Whoppers!

I went to McDonald’s (MCD) last weekend for the first time in a few years and it was a different place than I remember. First off, there were no employees to greet and take orders — electronic kiosks do all that now. The seating area was clean and modern and reminded me of IKEA. As for the food, my quarter pounder tasted exactly the same as every other one I’ve ever eaten, regardless of location. Although the whole experience had a certain sterile and industrial vibe to it (you feel like you’re standing in line to get your allotment of Soylent Green), it was the essence of fast food: efficient, relatively inexpensive, and consistent. You know what you’re going to get, every time. Apparently, a lot of Americans agree: on any given day, it is estimated that about 50 million of us eat fast food.

The reason I bring this up is that it got me wondering about what happened to McDonald’s former #1 competitor, Burger King. The two brands used to be more or less interchangeable, like Coke and Pepsi, but eventually Burger King just couldn’t keep up, slipping behind Wendy’s in 2021 and relinquishing the #2 slot. Simply, long menus, slow operations, and outdated restaurants turned off customers. Snappy ad campaigns and new menu items didn’t help.

Enter Burger King’s latest owner, Restaurant Brands International (QSR), which was formed in 2014 by the merger of Burger King and Tim Hortons and has since added Popeyes and Firehouse Subs to their portfolio. Burger King has gone through a few owners previously, including two other private equity shops. The difference this time is that RBI decided to invest $400 million in September 2022 to revive the chain, the so-called “Reclaim the Flame” strategy. It consists of two parts: $150 million for marketing (“Fuel the Flame”), and $250 million for redesigned restaurants, renovations, and more efficient kitchen operations (“Royal Reset”). Here’s hoping that they spent as much time on the new strategies as they did naming them. They also installed Tim Curtis, a 35-year Domino’s veteran, to head up the US and Canada and spearhead the comeback plan.

He faces an uphill battle. By any measure, McDonald’s has a commanding and very established lead. In 2022, Burger King ranked 12th out of 15 burger fast food chains in per unit volume at $1.47 million/year. McDonald’s was #1 at over $3 million. Similarly, the McDonald’s app was downloaded over 40 million times, compared to Burger King’s 7 million. And only 27% of consumers considered Burger King to be “good value.” McDonald’s was almost 50%.

There are some optimistic signs. Q1 ’23 sales were almost 11% higher than the year before and they have instituted a grading system (part of the “Royal Reset” strategy) in which high performing restaurants receive increased funding for equipment, renovation, and marketing. Expenses connected to Covid related supply chain issues and hiring shortages have also decreased.

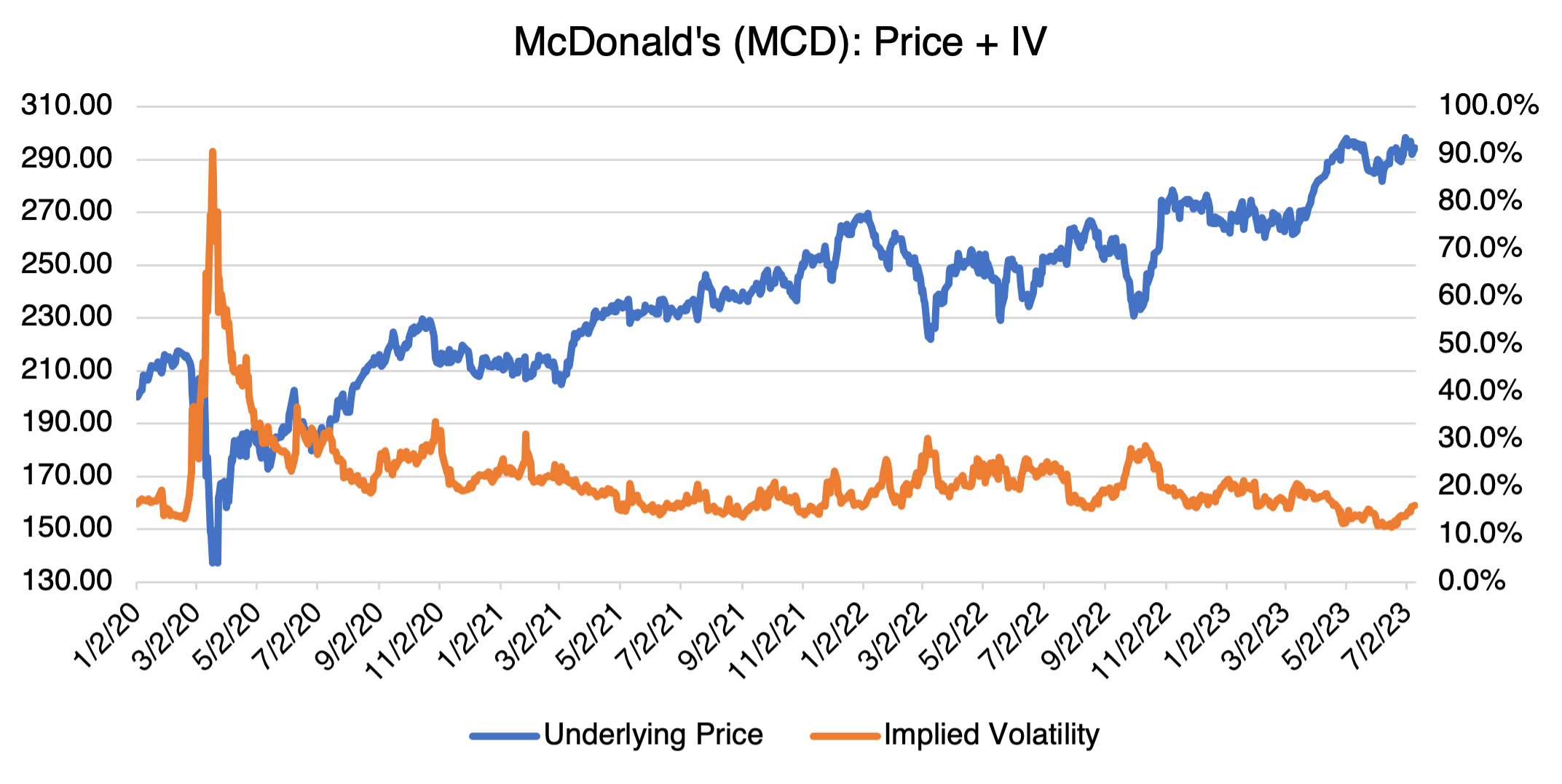

For investors, McDonald’s and Burger King present a classic choice — invest in the sector leader or in a quasi-turnaround situation. As noted, Burger King is part of Restaurant Brands International’s portfolio of fast food restaurants and contributes about 28% to RBI’s overall revenue. As such, there is no direct way to invest in Burger King as a stand-alone entity. And that might be just as well — McDonald’s seems to be going from strength to strength and is the clear industry leader, no question. The market agrees. MCD is up 11.5% YTD, mostly since the beginning of March.

At the same time, MCD’s implied volatility is relatively low historically at about 16%, but elevated by about 3 to 4 points from just a few weeks ago. Like many other stocks I have reviewed, it usually displays an inverse relationship between price and implied volatility (although not as pronounced as in other cases). With a vega of almost $0.37 cents, a several point decline in implied volatility, i.e., back to the 12 – 13 percent region where it was for most of June, would represent a very significant change in options value. Options investors should keep that in mind.

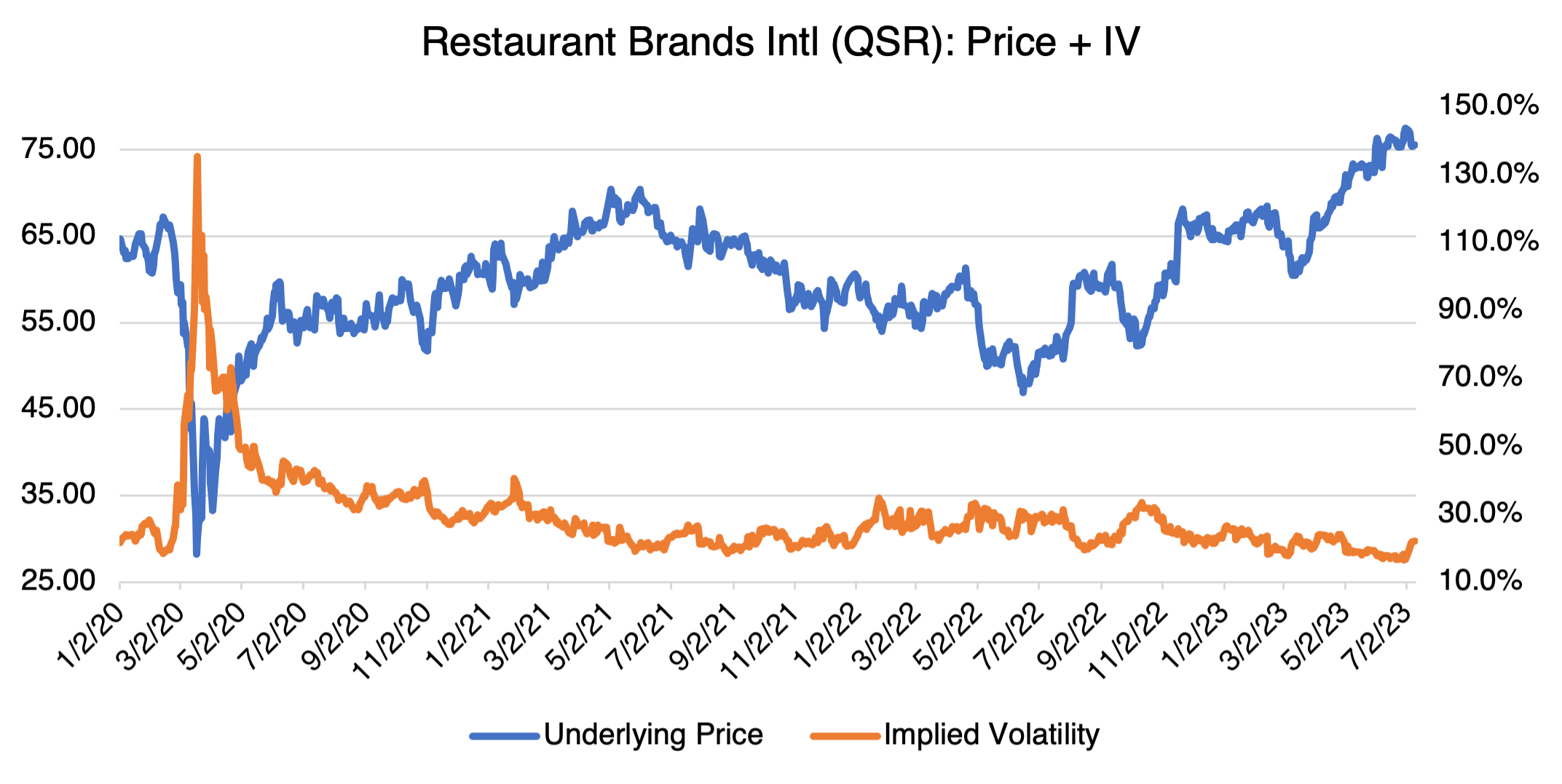

Since Burger King is the jewel of the Restaurant Brands (QSR) franchise, the success or failure of its revival plan will have an outsized effect on the stock. In addition, since QSR is a combination of several fast-food restaurants, it is a more diversified investment than MCD and is more representative of the fast-food industry in general. Similar to McDonald’s, QSR has been rallying and is up about 18% YTD. And similar to MCD, its current implied volatility of about 22% is elevated, 3 to 4 points higher than just a few weeks ago. The same volatility caution I pointed out for MCD applies to QSR as well.