Uranium is Glowing

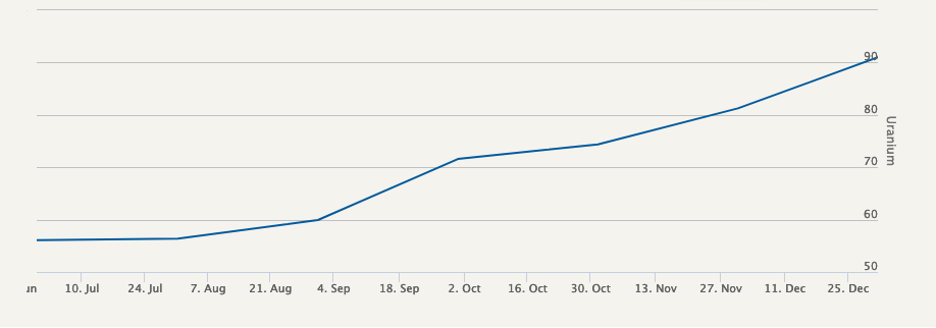

Yes, uranium. If you’re looking for an esoteric investment play that will dazzle your friends, this just might be the thing! In wrote about uranium last September (Uranium?) and concluded “__With increasing demand and uncertainties hanging over supply, it’s no wonder that uranium prices have been making new highs.” Since then, it’s gotten even more bullish, with spot prices increasing over 14% since the beginning of just this year.

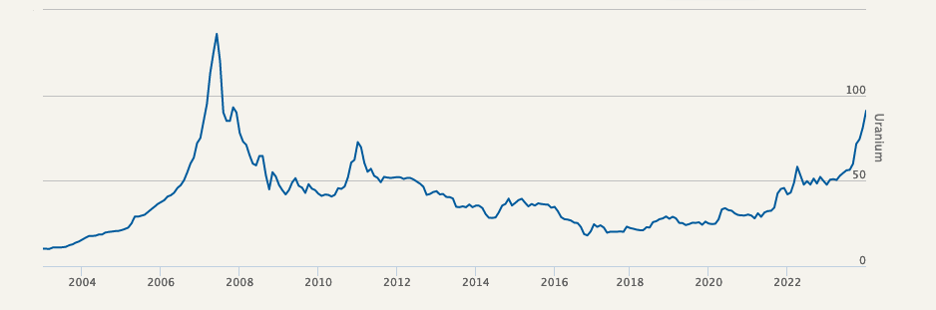

As you can see below, uranium’s spot prices decisively took out the old 2011 high of almost $73 last October and is currently trading about $104, over 73% higher than it was at the end of last August and over three times its level in August 2021. For comparison, and for a sense of where it might go, the high made in June 2007 was almost $140.

Source: Cameco

Source: Cameco

What’s going on? Nothing mysterious, just classic supply and demand pressure. On the demand side, nuclear power is increasingly (albeit grudgingly) being viewed as one of the solutions to ever more stringent carbon emission goals. Coupled with fuel requirements for existing plants, and a drawdown in existing reserves in the US and Europe, uranium purchases by utilities have been the highest since 2012. Since nuclear power plants need fuel to run, their demand is relatively price inelastic.

On the supply side, the war in Ukraine has shaken up the market. Nuclear power plants require enriched uranium and Russia has about half of the world’s enrichment facilities. A bill banning imports to the US passed the House last December. Given the tense, tit-for-tat relationship, Russia may beat us to the bunch by banning exports to the US. In both scenarios, supply disruptions are very possible.

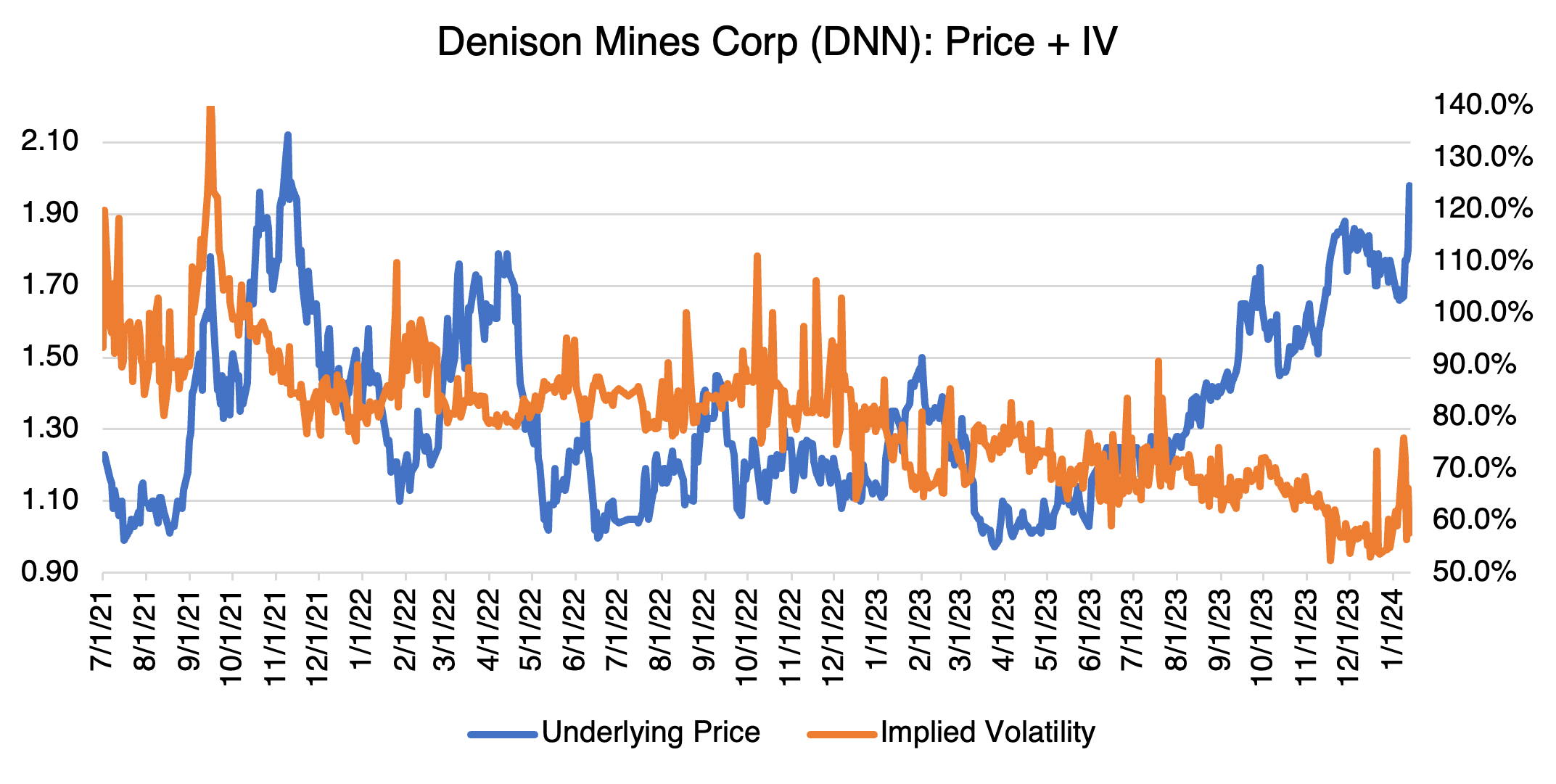

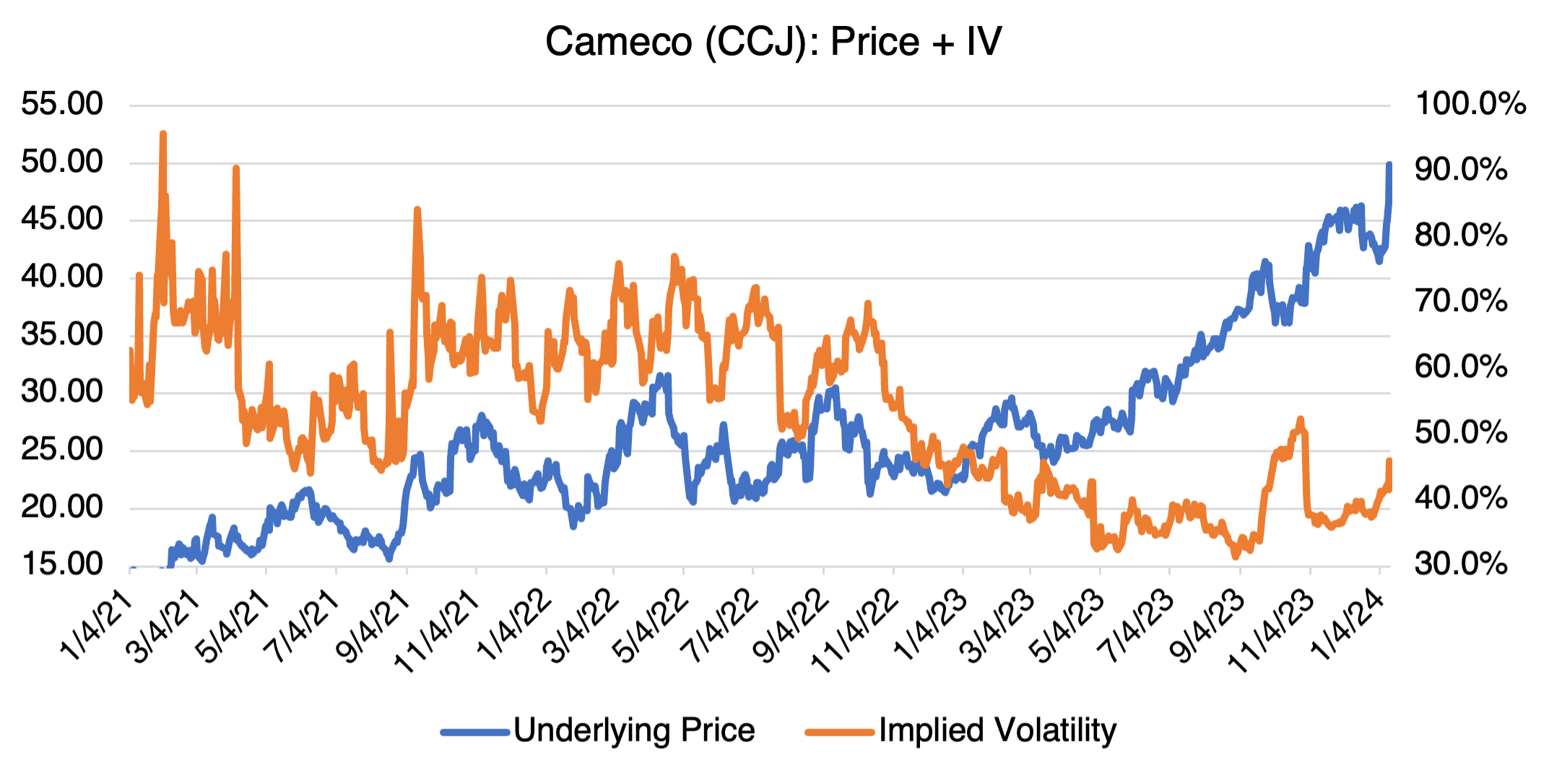

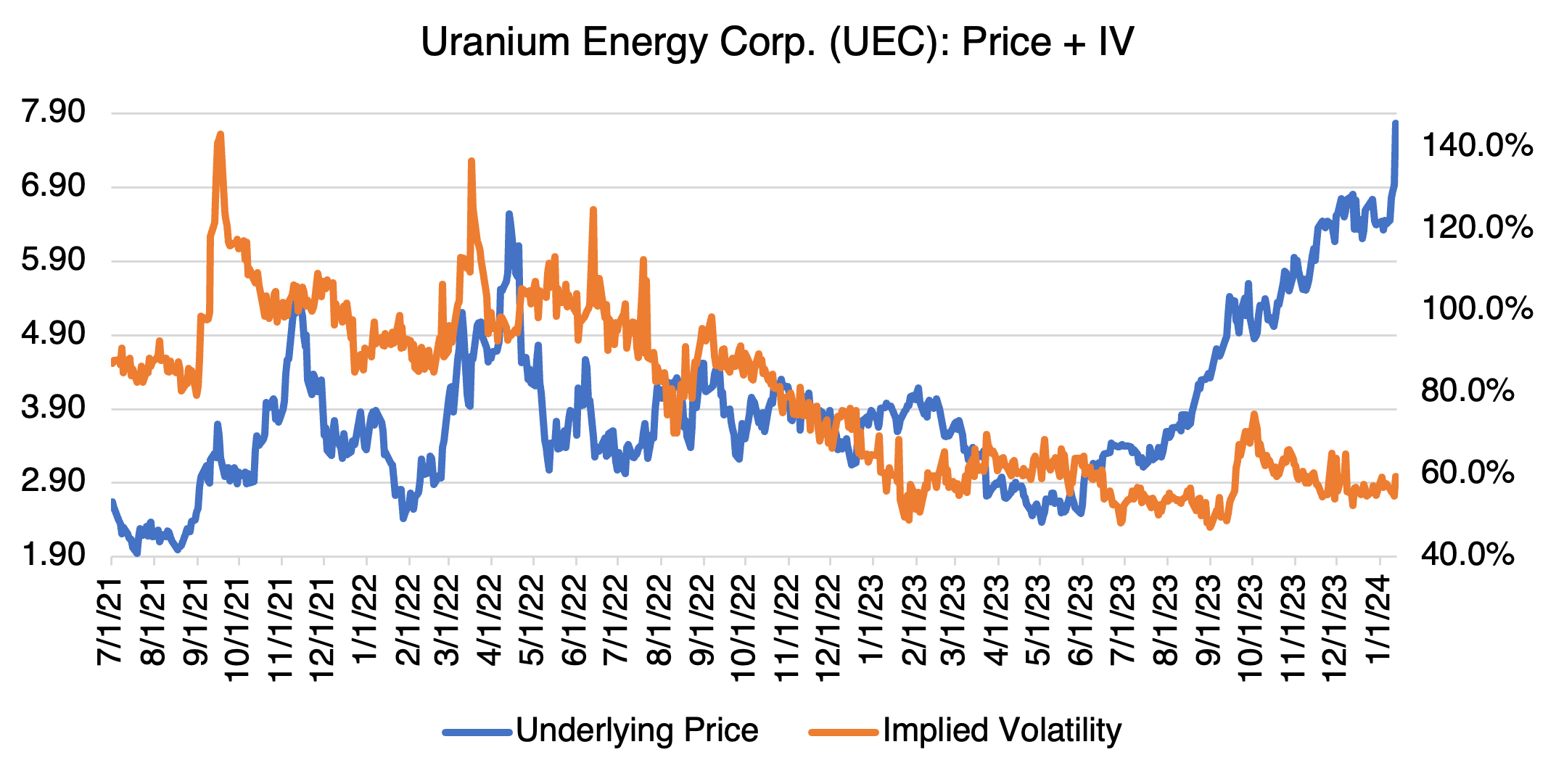

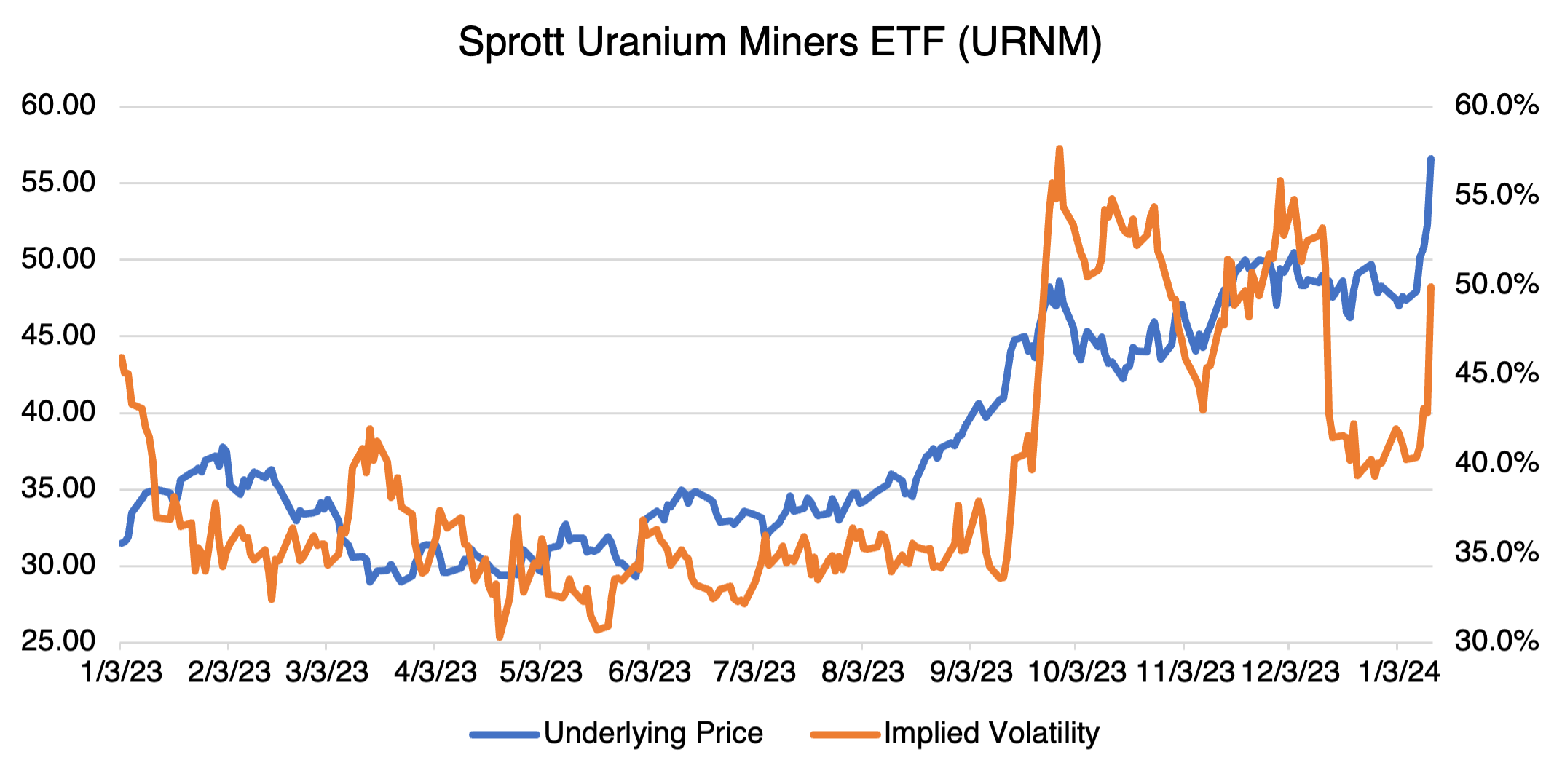

The CME has listed uranium futures but they are illiquid. Uranium mining companies, or ETFs tied the physical commodity, are the only viable investment vehicles for retail investors. Cameco (CCJ), Uranium Energy Corp. (UEC), and Denison Mines Corp. (DNN) are all examples of uranium mining stocks; Sprott Uranium Miners (URNM) is an ETF based on an index that tracks uranium mining companies (Sprott also offers ETFs based on physical uranium). Their price and implied volatility charts are below:

As you can see, the implied volatility of the uranium mining stocks has not increased significantly as a result of the rally in uranium. In contrast, the implied volatility of the Sprott ETF (URNM) has increased considerably, as has its price, since the beginning of the year. On an options basis, I would therefore consider mining stock options to be more reasonably priced.