has been compromised. Expect some extreme Russian house cleaning over the next few weeks as Putin attempts to shore up his tough guy image and regime.

The vital question (other than the fate of Russia’s thousands of nukes should civil war break out) is where all this leaves the war in Ukraine. The main talent of all autocrats, Putin included, is to stay in power, and the war is a chronic threat to his reign. Something has to be done; the longer the war drags out in stalemate, the higher the probability that a new Prigozhin will come along. Unfortunately for Putin, the most effective fighting force he had (the Wagner Group), just removed itself from the conflict. His best option is to try to gain some chips over the next few months that he could use to negotiate a cease fire. Press hard with everything you’ve got, frustrate the Ukrainians’ offensive, and then have a non-Western power, such as China, intervene to negotiate a cease fire. The Ukrainians won’t be nuts about possibly losing some territory, but the western powers will force the issue to end the war. And then, everything will go back to normal, until the Balkans, Taiwan, the Mideast, or some other vestige of WW1 or 2, ignites yet again.

This isn’t just a giant “what if” exercise; serious effects for the world economy and markets result from the beginnings and ends of wars and they are worth planning for. Commodity markets are usually the most sensitive to conflicts since physical supply and demand directly determines their fundamentals. Interestingly, not much happened, even in those sectors that should be the most effected, such as energy. The fact that the mutiny occurred over a weekend while the markets were closed, and was resolved by the opening on Monday morning, reduced its effect significantly. If it had happened during a normal trading day, the results would have been far different.

Does any of this present investment opportunities? It does reinforce existing trends that have been present since the beginning of the war. The conflict is a long way from being settled, and many countries, especially in western Europe, now have a renewed belief in the power of a strong, well prepared military equipped with the latest technology. Even if the war grounds to a conclusion (somehow), the events of the past weekend just reminded everyone that we do indeed live in an unpredictable and dangerous world and that you better be prepared for it.

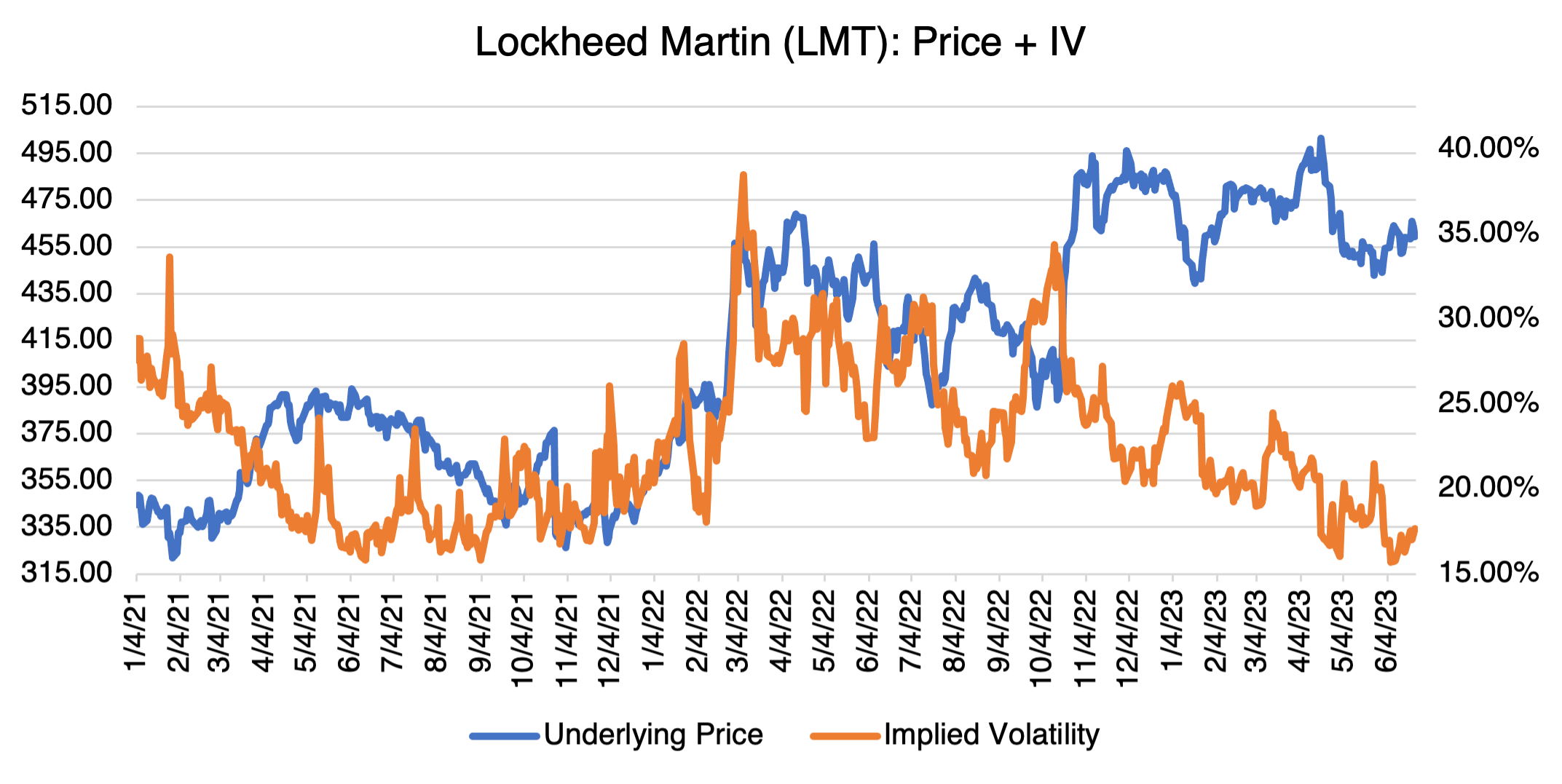

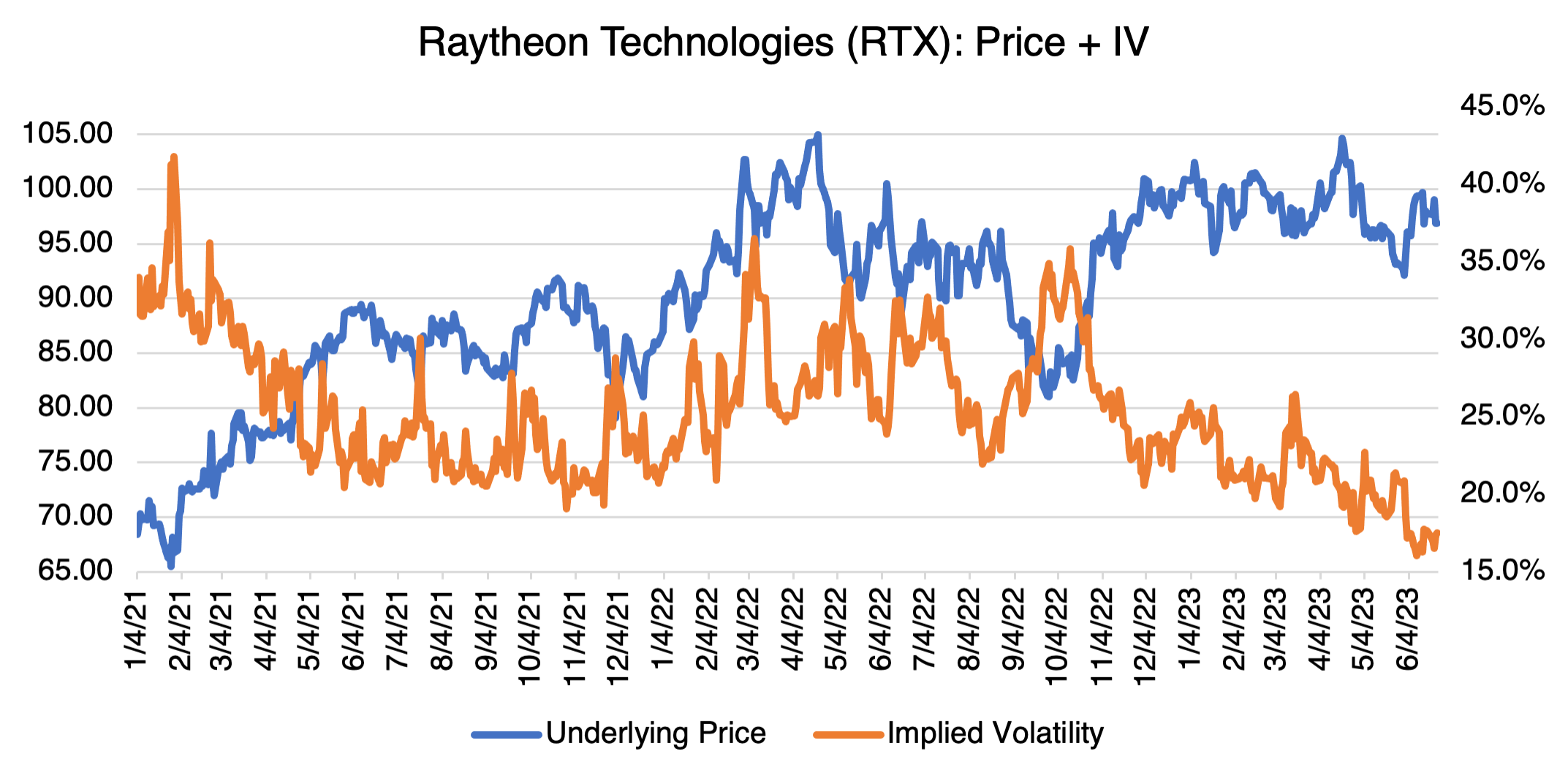

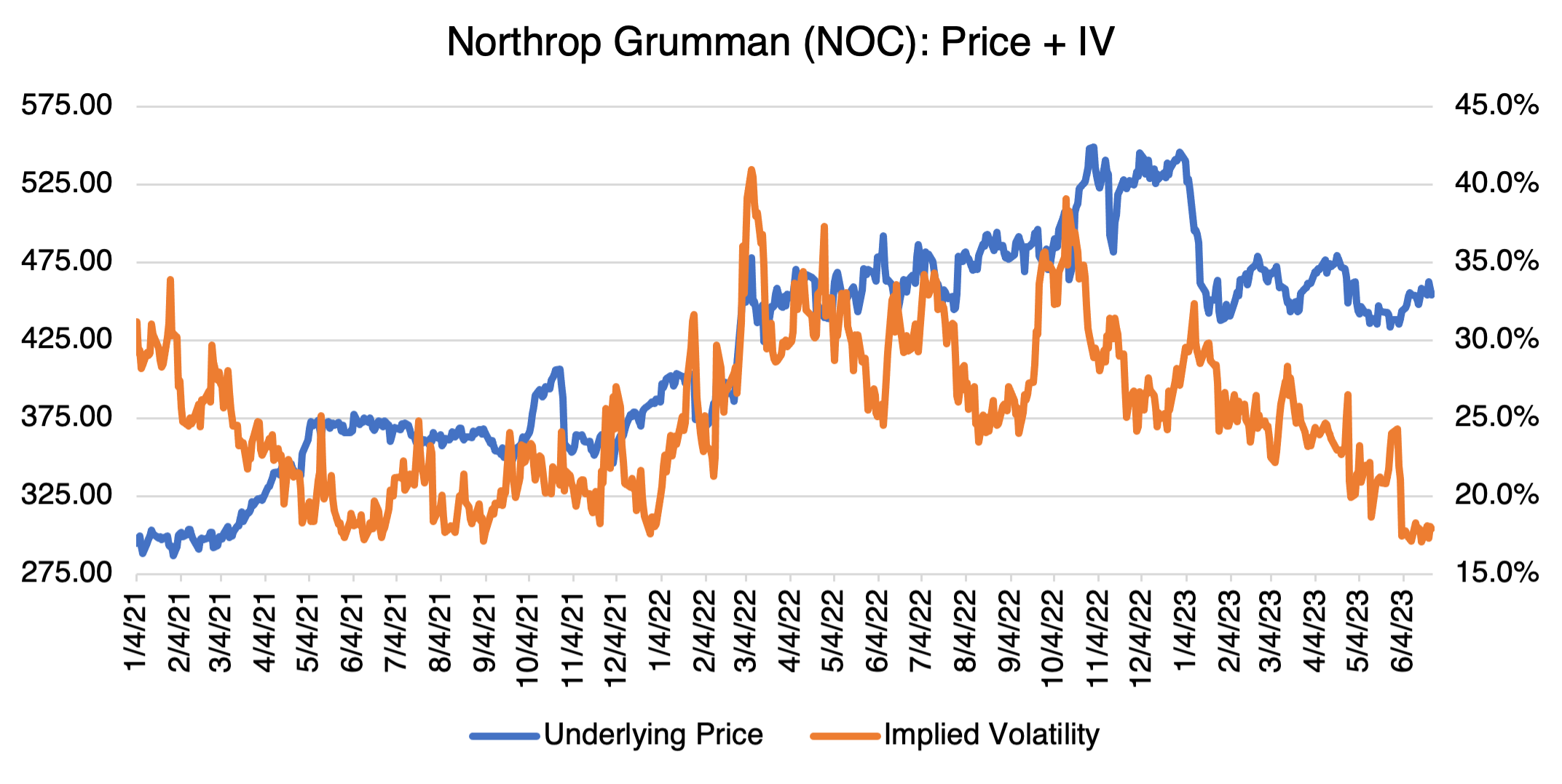

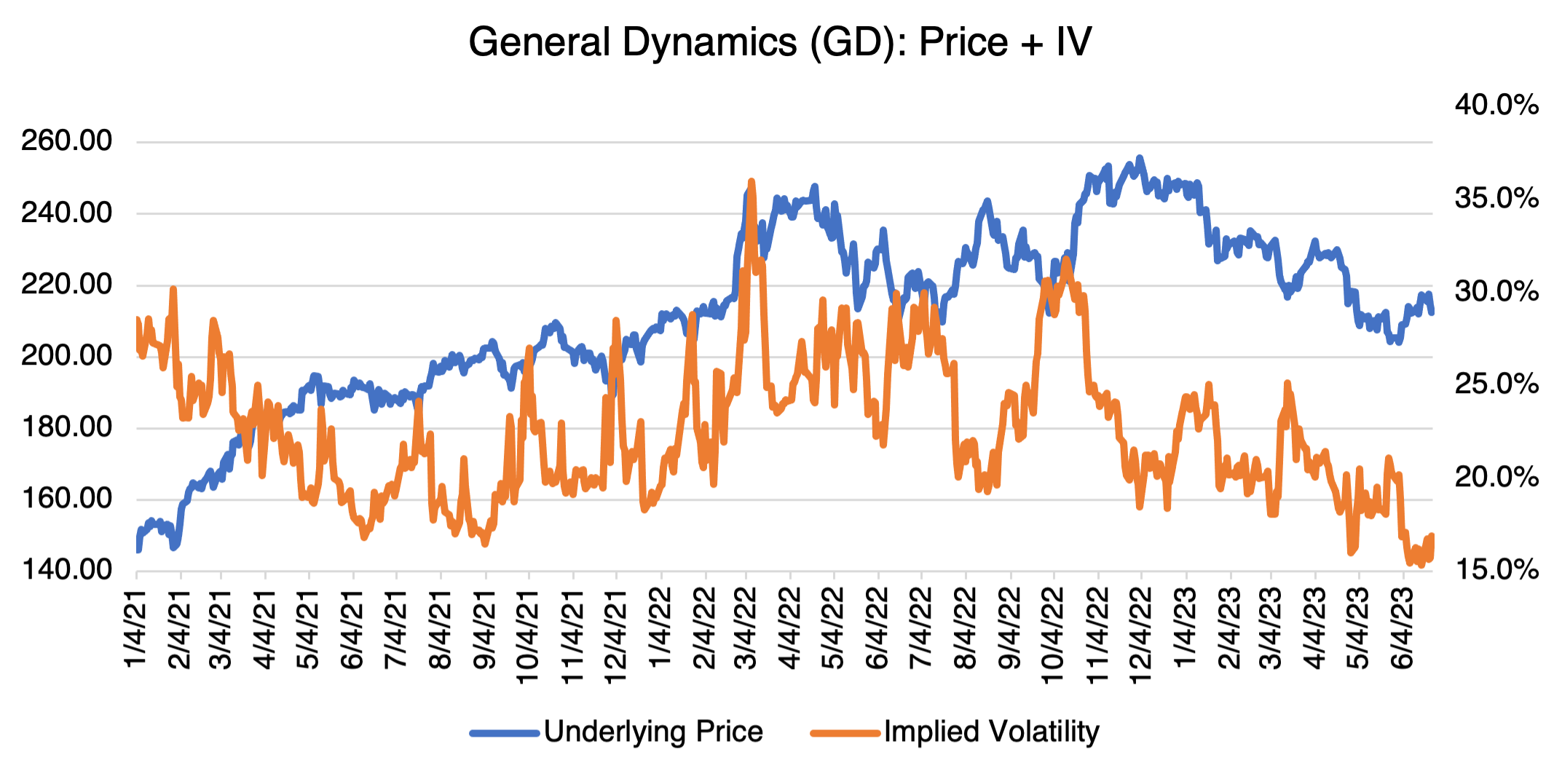

Defense contractors selling advanced technology weapons, such as Lockheed (LMT), Northrup (NOC), Raytheon (RTC), and General Dynamics (GD) are the most obvious beneficiaries from the situation. Although their prices have been trending mostly sideways since the start of the Ukrainian war in March 2022, their implied volatilities have been moving significantly lower and are now even below pre-war levels (see charts below). Options are therefore well-priced if you believe the long term, bullish prognosis for the defense industry.