The Magnificent Seven

Not a day goes by lately that you don’t hear about the performance of the Magnificent Seven. Nvidia (NVDA), Meta (META), Amazon (AMZN) and Microsoft (MSFT) are up an astonishing 49.8%, 35.2%, 16.4%, and 13.4% respectively, year-to-date. By comparison, the S&P 500 is up less than 5% this year. It would seem that one of the most significant effects of AI so far has been on the valuation of these four stocks.

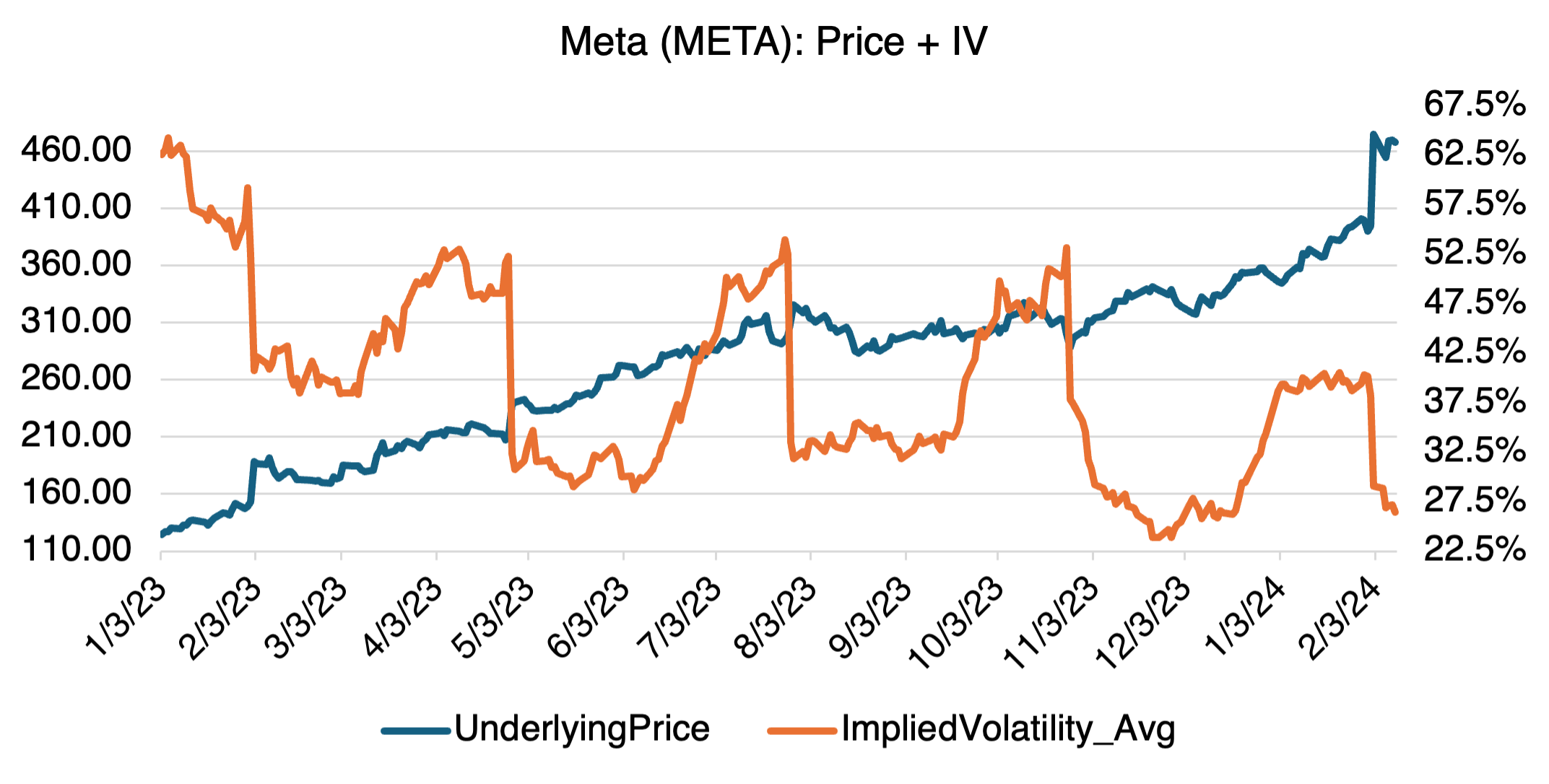

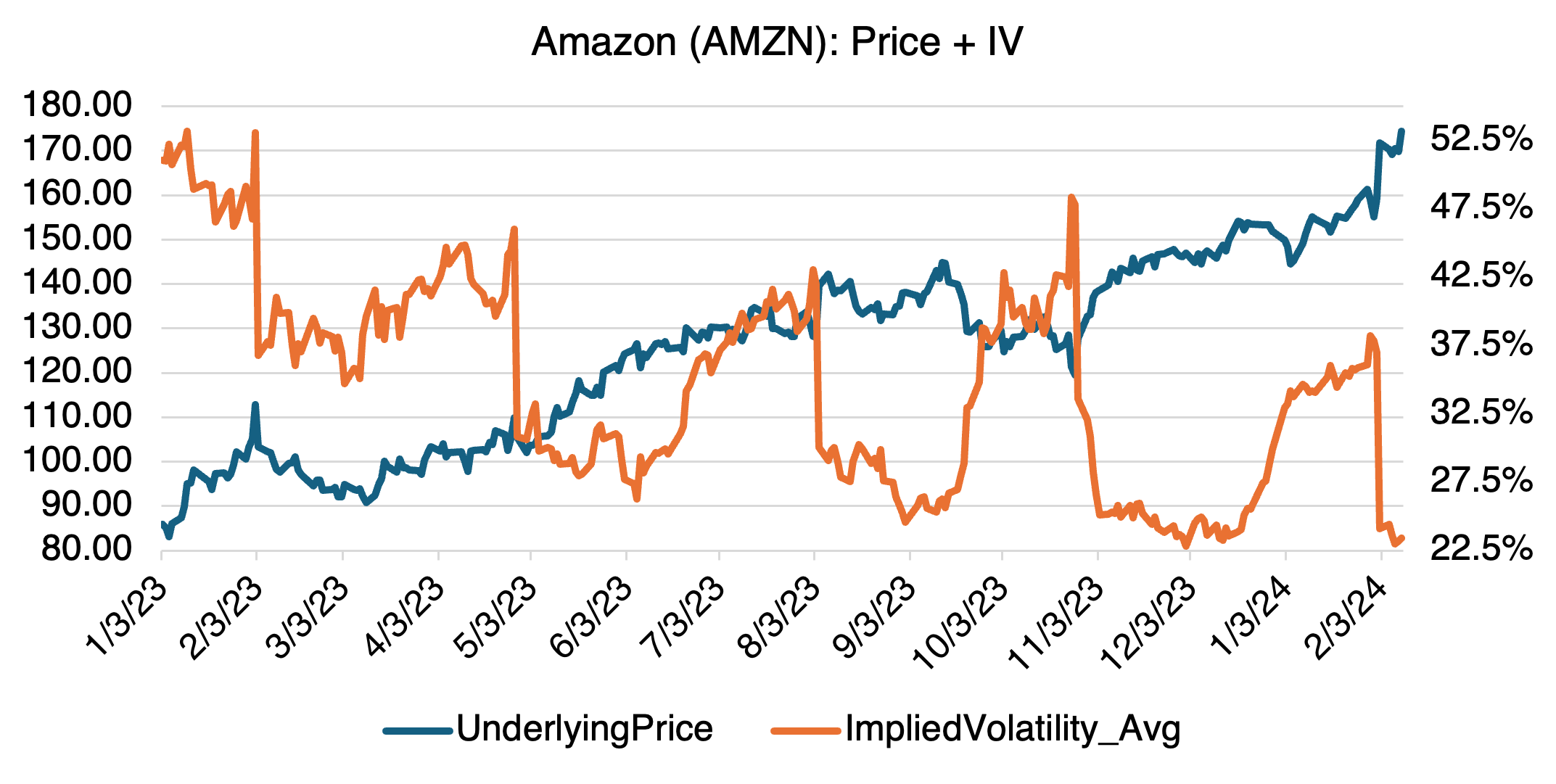

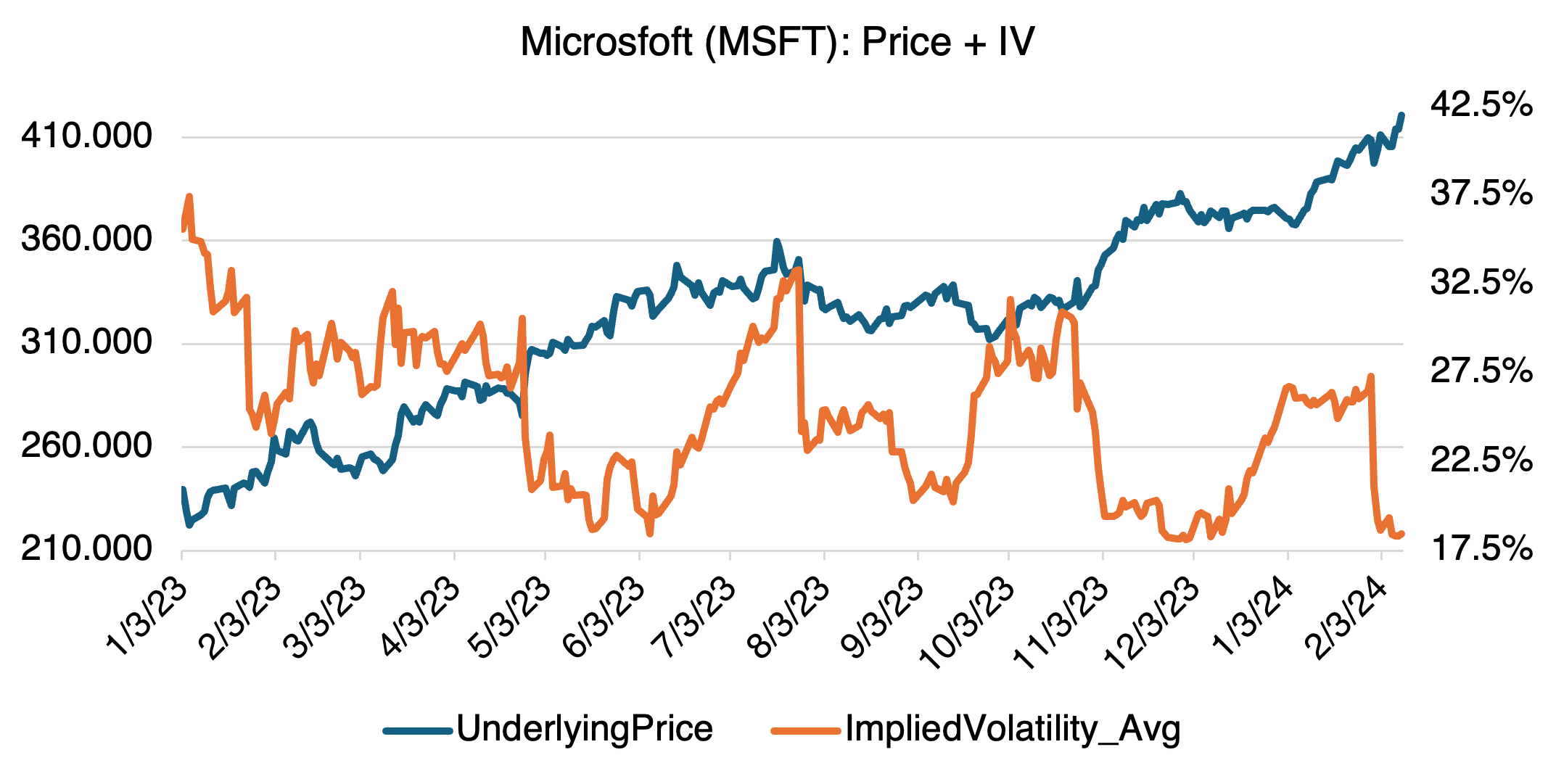

You would think given these stocks’ performance and upward acceleration, that their implied volatilities would be racing higher — and, with one notable exception, you would be dead wrong. Starting with Meta, Microsoft, and Amazon, each has shown significant decreases in implied volatility since late January:

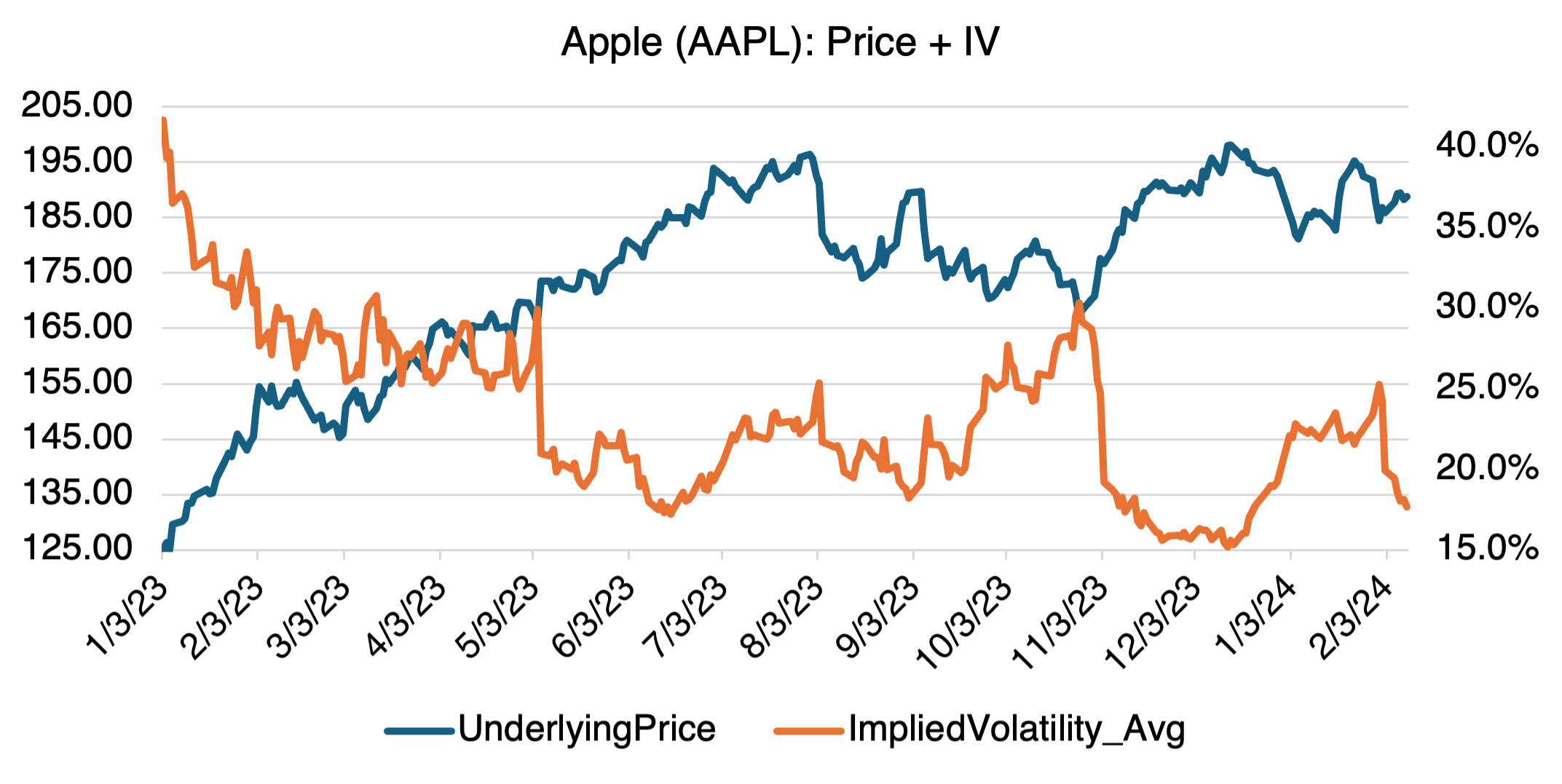

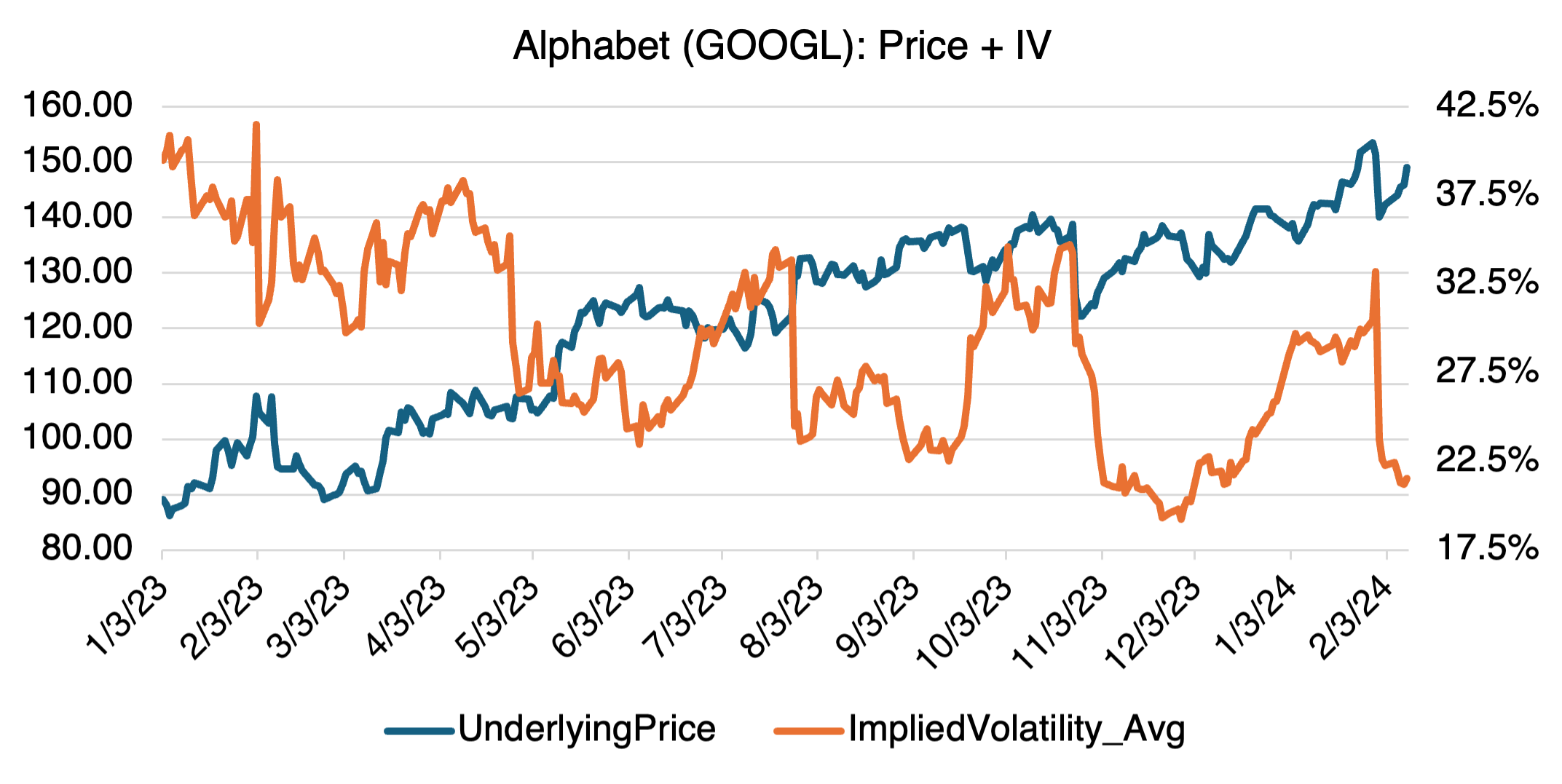

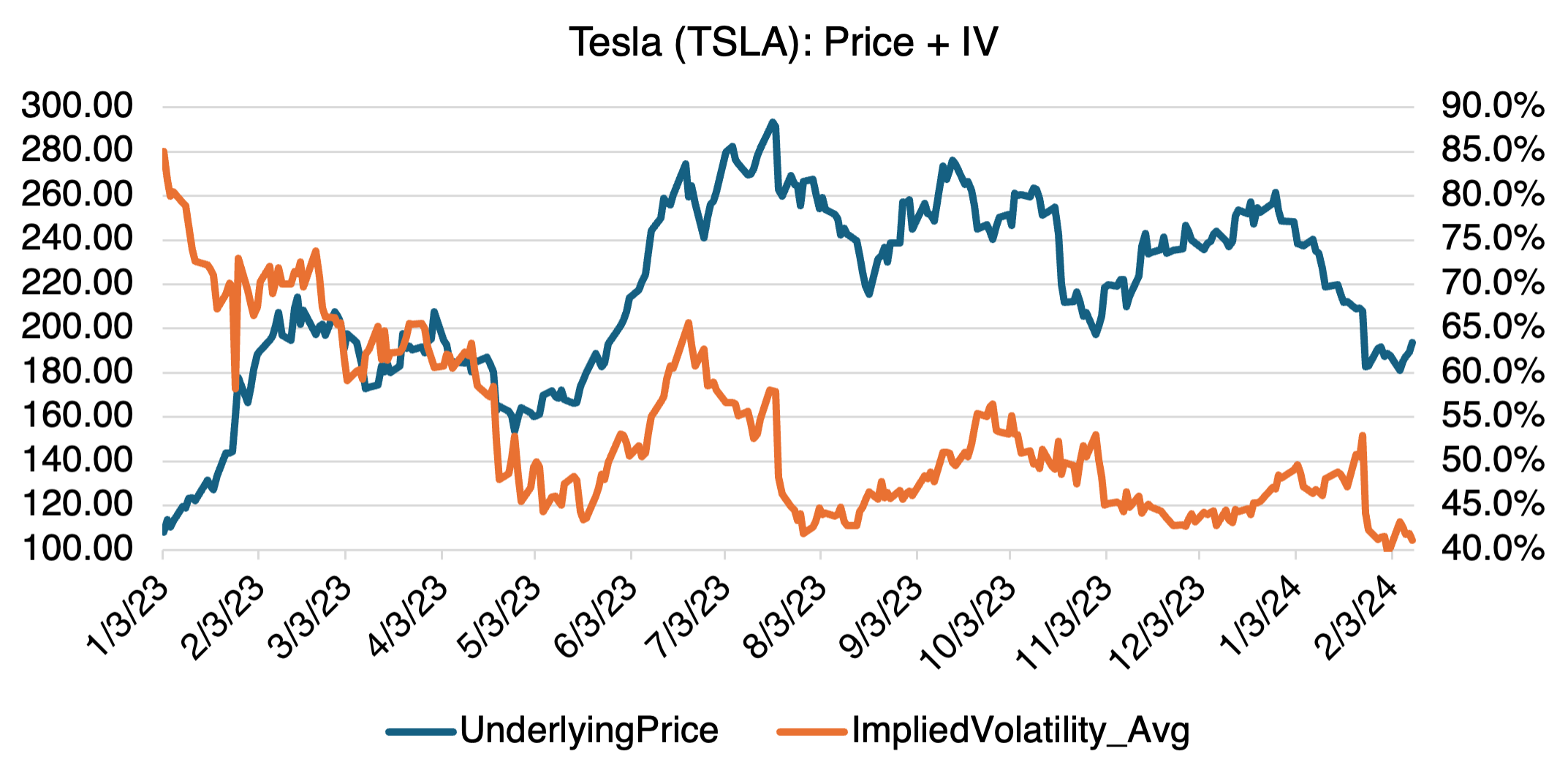

Even for those with more modest year-to-date gains (Alphabet and Apple), or indeed losses (Tesla), the pattern is the same:

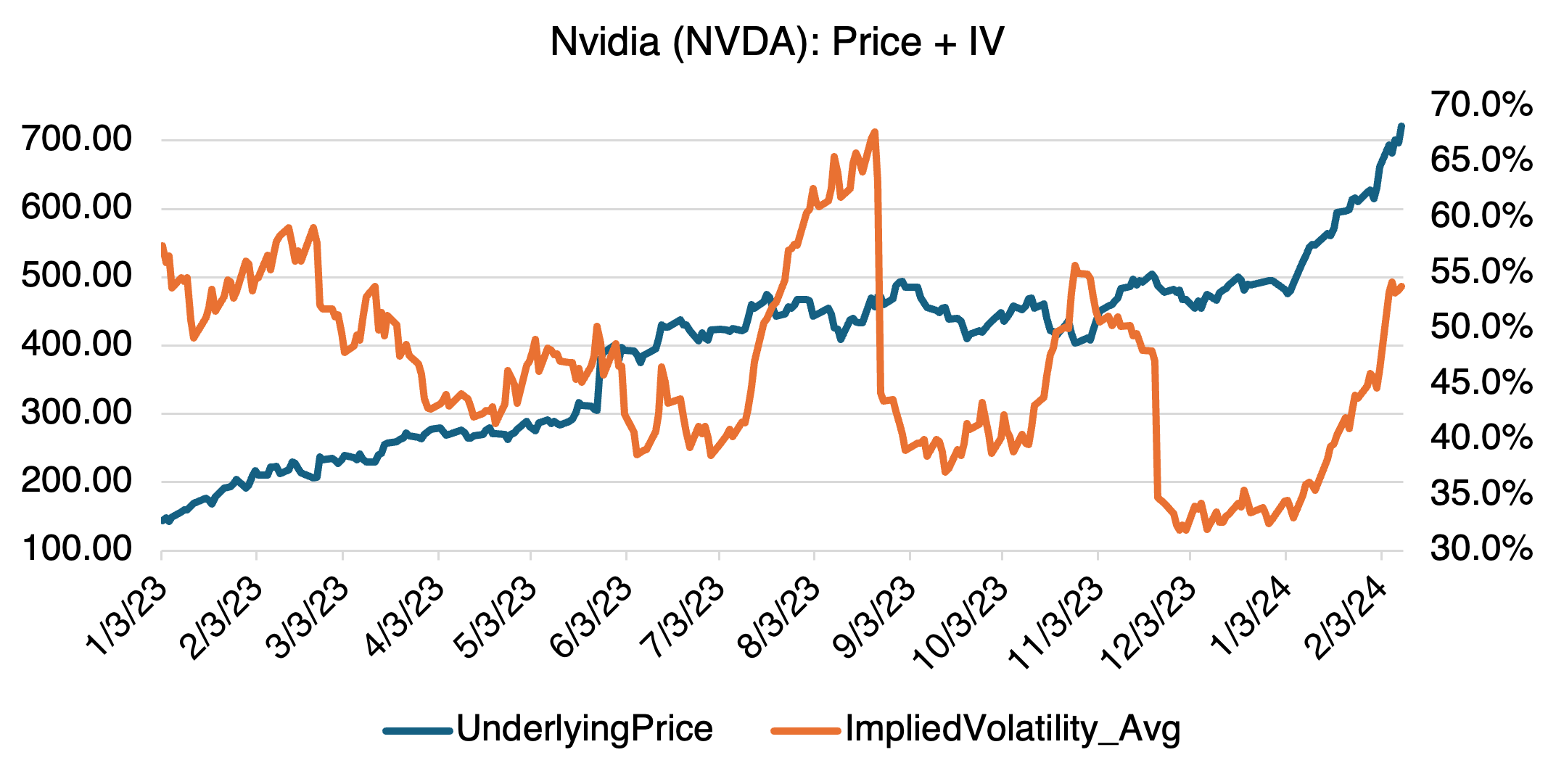

Nvidia is the notable exception. In contrast to other Magnificent Seven stocks, it’s implied volatility has increased to almost 54%, a full 21 vol points higher than it was at the end of last year.

Why? It’s almost hard to believe, but NVDA closed at $146.14 at the close of 2022; it closed at $720.25 on Monday (02/12), almost 5X higher! This year alone, it’s up over 50%. Naturally, option market makers are questioning whether this is the last upswing before the bubble (can we call it a bubble yet?) bursts. Options are therefore relatively expensive, as they should be in this case.

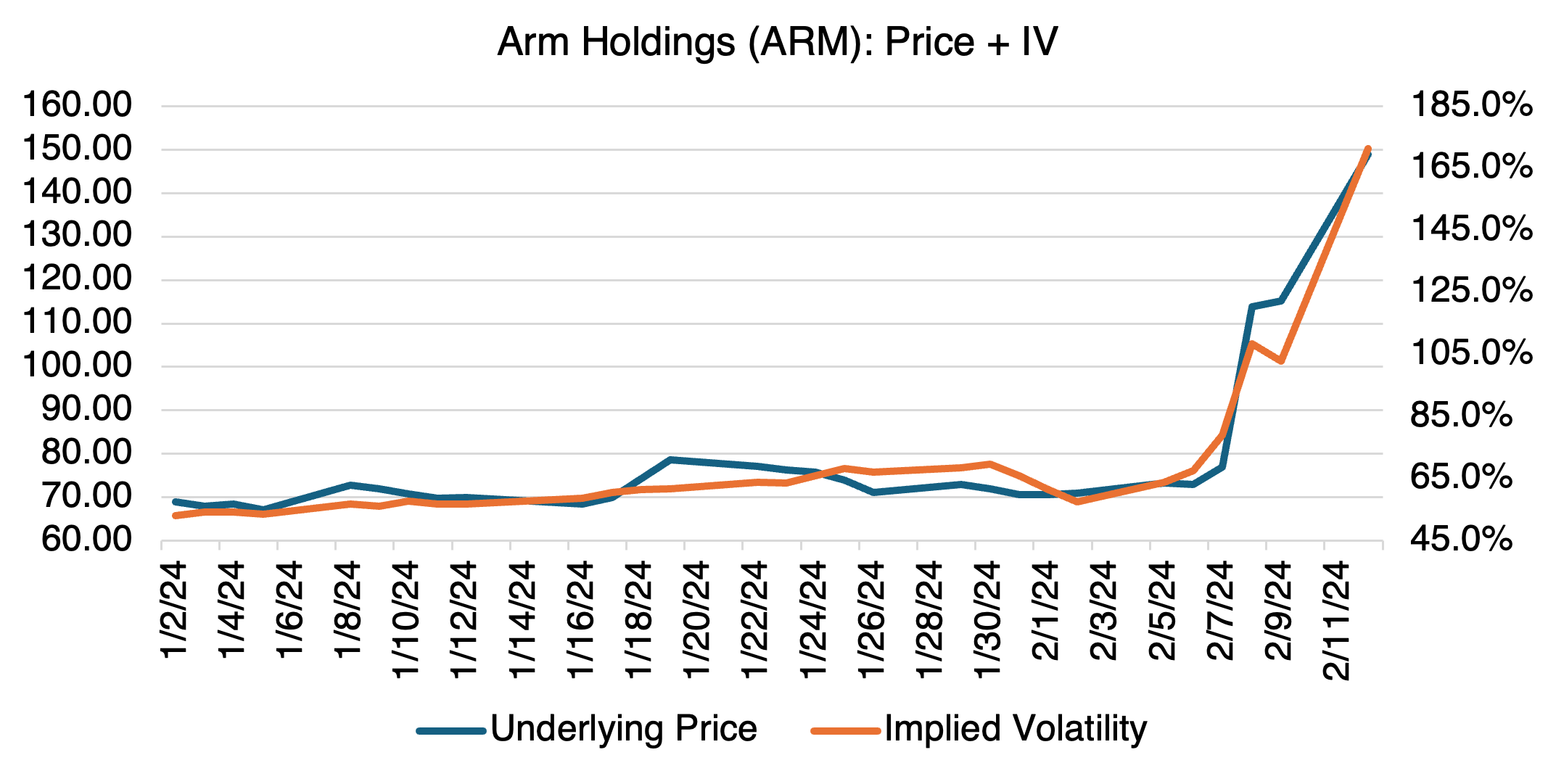

Similar to NVDA, at least in implied volatility terms, is another AI stock that has rocketed up over the last few days, Arm Holdings (ARM).

ARM stock more than doubling in three trading sessions with its implied volatility going up over 100 vol points — no problem! With AI, anything’s possible!

Valentine’s Day

This week is Valentine’s Day, and just like the January Barometer that I wrote about earlier in the year, it has a supposedly foolproof trade associated with it. There are several different versions, but the they all boil down to the same strategy: you buy a few trading days before the 14th and then sell on the holiday or the day after. The idea is that Valentine’s Day gift-giving causes retail spending to increase, sort of like a mini Christmas. Nothing very complex here.

To test whether the trade works, we compared the Valentine’s Day Trade (buy five trading days before the holiday and sell on the 14th) against 1000 other five day trading periods randomly selected since 1996. The object was to find out whether there is anything special about the period leading up to Valentine’s Day.

And the results? The Valentine’s Day trade beat the random return only 46.4% of the time. The results might have been stronger had we selected individual stocks or sectors that would directly benefit from the holiday, but I think you get the idea. Valentine’s Day is a holiday, not a trading tool.