Uranium?

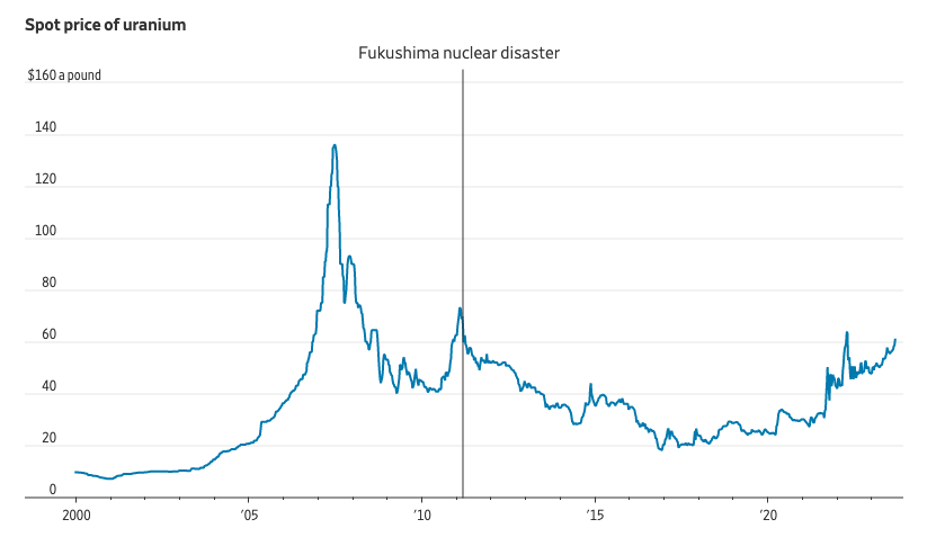

For those of you who have moved on from conventional and dirty fossil fuels, uranium might be of interest. Uranium is the primary source of nuclear power, and although certainly more controversial than wind or solar, nuclear might be the unavoidable solution to providing low carbon electricity. Interest in nuclear power bottomed out in 2011 after the Fukushima disaster, but has been increasing since as solutions to climate change become ever more pressing.

According to a report recently issued by the World Nuclear Association, nuclear power will increase by 75% by 2040. Other estimates put the increase at even higher levels. Although not exactly an unbiased source, the projected increases are impressive nevertheless. Coupled with existing and new reactors coming online, uranium prices have been propelled to their highest level since 2012:

Source: WSJ

Price action since the beginning of Q2 2023 has been impressive and is currently about 25% higher than its levels from mid-March:

Source: Trading Economics

On the supply side, the main sources of Uranium are Australia, Canada, Kazakhstan, Namibia, Uzbekistan, Russia, Niger, and others. Uranium prices can be affected by instability in some of these regimes, as evidenced by the recent spike caused by the coup in Niger. The war in Ukraine has also made Russian supplies in doubt.

With increasing demand and uncertainties hanging over supply, it’s no wonder that uranium prices have been making new highs. Of course, there are risks, namely the specter of a nuclear left tail event occurring (Fukushima, Chernobyl, etc.) and long term nuclear waste storage issues. Regardless of new technologies and the most ardent claims by the industry that reactors are safe, these issues will always cast a pall over the industry. In addition, as prices rise, new secondary supplies, recycled from exiting nuclear reactors and military stockpiles, come on to the market, naturally alleviating supply shortages to a certain extent.

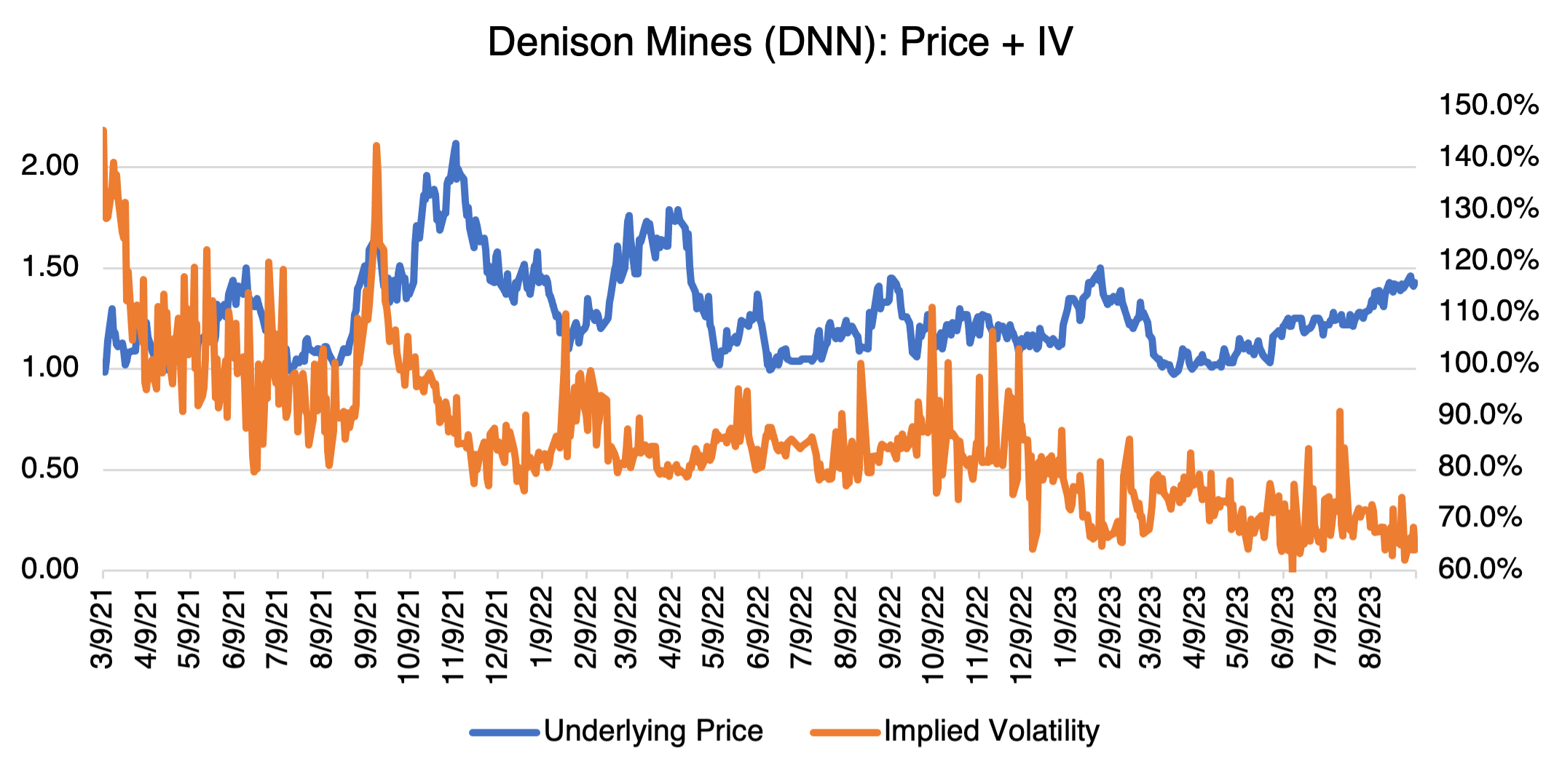

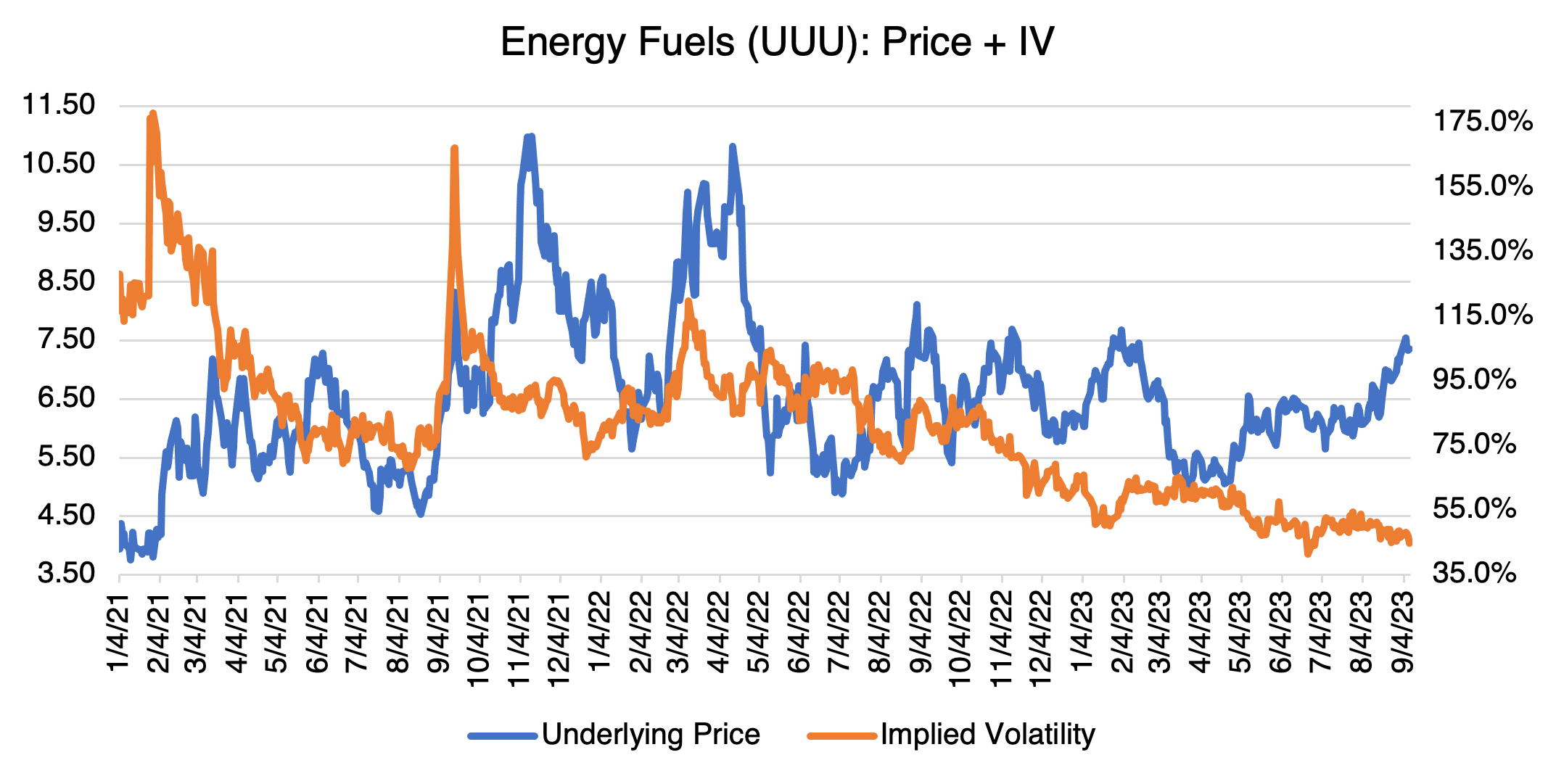

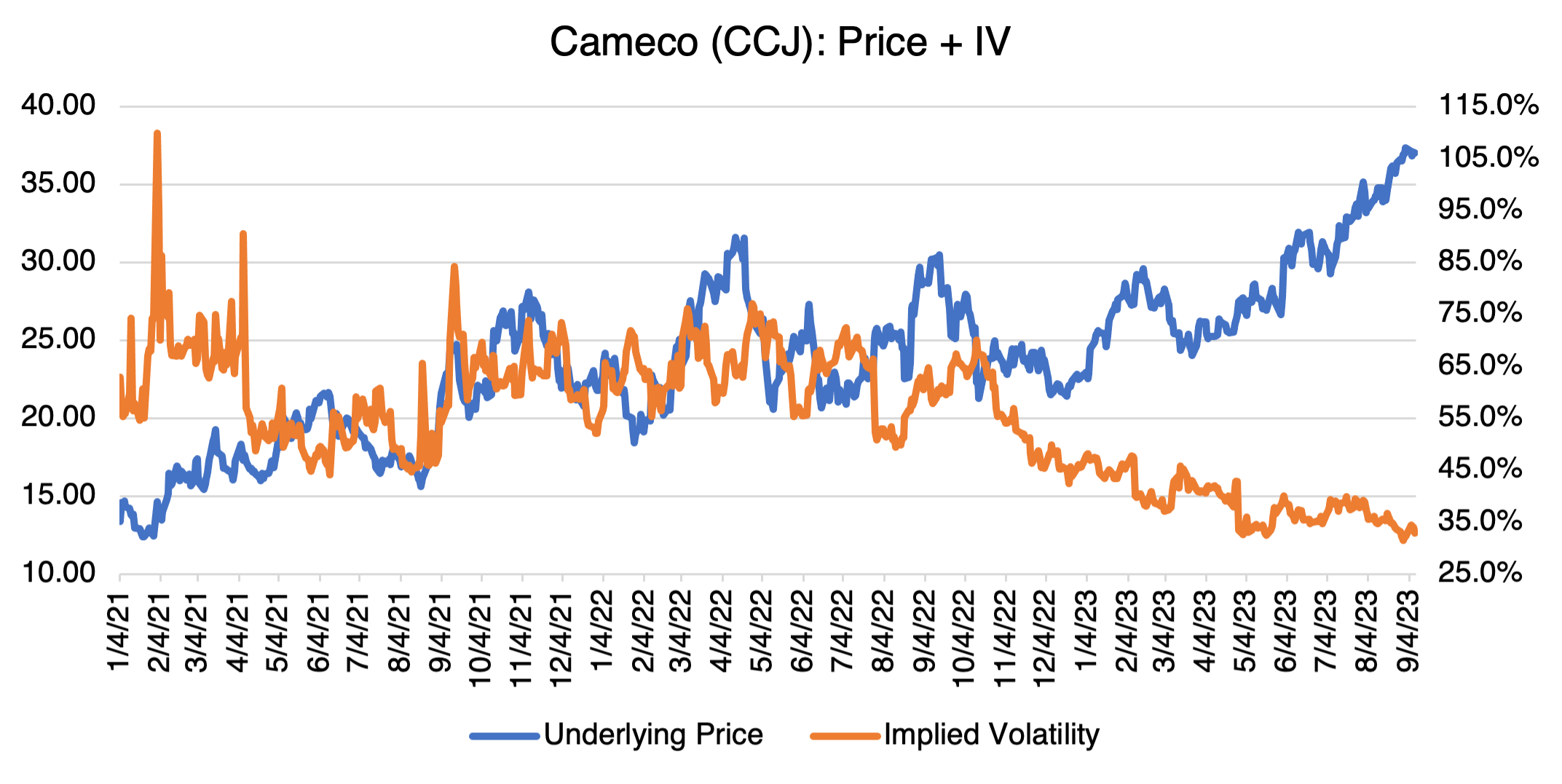

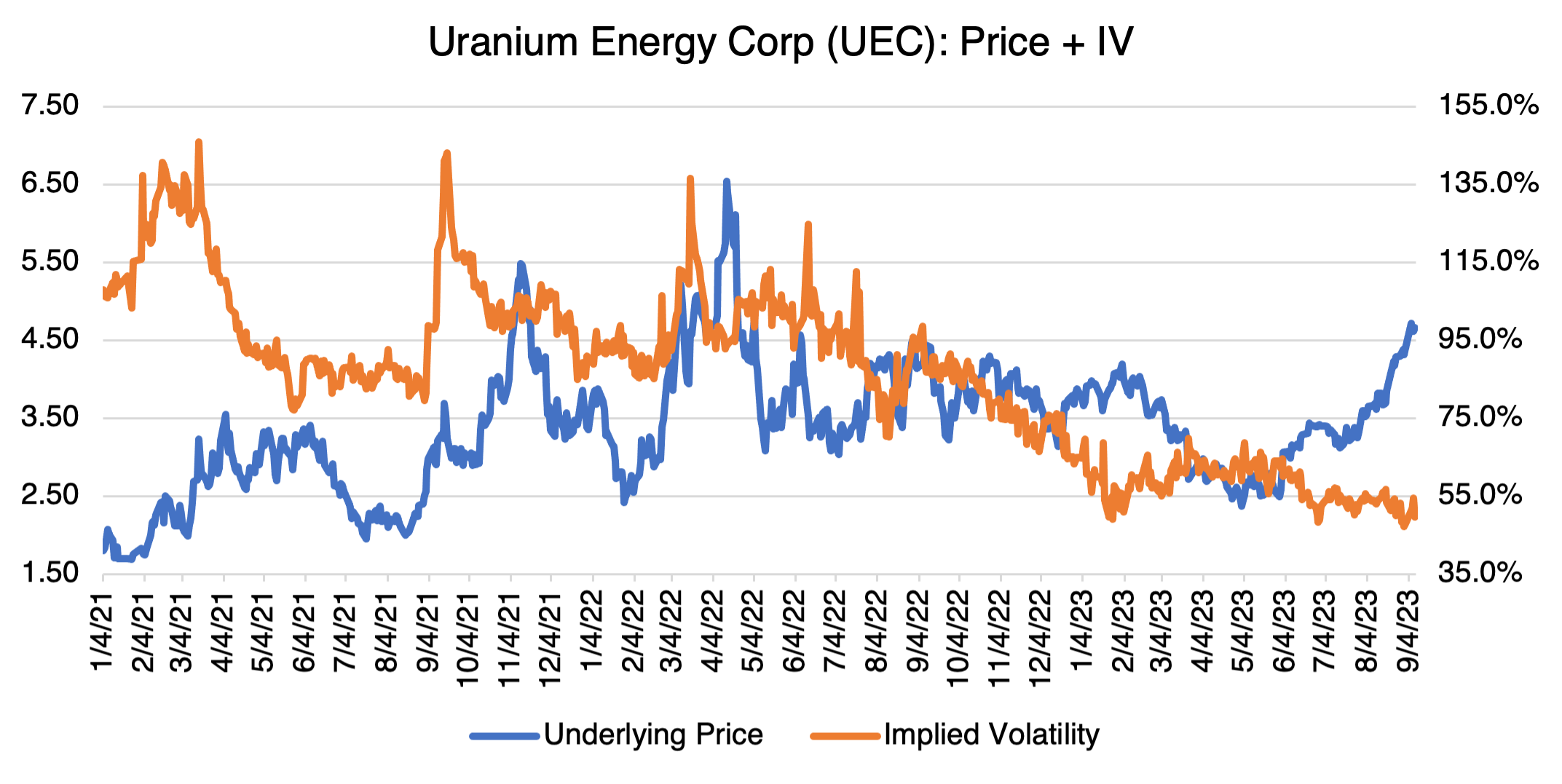

Uranium trades on an institutional (i.e., not retail) level and is priced in $/lb. Futures are available on the CME but have extremely limited, to no, liquidity. The only means by which retail investors can invest in uranium is through uranium mining companies, such as Denison Mining (DNN), Uranium Energy Corp (UEC), Cameco (CCJ), and Energy Fuels (UUUU), or physical uranium ETFs, such as the Sprott Physical Uranium Trust (U.U).

In the case of the individual uranium mining companies (below), they all demonstrate a feature that I’ve described before and is very common in equities: the inverse relationship between price and implied volatility. As you can see below, all four uranium producers have experienced significant price increases since last Spring and yet lower implied volatility. In this case, the drop in IV has not been drastic and has been overwhelmed by the most recent $49.75 to $62.00 uranium price increase. Therefore, long volatility positions won’t have as much drag as normal as the market increases.