There’s Money in Garbage

For those looking, the waste disposal industry has been getting a lot of attention lately. Why the sudden interest? Because collecting garbage is no longer about just taking out the trash, but about two of the market’s hottest “megatrends,” sustainability and renewables. Granted, sifting through the garbage isn’t as sexy as AI or Nvidia, but the two largest players, Waste Management (WM) and Republic Services (RSG), have handily outperformed the S&P since the end of 2020.

Long term results speak for themselves. When viewed on a weekly basis since 12/31/2020, WM and RSG have increased by 39.9% and 49.5%, respectively, compared to 14.0% for the S&P. Although their performance has leveled out this year, their long term fundamentals still make a compelling case.

WM and RSG are capitalizing on two “megatrends,” recycling and reusing materials and the need to reduce greenhouse gas emissions. Two strategies are being employed. The first is to use new and more advanced landfill sorting technologies that enables them to sift out the more valuable inputs, such as cardboard boxes and plastic, to better meet minimum post-consumer content mandates. Monetizing the gasses that naturally occur in their landfills is their second strategy. So-called biogas, or “trash gas,” results from the decomposition of organic matter, and in the past it has been mostly released or flared off. With new emphasis on limiting greenhouse gas emissions, gathering and selling it has become a supplemental source of revenue for waste services companies and any producer looking for green credentials. Although currently a miniscule percentage of total gas supply in the US, the passage of the climate, tax and healthcare bill last August will help to increase its market share through incentives and tax credits.

Of course, that government support is a two-way street. Biogas is relatively expensive to produce compared to shale gas (which is a by-product of fracking) and conventional natural gas. Without tax credits or renewable fuel credits, the economics of biogas are questionable. Although waste management companies, utilities, and livestock producers are eager to show off their commitment to limiting greenhouse gases, and earn extra revenue in the process, it is only government subsidies that allow them to do so without inflicting pain to their bottom line. In other words, biogas is great…while the subsidies last. They also change the nature of the waste management business from one of steady, dependable returns to one dependent on the variable nature of commodity prices. Consequently, biogas has increased the risk profile of the industry and the investment proposition.

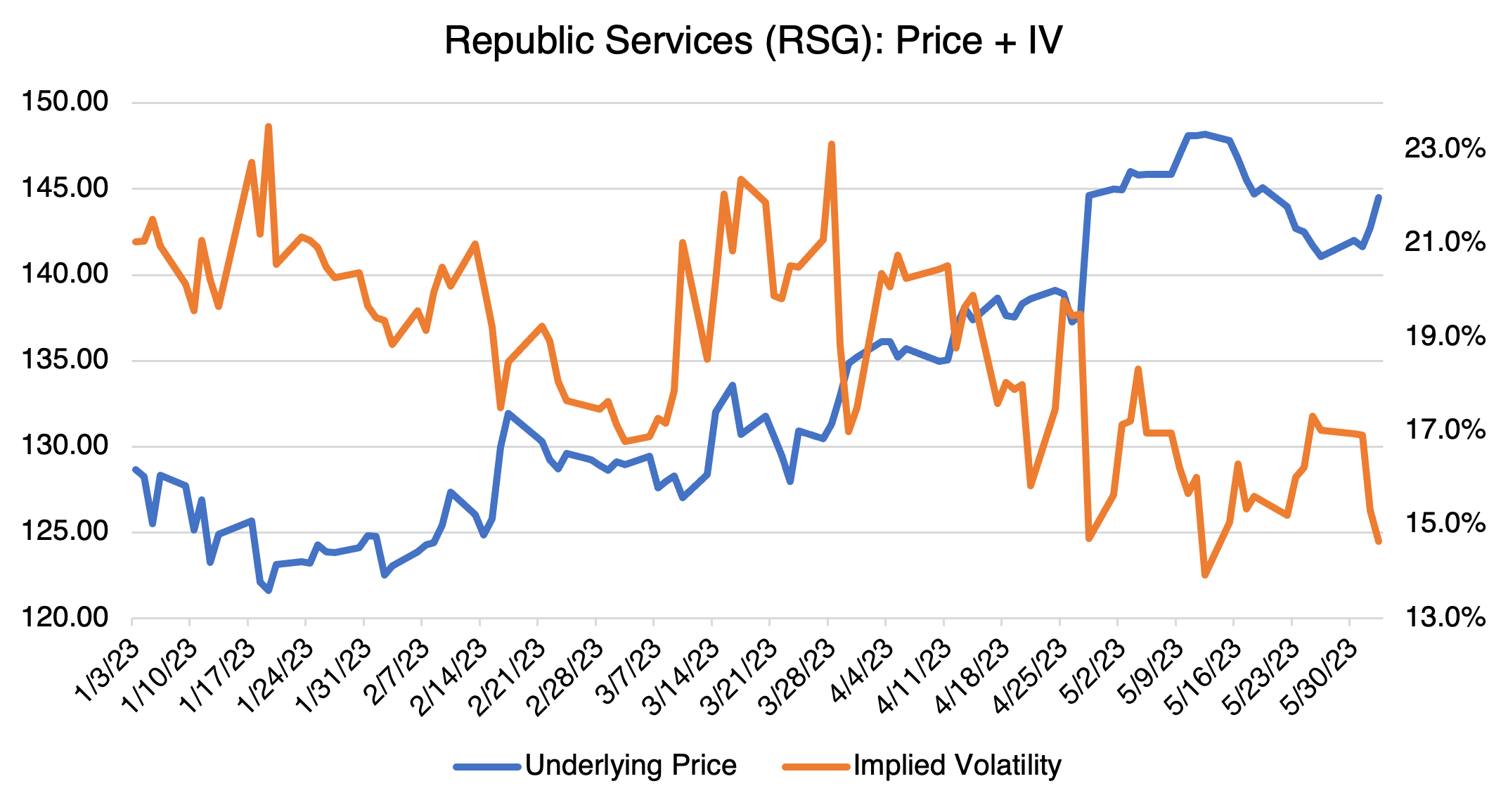

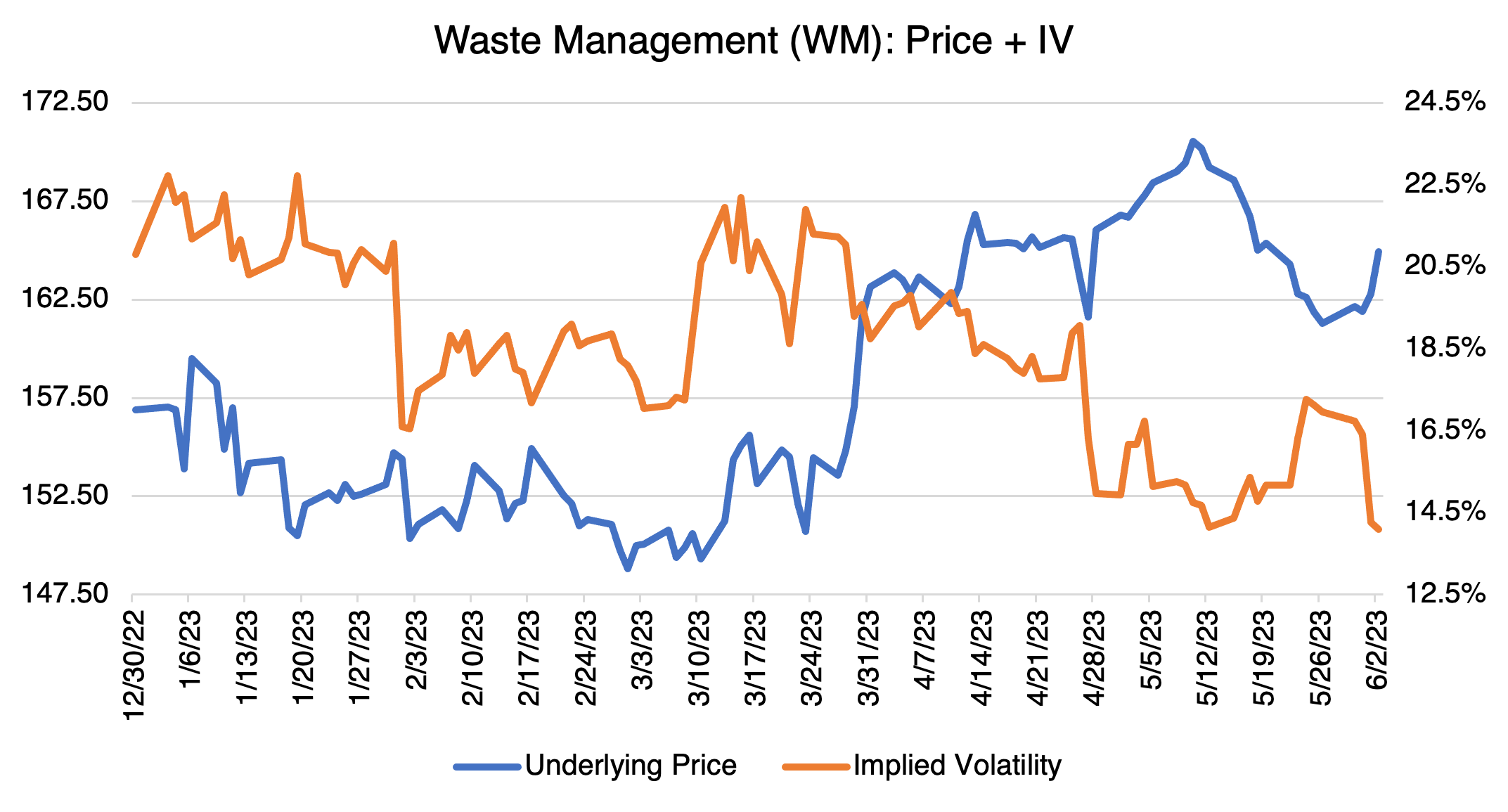

Both RSG and WM are interesting from an options point of view. As I’ve pointed out with many other stocks, their implied volatility moves inversely to their price (in general). This has b een especially true most recently (see below) as the two stocks have rallied.

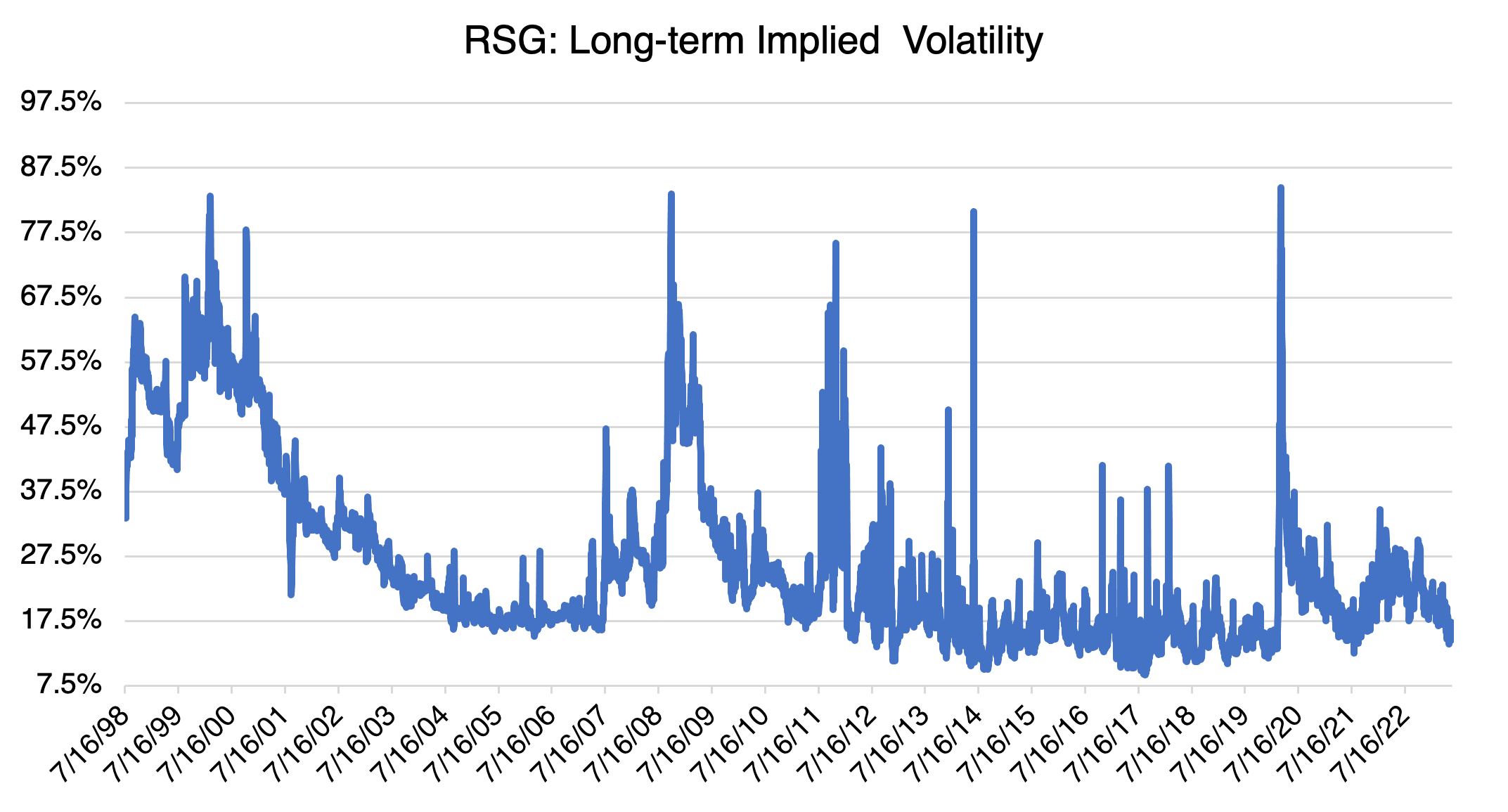

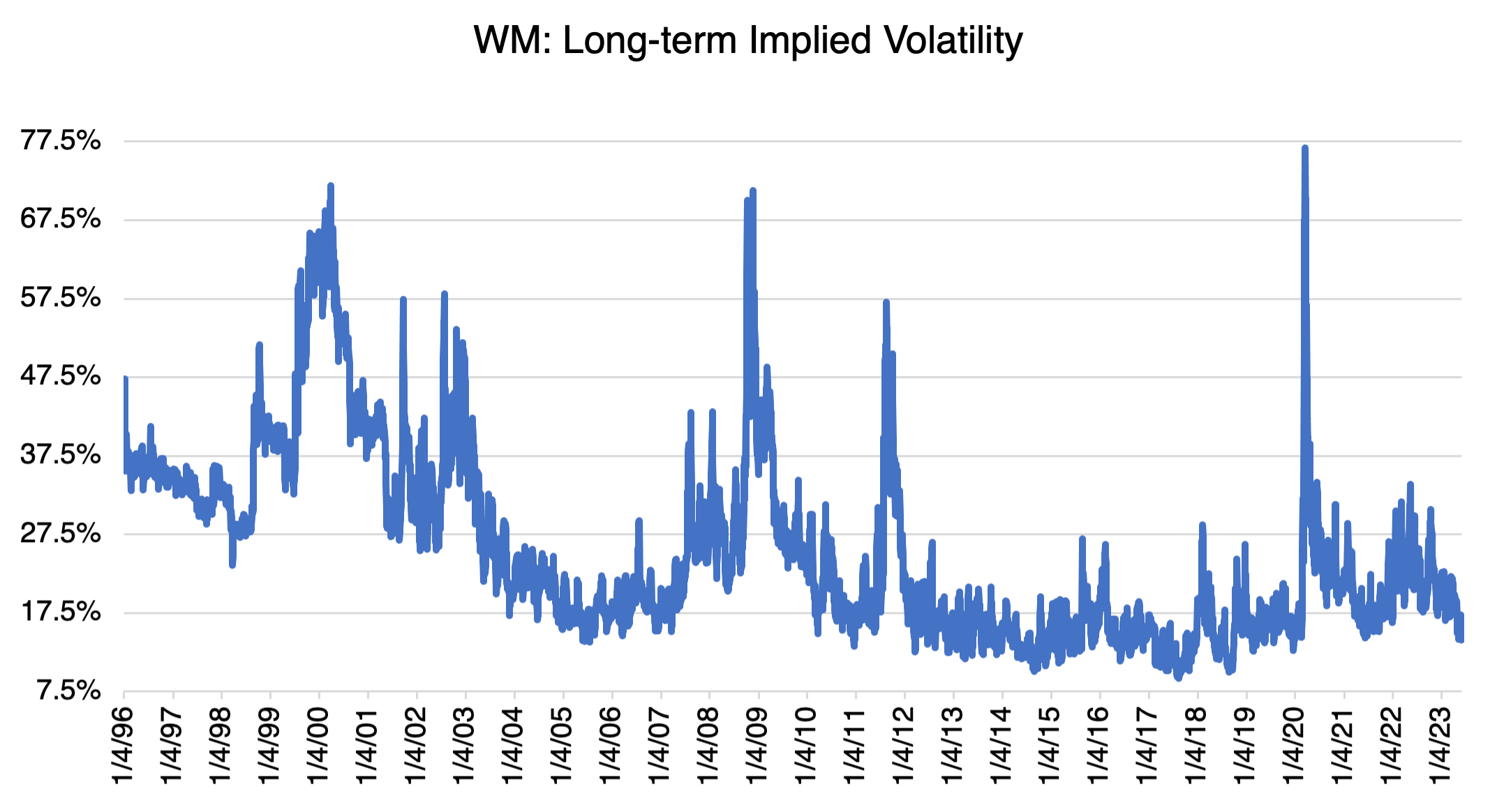

As you can see below from long term charts, both RSG and WM are trading in the lower end of the historical range of their respective implied volatilities.

On a relative implied volatility basis, this would make WM and RSG options relatively cheap. A word of warning, however. Using OptionStrat’s options profit calculator, consider the RSG 07/21 $145 call:

As you can see, the option’s vega at a 13% IV is 0.198, or roughly $20 cents. That’s not insignificant if you have a strategy that is long volatility (e.g., long calls) in a stock whose volatility tends to decrease as its price increases. Again, you must take this into account when constructing any options strategy. If you don’t, or just ignore it, you might have a situation in which you have volatility working against any favorable price movement. In the above example, a 5 point move in implied volatility would result in about a $1.00 move in premium, or 45%. That’s quite a headwind if you get it wrong. Price isn’t the only thing!