The Option Trader's Toolkit

Trade smarter with the best visualization and analysis tools available.

Start Free TrialPredict your Strategy

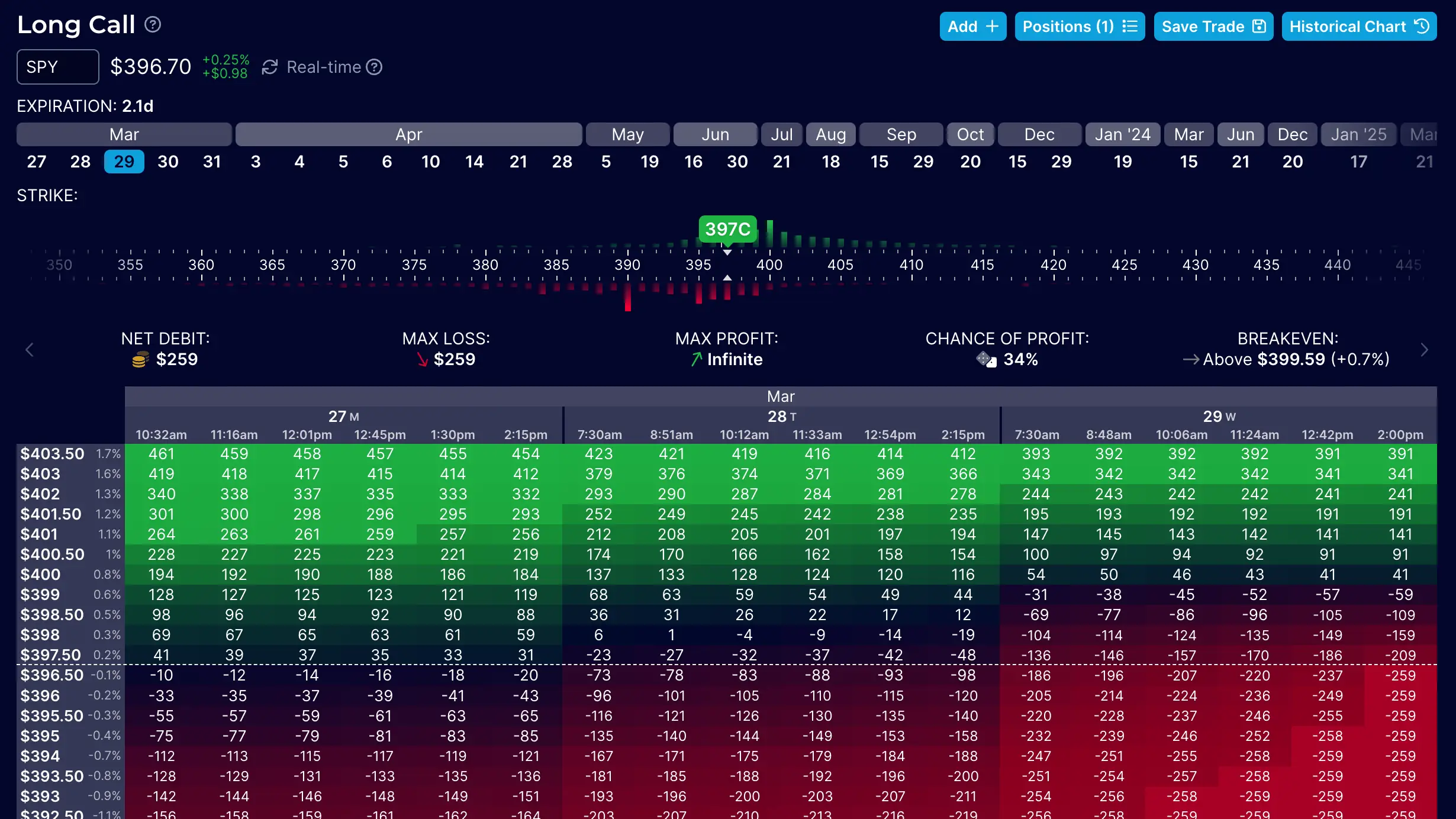

Use the strategy builder to calculate and visualize the expected profit and loss of over 50 pre-made strategies. Or, create your own strategy by selecting various option strikes and expirations.

Optimize an Idea

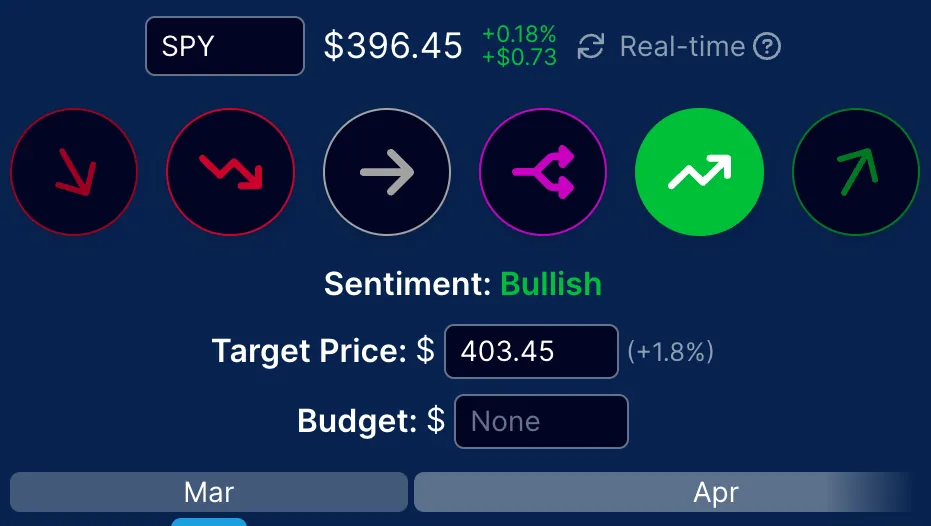

Use the options optimizer to find the best trades for a given target price and date. The strategies are ranked by best return or best chance.

View Unusual Trades

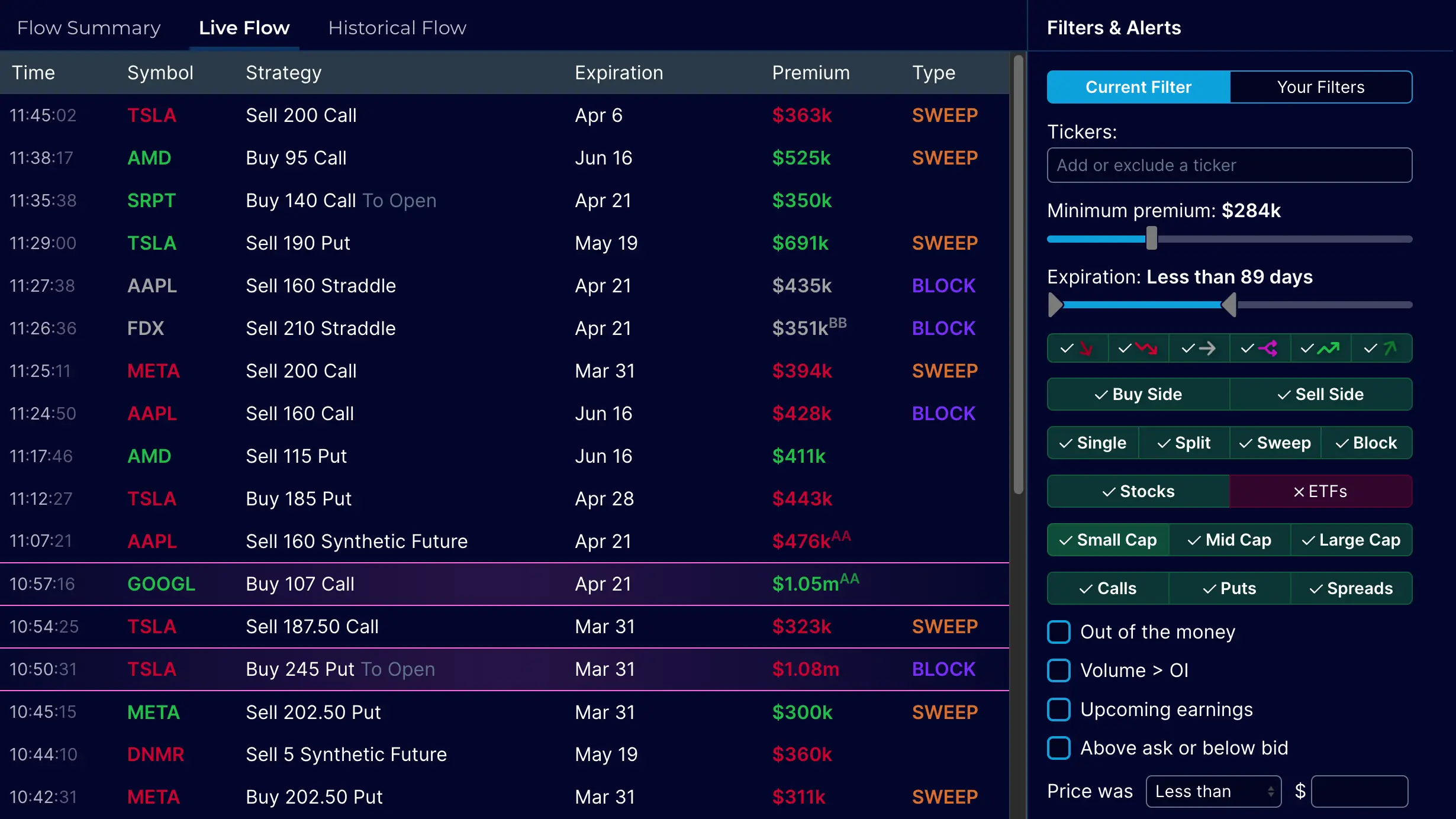

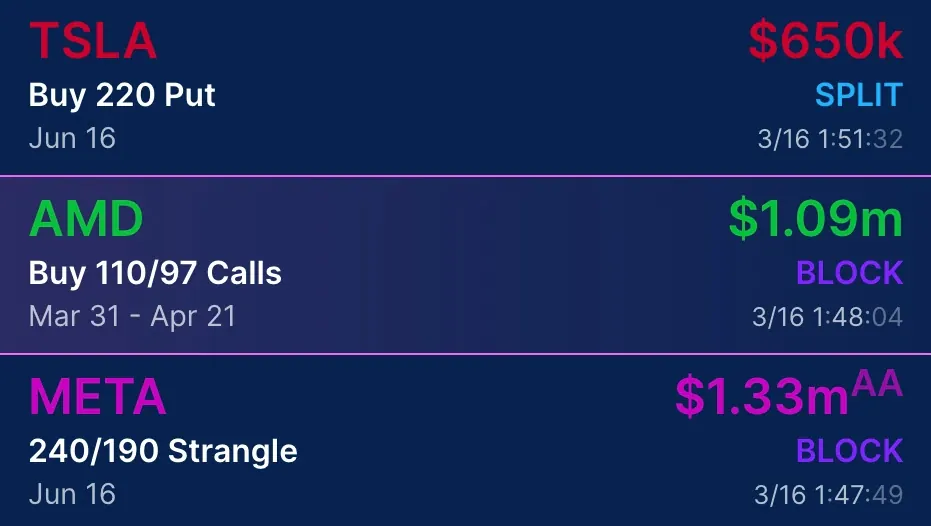

Follow the smart money by watching large and unusual trades as they are made. Our options flow uncovers complex trades that otherwise go unnoticed.

OptionStrat is the next-generation options profit calculator and flow analyzer. Through continual monitoring and analysis, OptionStrat uncovers high-profit-potential trades you can't find anywhere else — giving you unmatched insight into what the big players are buying and selling right now.

What our traders say:

Everything you need to go from good to legendary in one place

Enhanced Real-Time Flow

We scan the market to uncover real trades that professionals, congress, and company insiders are making.

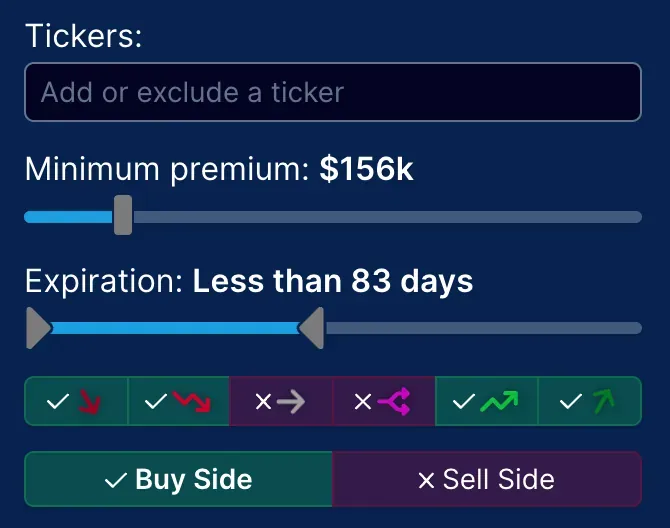

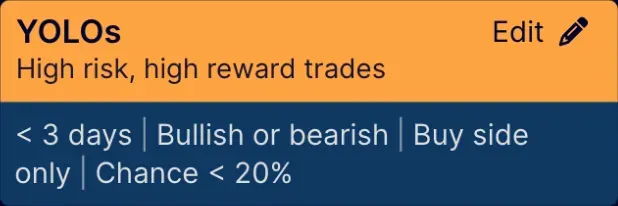

Customizable Filters & Alerts

Set up custom filters to find trades matching your criteria. Add alerts to instantly be notified the second a matching trade is made.

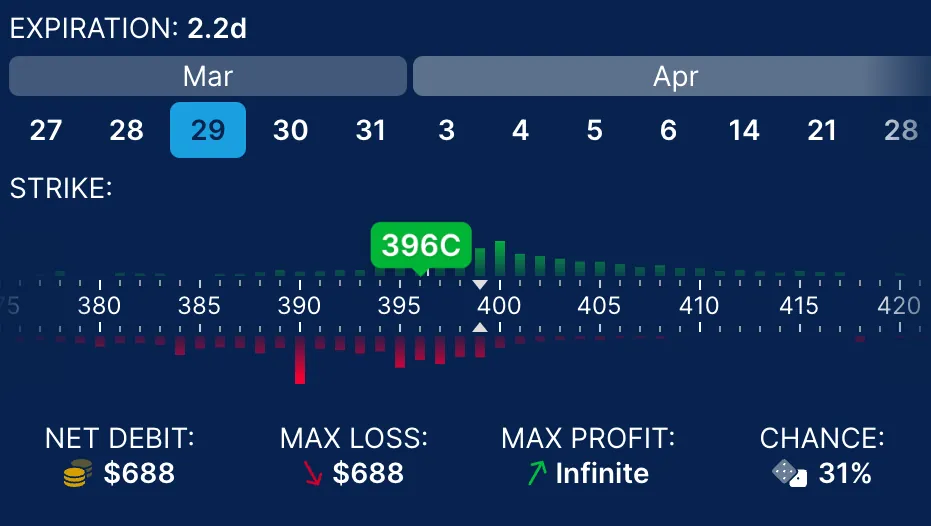

Powerful Options Profit Calculator

Our strategy builder helps you instantly visualize the expected profit and loss for your strategy. Never trade in the dark again.

Trade Optimization

Not sure where to start? Simply give our optimizer a target date and price and we'll scan thousands of potential trade to find something for you.

Performance Tracking

Save trades to your account to see how they perform, without risking real money. We track the performance of each trade over time.

News & Insights

Our tools pack in relevant information for your trades, including breaking news, important upcoming dates, and helpful liquidity reminders.

Explore these and other powerful features as you grow:

Explore All FeaturesUnsurpassed Data Quality and Speed

To provide you with unerring accuracy, especially with unusual options activity for complex strategy types, OptionStrat calculates and charts trades using data provided exclusively by the Options Price Reporting Authority (OPRA). That means OptionStrat gets the same data that your trading platform does. Data lags by only 15 minutes for free users. Premium accounts receive live auto-refreshing data.

Start a free trial today:

Live Flow

Live Tools

Free

Recent News & Videos

As part of our commitment to educating and building better traders, we publish weekly videos and blog posts covering market insights and trade ideas. Follow along and gain a deeper understanding of options trading!

DO THIS Instead of an IRON CONDOR

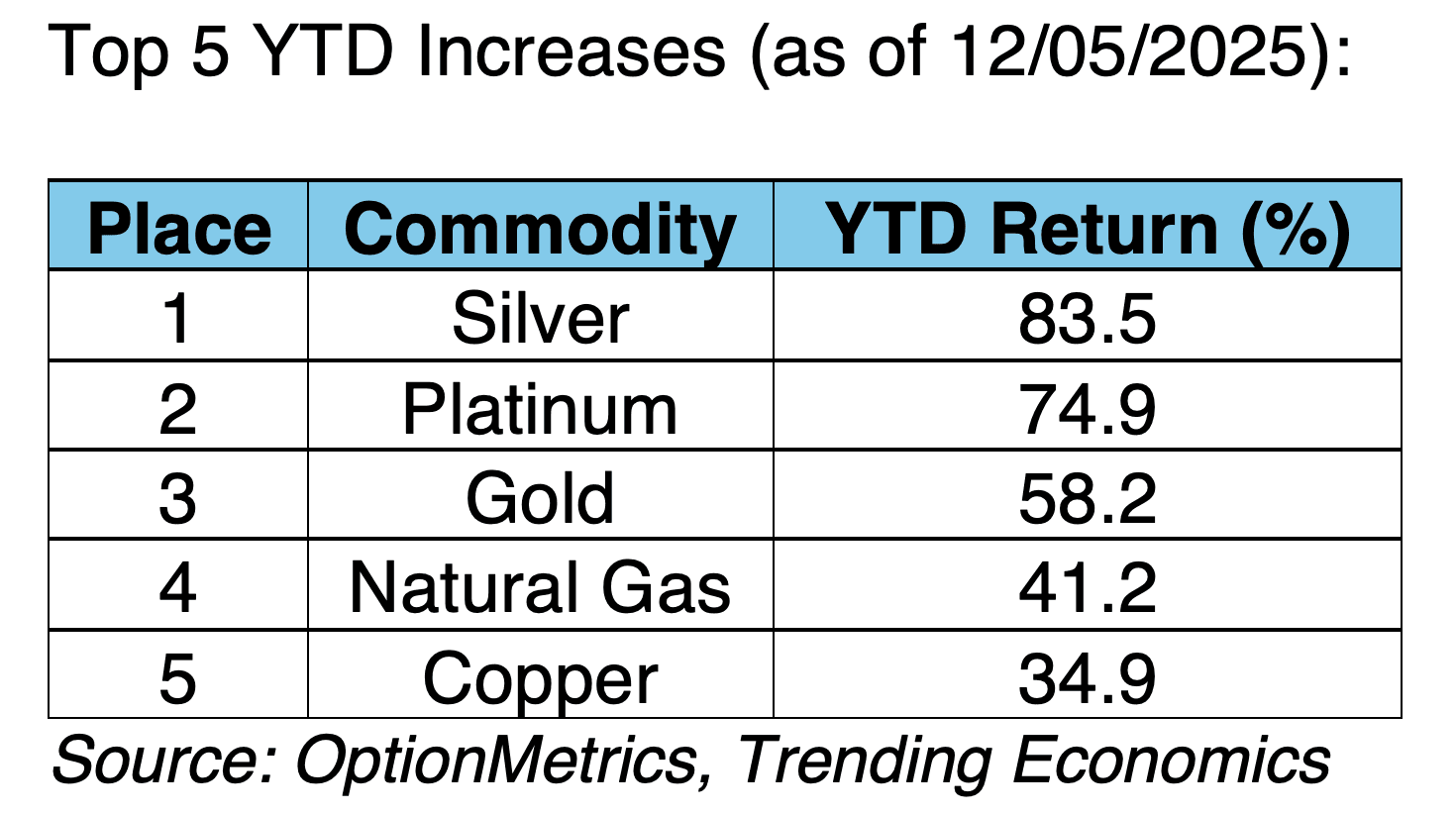

2025 Commodity Top-10

The year is almost over, and it’s time to examine the top five winners and losers in commodities and what they may portend for 2026. On the winning side (although I guess that really depends...

SPX Breaking Higher? What The Charts Reveal This Week

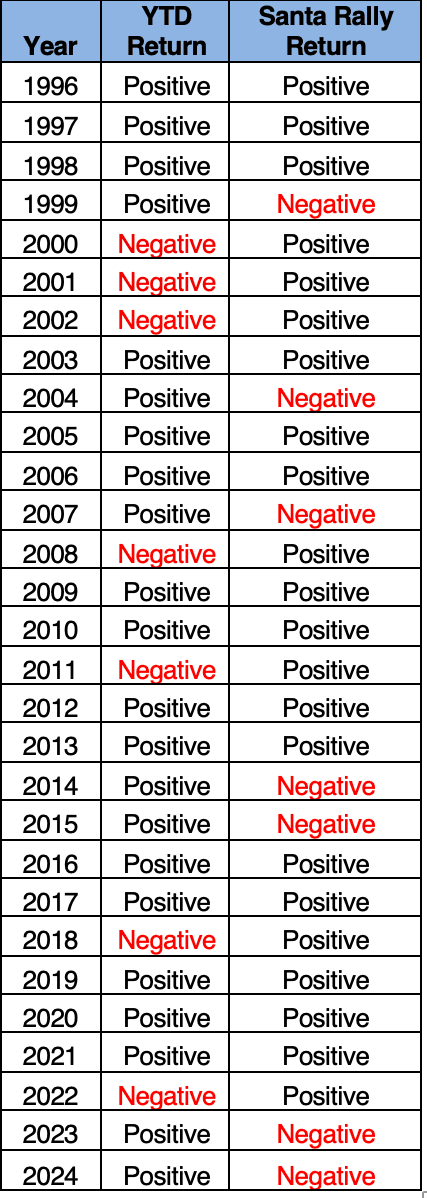

Santa Rallies!

Unbelievably, it’s December and we are approaching the end of the year. Almost always, traders now start talking about the so-called Santa Rally. As I’ve noted in the past, investors love patterns, rules, and metrics...